Question: Question 5. Answer questions (a) to (g). (10 marks) ABC Ltd. has sold 100 European call contracts on IBM stocks (t=0), and each call contract

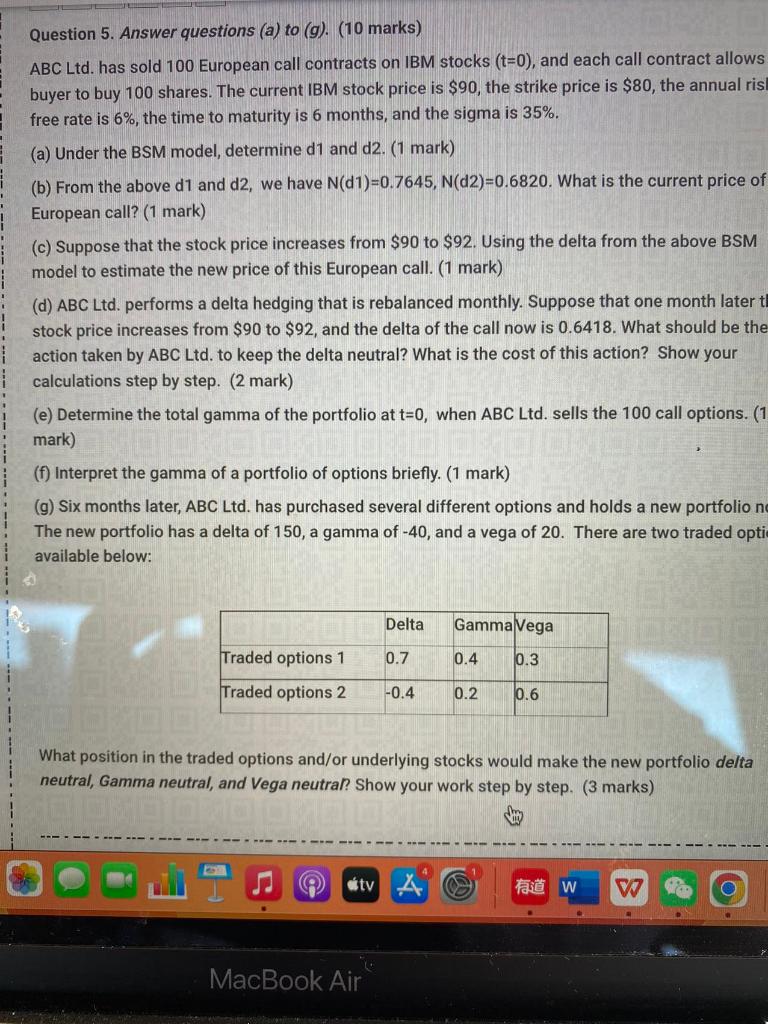

Question 5. Answer questions (a) to (g). (10 marks) ABC Ltd. has sold 100 European call contracts on IBM stocks (t=0), and each call contract allows buyer to buy 100 shares. The current IBM stock price is $90, the strike price is $80, the annual risi free rate is 6%, the time to maturity is 6 months, and the sigma is 35%. (a) Under the BSM model, determine d1 and d2. (1 mark) (b) From the above d1 and d2, we have N(d1)=0.7645,N(d2)=0.6820. What is the current price of European call? (1 mark) (c) Suppose that the stock price increases from \$90 to $92. Using the delta from the above BSM model to estimate the new price of this European call. ( 1 mark) (d) ABC Ltd. performs a delta hedging that is rebalanced monthly. Suppose that one month later t stock price increases from $90 to $92, and the delta of the call now is 0.6418. What should be the action taken by ABC Ltd. to keep the delta neutral? What is the cost of this action? Show your calculations step by step. ( 2 mark) (e) Determine the total gamma of the portfolio at t=0, when ABC Ltd. sells the 100 call options. ( mark) (f) Interpret the gamma of a portfolio of options briefly. (1 mark) (g) Six months later, ABC Ltd. has purchased several different options and holds a new portfolio n The new portfolio has a delta of 150 , a gamma of 40, and a vega of 20 . There are two traded optii available below: What position in the traded options and/or underlying stocks would make the new portfolio delta neutral, Gamma neutral, and Vega neutral? Show your work step by step. ( 3 marks) Question 5. Answer questions (a) to (g). (10 marks) ABC Ltd. has sold 100 European call contracts on IBM stocks (t=0), and each call contract allows buyer to buy 100 shares. The current IBM stock price is $90, the strike price is $80, the annual risi free rate is 6%, the time to maturity is 6 months, and the sigma is 35%. (a) Under the BSM model, determine d1 and d2. (1 mark) (b) From the above d1 and d2, we have N(d1)=0.7645,N(d2)=0.6820. What is the current price of European call? (1 mark) (c) Suppose that the stock price increases from \$90 to $92. Using the delta from the above BSM model to estimate the new price of this European call. ( 1 mark) (d) ABC Ltd. performs a delta hedging that is rebalanced monthly. Suppose that one month later t stock price increases from $90 to $92, and the delta of the call now is 0.6418. What should be the action taken by ABC Ltd. to keep the delta neutral? What is the cost of this action? Show your calculations step by step. ( 2 mark) (e) Determine the total gamma of the portfolio at t=0, when ABC Ltd. sells the 100 call options. ( mark) (f) Interpret the gamma of a portfolio of options briefly. (1 mark) (g) Six months later, ABC Ltd. has purchased several different options and holds a new portfolio n The new portfolio has a delta of 150 , a gamma of 40, and a vega of 20 . There are two traded optii available below: What position in the traded options and/or underlying stocks would make the new portfolio delta neutral, Gamma neutral, and Vega neutral? Show your work step by step. ( 3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts