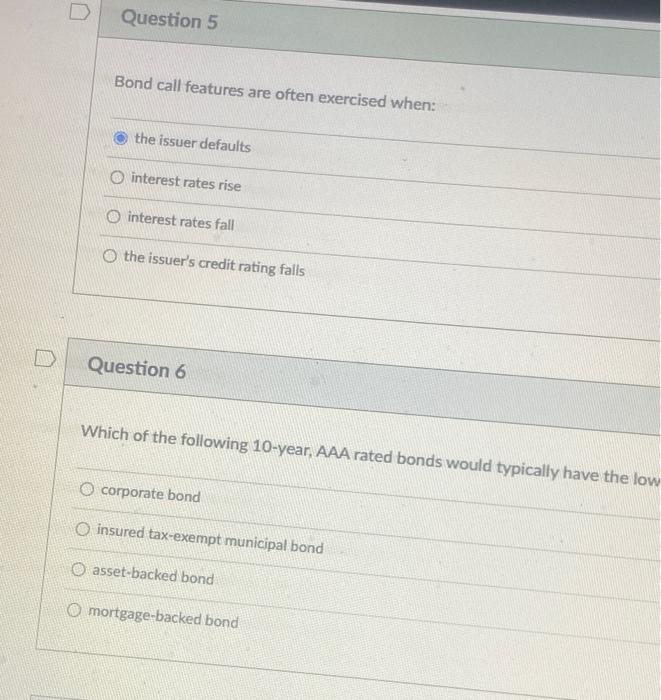

Question: Question 5 Bond call features are often exercised when: the issuer defaults O interest rates rise O interest rates fall o the issuer's credit rating

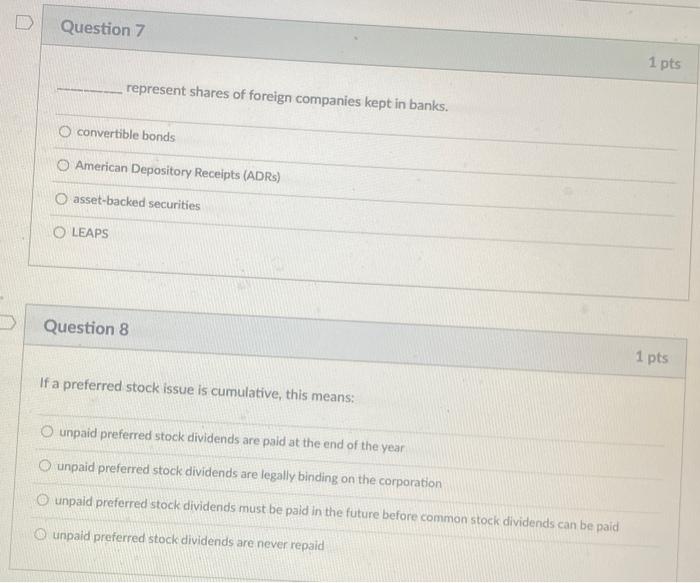

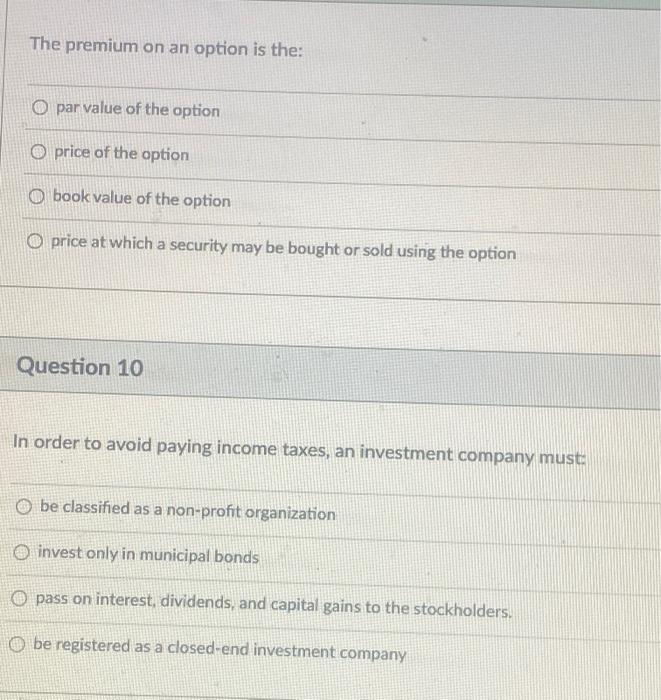

Question 5 Bond call features are often exercised when: the issuer defaults O interest rates rise O interest rates fall o the issuer's credit rating falls Question 6 Which of the following 10-year, AAA rated bonds would typically have the low corporate bond o insured tax-exempt municipal bond O asset-backed bond mortgage-backed bond Question 7 1 pts represent shares of foreign companies kept in banks. O convertible bonds American Depository Receipts (ADR) O asset-backed securities LEAPS Question 8 1 pts If a preferred stock issue is cumulative, this means: unpaid preferred stock dividends are paid at the end of the year unpaid preferred stock dividends are legally binding on the corporation unpaid preferred stock dividends must be paid in the future before common stock dividends can be paid unpaid preferred stock dividends are never repaid The premium on an option is the: O par value of the option O price of the option O book value of the option O price at which a security may be bought or sold using the option Question 10 In order to avoid paying income taxes, an investment company must: O be classified as a non-profit organization o invest only in municipal bonds pass on interest, dividends, and capital gains to the stockholders, registered as a closed-end investment company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts