Question: QUESTION 5 Based on the analysis in Question 4, explain two (2) strategies for Tashin Holdings Berhad to perform and sustain competitive advantage in the

QUESTION 5

Based on the analysis in Question 4, explain two (2) strategies for Tashin Holdings Berhad to perform and sustain competitive advantage in the global pandemic covid-19.

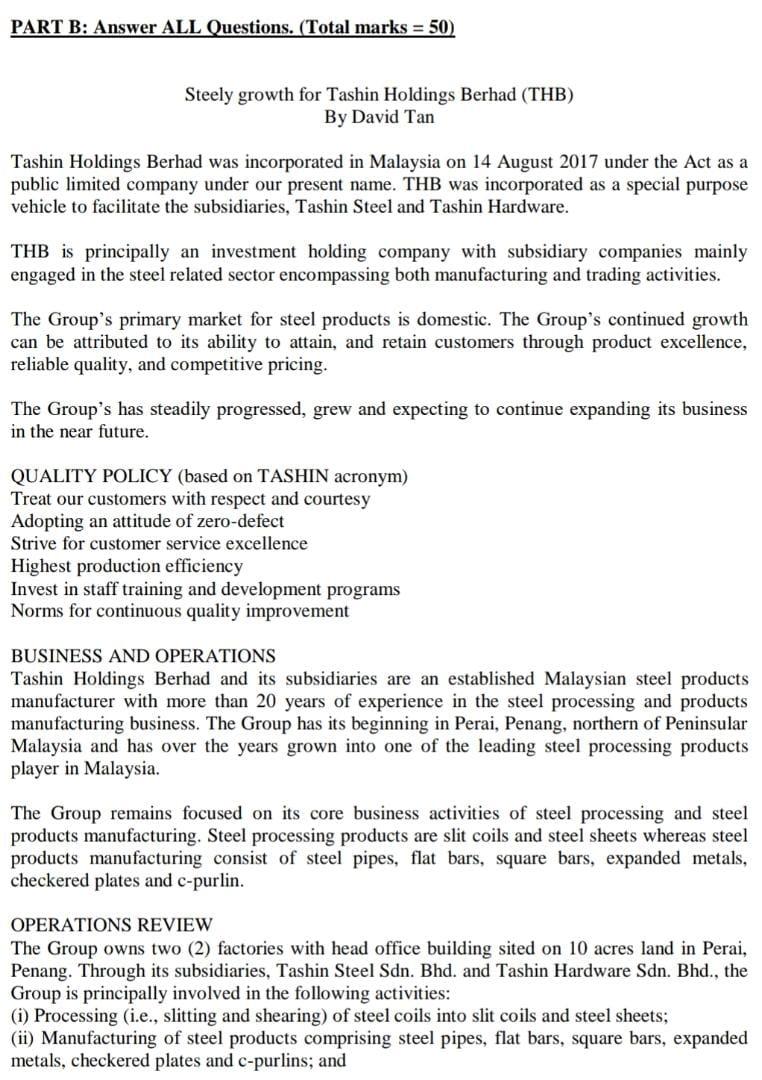

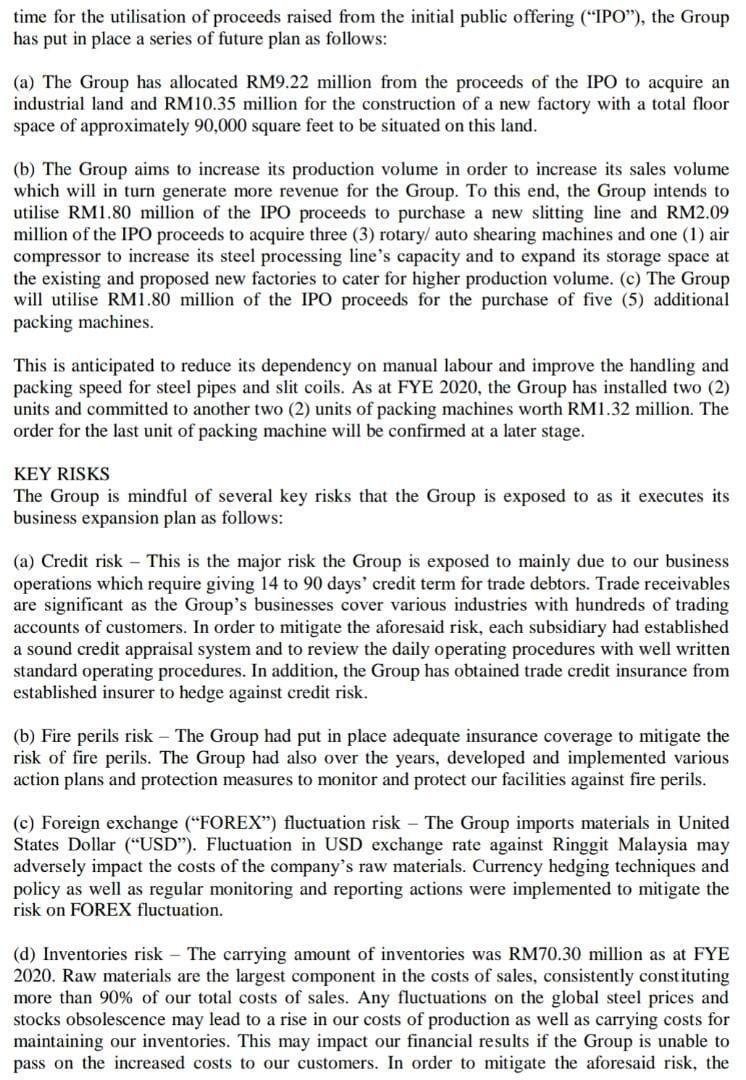

PART B: Answer ALL Questions. (Total marks = 50) Steely growth for Tashin Holdings Berhad (THB) By David Tan Tashin Holdings Berhad was incorporated in Malaysia on 14 August 2017 under the Act as a public limited company under our present name. THB was incorporated as a special purpose vehicle to facilitate the subsidiaries, Tashin Steel and Tashin Hardware. THB is principally an investment holding company with subsidiary companies mainly engaged in the steel related sector encompassing both manufacturing and trading activities. The Group's primary market for steel products is domestic. The Group's continued growth can be attributed to its ability to attain, and retain customers through product excellence, reliable quality, and competitive pricing. The Group's has steadily progressed, grew and expecting to continue expanding its business in the near future. QUALITY POLICY (based on TASHIN acronym) Treat our customers with respect and courtesy Adopting an attitude of zero-defect Strive for customer service excellence Highest production efficiency Invest in staff training and development programs Norms for continuous quality improvement BUSINESS AND OPERATIONS Tashin Holdings Berhad and its subsidiaries are an established Malaysian steel products manufacturer with more than 20 years of experience in the steel processing and products manufacturing business. The Group has its beginning in Perai, Penang, northern of Peninsular Malaysia and has over the years grown into one of the leading steel processing products player in Malaysia. The Group remains focused on its core business activities of steel processing and steel products manufacturing. Steel processing products are slit coils and steel sheets whereas steel products manufacturing consist of steel pipes, flat bars, square bars, expanded metals, checkered plates and c-purlin. OPERATIONS REVIEW The Group owns two (2) factories with head office building sited on 10 acres land in Perai, Penang. Through its subsidiaries, Tashin Steel Sdn. Bhd. and Tashin Hardware Sdn. Bhd., the Group is principally involved in the following activities: (1) Processing (i.e., slitting and shearing) of steel coils into slit coils and steel sheets; (ii) Manufacturing of steel products comprising steel pipes, flat bars, square bars, expanded metals, checkered plates and c-purlins; and (iii) Trading of steel products including steel plates, steel pipes, round bars, angle bars and wire mesh. The Group's revenue mainly derived from manufacturing activities and the Group also carrying trading activities for steel products in small volume. FINANCIAL PERFORMANCE 2020 239.145 12.019 9.268 Group Financial Highlights (2016-2020) (RM 000) 2016 2017 2018 2019 Revenue 214.741 257.701 260,545 238.179 Profit before tax 14,585 21,671 14.829 1,492 Profit attributable to 12,184 15,715 11,281 398 owners of the parent Total Assets 186,120 260,774 202.971 253,207 Equity attributable to 115, 701 144,809 155,783 188,090 owners of the parent EBITDA 19,487 26,941 21,497 6,219 Net assets per share 0.40 0.50 0.54 0.54 (RM) chart Earnings per share (sen) 4.21 5.43 3.89 0.12 Source: Tashin Holdings Berhad. (2021). Annual Report 2020. https://tashin.com.my/wp-content/uploads/2021/04/Tashin-AR-2020.pdf 249.708 197.358 1.6199 0.57 2.66 An an established more than 20 years as a steel processing company, Tashin Holdings Bhd has come a long way while maintaining its profitability despite the economic challenges of the 21st century. "The success of the company has to do with our sales and marketing team's ability to penetrate into those markets that consume steel products despite the economic downturn of the early 21st century, a consequence of the Asian Financial Crisis. "There were still industrial and construction businesses that carried out projects then although the times were tough," says managing director Lim Choon Teik. Tashin produces cold rolling steel bars, slit coils, steel sheets and expanded metal for the automotive, electrical appliances, steel fabrication, constructions and furniture industries. "We sell a lot of our products to stockists and wholesalers who then sell them to the end users in the construction industry," he adds. According to Lim, demand for steel is expected to recover moderately over the second half of 2019 and into 2020 as the expected commencement of mega projects such as the East Coast Rail Link (ECRL) and Bandar Malaysia will help to boost the current dampened steel demand. "These projects will stimulate demand for our slit coils, steel sheets, steel wire products and steel pipes. "Smith Zander, a specialist research and consulting firm based in Kuala Lumpur, projects that the market for slit coil and steel sheet will grow to 5.1 million tonnes in 2020 from 4.89 million tonnes in 2017 at a compounded annual growth rate (CAGR) of 1.41%. "It also forecast that the consumption of steel wire products such as steel pipes and tubes will grow at a 13.3% CAGR to 2.85 million tonnes in 2020 from 2.56 million tonnes in 2017," says Lim. He also notes that the construction and furniture sectors as well as building material suppliers contribute about 50% of the group's revenue. The automotive industry and steel-based product manufacturers - those involved in making electrical appliances and mechanical and engineering components-generate the other 50% of the group's revenue. Lim thinks there are enough supportive factors in the market that will help the company. According to the Malaysian Automotive Association (MAA), there are about 800 automotive component manufacturers in Malaysia, producing a wide range of steel body panels, engine parts, brake parts and transmission and steering parts. The MAA forecasts that total industry volume (TIV) in Malaysia will grow from 600,000 vehicles in 2019 to 653,290 vehicles in 2023, growing at a rate of 2.15%, driven mostly by public transportation and increasing disposable income of the population. Tashin also plans to venture into the wire mesh production business. We are presently involved in the trading of wire mesh and the expansion into the manufacturing of wire mesh will allow us to have control over the supply of wire mesh to reduce our dependency on third party suppliers for wire mesh. "The manufacturing of wire mesh will also enable us to have better control over our cost of sales and this will improve our profitability. Wire mesh is a steel product used as concrete reinforcement in the construction industry. The product is increasingly used in place of steel bar products as concrete reinforcement materials because of the lower installation cost and time as compared to steel bar products," says Lim. Tashin will use RM4.1 mil from the IPO proceeds to acquire five new wire mesh production lines with a combined effective production capacity of 24,000 tonnes per annum. We expect to commence the production of wire mesh upon completion of the construction of the new factory in 2021," Lim says. Tashin is an associate company of Prestar Resources Bhd, a main-board investment holding company with subsidiary companies mainly engaged in the steel-processing and steel- products manufacturing activities with factories in Malaysia and Vietnam. EXPANSION PLANS As disclosed in the Prospectus of the Company dated 25 June 2019 and followed by the Company's announcement on 27 January 2021 in relation to the revision and extension of time for the utilisation of proceeds raised from the initial public offering (IPO"), the Group has put in place a series of future plan as follows: (a) The Group has allocated RM9.22 million from the proceeds of the IPO to acquire an industrial land and RM10.35 million for the construction of a new factory with a total floor space of approximately 90,000 square feet to be situated on this land. (b) The Group aims to increase its production volume in order to increase its sales volume