Question: Question 5 Answer saved Marked out of 2.00 Flag question When a risk-free asset is combined with a portfolio of risky assets, which of the

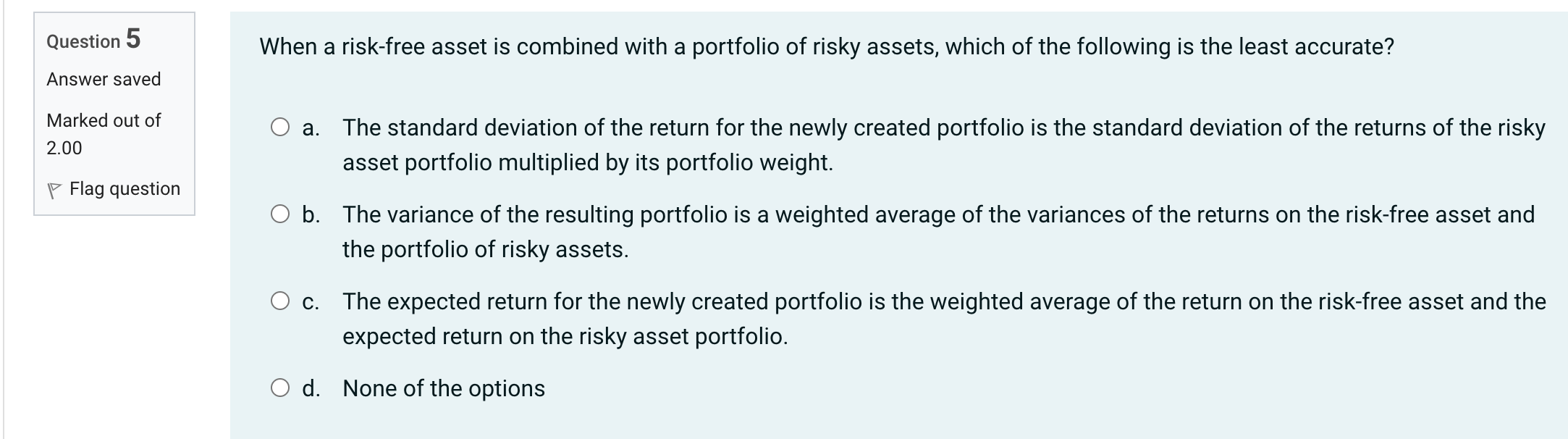

Question 5 Answer saved Marked out of 2.00 Flag question When a risk-free asset is combined with a portfolio of risky assets, which of the following is the least accurate? a. The standard deviation of the return for the newly created portfolio is the standard deviation of the returns of the risky asset portfolio multiplied by its portfolio weight. O b. The variance of the resulting portfolio is a weighted average of the variances of the returns on the risk-free asset and the portfolio of risky assets. c. The expected return for the newly created portfolio is the weighted average of the return on the risk-free asset and the expected return on the risky asset portfolio. O d. None of the options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts