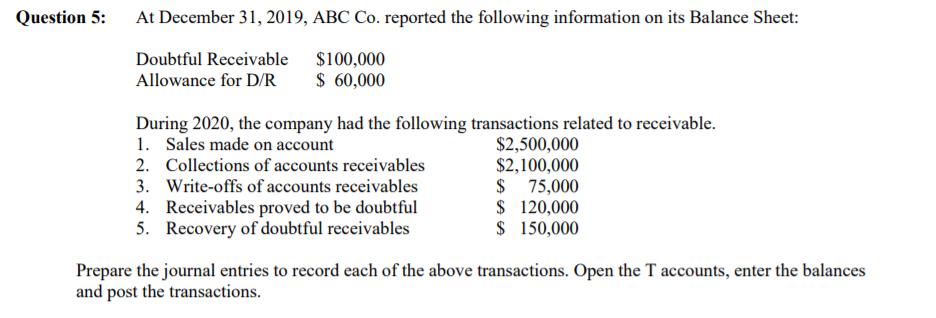

Question: Question 5: At December 31, 2019, ABC Co. reported the following information on its Balance Sheet: Doubtful Receivable $100,000 Allowance for D/R $ 60,000

Question 5: At December 31, 2019, ABC Co. reported the following information on its Balance Sheet: Doubtful Receivable $100,000 Allowance for D/R $ 60,000 During 2020, the company had the following transactions related to receivable. 1. Sales made on account 2. Collections of accounts receivables 3. Write-offs of accounts receivables 4. Receivables proved to be doubtful 5. Recovery of doubtful receivables $2,500,000 $2,100,000 $ 75,000 $ 120,000 $ 150,000 Prepare the journal entries to record each of the above transactions. Open the T accounts, enter the balances and post the transactions.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

No Account Title and Explanation 1 Accounts Receivable Sales Revenue sold goods on accou... View full answer

Get step-by-step solutions from verified subject matter experts