which will in turn generate more revenue for the Group. To this end, the Group intends to utilise RM1.80 million of the IPO proceeds to purchase a new slitting line and RM2.09 million of the IPO proceeds to acquire three (3) rotary/ auto shearing machines and one (1) air compressor to increase its steel processing line's capacity and to expand its storage space at the existing and proposed new factories to cater for higher production volume. (c) The Group will utilise RM1.80 million of the IPO proceeds for the purchase of five (5) additional packing machines. This is anticipated to reduce its dependency on manual labour and improve the handling and packing speed for steel pipes and slit coils. As at FYE 2020, the Group has installed two (2) units and committed to another two (2) units of packing machines worth RM1.32 million. The order for the last unit of packing machine will be confirmed at a later stage. KEY RISKS The Group is mindful of several key risks that the Group is exposed to as it executes its business expansion plan as follows: (a) Credit risk - This is the major risk the Group is exposed to mainly due to our business operations which require giving 14 to 90 days' credit term for trade debtors. Trade receivables are significant as the Group's businesses cover various industries with hundreds of trading accounts of customers. In order to mitigate the aforesaid risk, each subsidiary had established a sound credit appraisal system and to review the daily operating procedures with well written standard operating procedures. In addition, the Group has obtained trade credit insurance from established insurer to hedge against credit risk. (b) Fire perils risk - The Group had put in place adequate insurance coverage to mitigate the risk of fire perils. The Group had also over the years, developed and implemented various action plans and protection measures to monitor and protect our facilities against fire perils. (c) Foreign exchange (FOREX") fluctuation risk - The Group imports materials in United States Dollar ("USD"). Fluctuation in USD exchange rate against Ringgit Malaysia may adversely impact the costs of the company's raw materials. Currency hedging techniques and policy as well as regular monitoring and reporting actions were implemented to mitigate the risk on FOREX fluctuation. (d) Inventories risk - The carrying amount of inventories was RM70.30 million as at FYE 2020. Raw materials are the largest component in the costs of sales, consistently constituting more than 90% of our total costs of sales. Any fluctuations on the global steel prices and stocks obsolescence may lead to a rise in our costs of production as well as carrying costs for maintaining our inventories. This may impact our financial results if the Group is unable to pass on the increased costs to our customers. In order to mitigate the aforesaid risk, the Group's sourcing department has a team of experience staff in steel industry to implement prudent and effective inventory management. FUTURE PROSPECTS The onset of the Coronavirus (Covid-19') pandemic since 18 March 2020 and the implementation of Movement Control Order by the Malaysian Government had impacted the Group's business, resulting in production halt in the beginning of pandemic breakout from March 2020 to April 2020. Despite many restrictions and adjustments that the Group has made to accommodate supply chain interruptions and social distancing measures, the Group is happy to report that the production is able to resume full force after 1.5 months of production halt. The Group will continue its cautious and pragmatic strategy in the business operations and execution of expansion plans in view of the slow global economy recovery impacted by Covid-19. The Group will continuously improve the manufacturing efficiency, focus on its core businesses to strengthen and increase the market share, uphold its reputation as a reliable quality products supplier and deliver better financial performance to our shareholders. Barring any unforeseen circumstances, the Group is cautiously optimistic to achieve higher profitability for the coming year. Tashin. Source: David Tan. (2019). Steely growth for https://www.thestar.com.my/business/smebiz/2019/07/15/steely-growth-for-tashin Tashin. (2021). About company. https://tashin.com.my/about/#ourcompany PART B: Answer ALL Questions. (Total marks = 50) Steely growth for Tashin Holdings Berhad (THB) By David Tan Tashin Holdings Berhad was incorporated in Malaysia on 14 August 2017 under the Act as a public limited company under our present name. THB was incorporated as a special purpose vehicle to facilitate the subsidiaries, Tashin Steel and Tashin Hardware. THB is principally an investment holding company with subsidiary companies mainly engaged in the steel related sector encompassing both manufacturing and trading activities. The Group's primary market for steel products is domestic. The Group's continued growth can be attributed to its ability to attain, and retain customers through product excellence, reliable quality, and competitive pricing. The Group's has steadily progressed, grew and expecting to continue expanding its business in the near future. QUALITY POLICY (based on TASHIN acronym) Treat our customers with respect and courtesy Adopting an attitude of zero-defect Strive for customer service excellence Highest production efficiency Invest in staff training and development programs Norms for continuous quality improvement BUSINESS AND OPERATIONS Tashin Holdings Berhad and its subsidiaries are an established Malaysian steel products manufacturer with more than 20 years of experience in the steel processing and products manufacturing business. The Group has its beginning in Perai, Penang, northern of Peninsular Malaysia and has over the years grown into one of the leading steel processing products player in Malaysia. The Group remains focused on its core business activities of steel processing and steel products manufacturing. Steel processing products are slit coils and steel sheets whereas steel products manufacturing consist of steel pipes, flat bars, square bars, expanded metals, checkered plates and c-purlin. OPERATIONS REVIEW The Group owns two (2) factories with head office building sited on 10 acres land in Perai, Penang. Through its subsidiaries, Tashin Steel Sdn. Bhd. and Tashin Hardware Sdn. Bhd., the Group is principally involved in the following activities: (1) Processing (i.e., slitting and shearing) of steel coils into slit coils and steel sheets; (ii) Manufacturing of steel products comprising steel pipes, flat bars, square bars, expanded metals, checkered plates and c-purlins; and (iii) Trading of steel products including steel plates, steel pipes, round bars, angle bars and wire mesh. The Group's revenue mainly derived from manufacturing activities and the Group also carrying trading activities for steel products in small volume. FINANCIAL PERFORMANCE 2020 239.145 12.019 9.268 Group Financial Highlights (2016-2020) (RM 000) 2016 2017 2018 2019 Revenue 214.741 257.701 260,545 238.179 Profit before tax 14,585 21,671 14.829 1,492 Profit attributable to 12,184 15,715 11,281 398 owners of the parent Total Assets 186,120 260,774 202.971 253,207 Equity attributable to 115, 701 144,809 155,783 188,090 owners of the parent EBITDA 19,487 26,941 21,497 6,219 Net assets per share 0.40 0.50 0.54 0.54 (RM) chart Earnings per share (sen) 4.21 5.43 3.89 0.12 Source: Tashin Holdings Berhad. (2021). Annual Report 2020. https://tashin.com.my/wp-content/uploads/2021/04/Tashin-AR-2020.pdf 249.708 197.358 1.6199 0.57 2.66 An an established more than 20 years as a steel processing company, Tashin Holdings Bhd has come a long way while maintaining its profitability despite the economic challenges of the 21st century. "The success of the company has to do with our sales and marketing team's ability to penetrate into those markets that consume steel products despite the economic downturn of the early 21st century, a consequence of the Asian Financial Crisis. "There were still industrial and construction businesses that carried out projects then although the times were tough," says managing director Lim Choon Teik. Tashin produces cold rolling steel bars, slit coils, steel sheets and expanded metal for the automotive, electrical appliances, steel fabrication, constructions and furniture industries. "We sell a lot of our products to stockists and wholesalers who then sell them to the end users in the construction industry," he adds. According to Lim, demand for steel is expected to recover moderately over the second half of 2019 and into 2020 as the expected commencement of mega projects such as the East Coast Rail Link (ECRL) and Bandar Malaysia will help to boost the current dampened steel demand. "These projects will stimulate demand for our slit coils, steel sheets, steel wire products and steel pipes. "Smith Zander, a specialist research and consulting firm based in Kuala Lumpur, projects that the market for slit coil and steel sheet will grow to 5.1 million tonnes in 2020 from 4.89 million tonnes in 2017 at a compounded annual growth rate (CAGR) of 1.41%. "It also forecast that the consumption of steel wire products such as steel pipes and tubes will grow at a 13.3% CAGR to 2.85 million tonnes in 2020 from 2.56 million tonnes in 2017," says Lim. He also notes that the construction and furniture sectors as well as building material suppliers contribute about 50% of the group's revenue. The automotive industry and steel-based product manufacturers - those involved in making electrical appliances and mechanical and engineering components-generate the other 50% of the group's revenue. Lim thinks there are enough supportive factors in the market that will help the company. According to the Malaysian Automotive Association (MAA), there are about 800 automotive component manufacturers in Malaysia, producing a wide range of steel body panels, engine parts, brake parts and transmission and steering parts. The MAA forecasts that total industry volume (TIV) in Malaysia will grow from 600,000 vehicles in 2019 to 653,290 vehicles in 2023, growing at a rate of 2.15%, driven mostly by public transportation and increasing disposable income of the population. Tashin also plans to venture into the wire mesh production business. We are presently involved in the trading of wire mesh and the expansion into the manufacturing of wire mesh will allow us to have control over the supply of wire mesh to reduce our dependency on third party suppliers for wire mesh. "The manufacturing of wire mesh will also enable us to have better control over our cost of sales and this will improve our profitability. Wire mesh is a steel product used as concrete reinforcement in the construction industry. The product is increasingly used in place of steel bar products as concrete reinforcement materials because of the lower installation cost and time as compared to steel bar products," says Lim. Tashin will use RM4.1 mil from the IPO proceeds to acquire five new wire mesh production lines with a combined effective production capacity of 24,000 tonnes per annum. We expect to commence the production of wire mesh upon completion of the construction of the new factory in 2021," Lim says. Tashin is an associate company of Prestar Resources Bhd, a main-board investment holding company with subsidiary companies mainly engaged in the steel-processing and steel- products manufacturing activities with factories in Malaysia and Vietnam. EXPANSION PLANS As disclosed in the Prospectus of the Company dated 25 June 2019 and followed by the Company's announcement on 27 January 2021 in relation to the revision and extension of time for the utilisation of proceeds raised from the initial public offering (IPO"), the Group has put in place a series of future plan as follows: (a) The Group has allocated RM9.22 million from the proceeds of the IPO to acquire an industrial land and RM10.35 million for the construction of a new factory with a total floor space of approximately 90,000 square feet to be situated on this land. (b) The Group aims to increase its production volume in order to increase its sales volume which will in turn generate more revenue for the Group. To this end, the Group intends to utilise RM1.80 million of the IPO proceeds to purchase a new slitting line and RM2.09 million of the IPO proceeds to acquire three (3) rotary/ auto shearing machines and one (1) air compressor to increase its steel processing line's capacity and to expand its storage space at the existing and proposed new factories to cater for higher production volume. (c) The Group will utilise RM1.80 million of the IPO proceeds for the purchase of five (5) additional packing machines. This is anticipated to reduce its dependency on manual labour and improve the handling and packing speed for steel pipes and slit coils. As at FYE 2020, the Group has installed two (2) units and committed to another two (2) units of packing machines worth RM1.32 million. The order for the last unit of packing machine will be confirmed at a later stage. KEY RISKS The Group is mindful of several key risks that the Group is exposed to as it executes its business expansion plan as follows: (a) Credit risk - This is the major risk the Group is exposed to mainly due to our business operations which require giving 14 to 90 days' credit term for trade debtors. Trade receivables are significant as the Group's businesses cover various industries with hundreds of trading accounts of customers. In order to mitigate the aforesaid risk, each subsidiary had established a sound credit appraisal system and to review the daily operating procedures with well written standard operating procedures. In addition, the Group has obtained trade credit insurance from established insurer to hedge against credit risk. (b) Fire perils risk - The Group had put in place adequate insurance coverage to mitigate the risk of fire perils. The Group had also over the years, developed and implemented various action plans and protection measures to monitor and protect our facilities against fire perils. (c) Foreign exchange (FOREX") fluctuation risk - The Group imports materials in United States Dollar ("USD"). Fluctuation in USD exchange rate against Ringgit Malaysia may adversely impact the costs of the company's raw materials. Currency hedging techniques and policy as well as regular monitoring and reporting actions were implemented to mitigate the risk on FOREX fluctuation. (d) Inventories risk - The carrying amount of inventories was RM70.30 million as at FYE 2020. Raw materials are the largest component in the costs of sales, consistently constituting more than 90% of our total costs of sales. Any fluctuations on the global steel prices and stocks obsolescence may lead to a rise in our costs of production as well as carrying costs for maintaining our inventories. This may impact our financial results if the Group is unable to pass on the increased costs to our customers. In order to mitigate the aforesaid risk, the Group's sourcing department has a team of experience staff in steel industry to implement prudent and effective inventory management. FUTURE PROSPECTS The onset of the Coronavirus (Covid-19') pandemic since 18 March 2020 and the implementation of Movement Control Order by the Malaysian Government had impacted the Group's business, resulting in production halt in the beginning of pandemic breakout from March 2020 to April 2020. Despite many restrictions and adjustments that the Group has made to accommodate supply chain interruptions and social distancing measures, the Group is happy to report that the production is able to resume full force after 1.5 months of production halt. The Group will continue its cautious and pragmatic strategy in the business operations and execution of expansion plans in view of the slow global economy recovery impacted by Covid-19. The Group will continuously improve the manufacturing efficiency, focus on its core businesses to strengthen and increase the market share, uphold its reputation as a reliable quality products supplier and deliver better financial performance to our shareholders. Barring any unforeseen circumstances, the Group is cautiously optimistic to achieve higher profitability for the coming year. Tashin. Source: David Tan. (2019). Steely growth for https://www.thestar.com.my/business/smebiz/2019/07/15/steely-growth-for-tashin Tashin. (2021). About company. https://tashin.com.my/about/#ourcompanyStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts