Question: QUESTION 5 Chapter 9 pg#347 - Experiential Exercise #12 12. a. From the balance sheet and income statement of Sam's Paint and Drywall, determine the

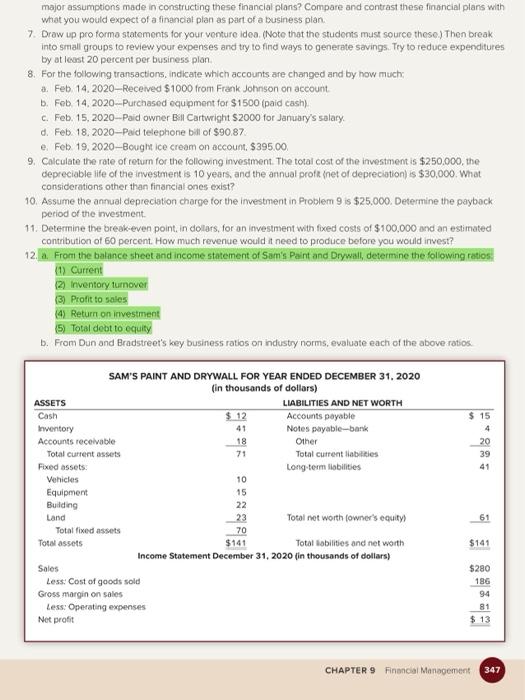

QUESTION 5 Chapter 9 pg#347 - Experiential Exercise #12 12. a. From the balance sheet and income statement of Sam's Paint and Drywall, determine the following ratios The inventory turnover ratio is 0.5 points Save Answ QUESTION 6 Chapter 9 pg#347 - Experiential Exercise #12 12. a. From the balance sheet and income statement of Sam's Paint and Drywall, determine the following ratios The profit to sales ratio is 05 points Save Ancu major assumptions made in constructing these financial plans? Compare and contrast these financial plans with what you would expect of a financial plan as part of a business plan. 7. Draw up pro formo statements for your venture idea (Note that the students must source these) Then break into small groups to review your expenses and try to find ways to generate savings. Try to reduce expenditures by at least 20 percent per business plan 8. For the following transactions, indicate which accounts are changed and by how much a. Feb. 14.2020-Received $1000 from Frank Johnson on account b. Feb 14, 2020--Purchased equipment for $1500 (paid cash) c. Feb. 15, 2020-Paid owner Bill Cartwright S2000 for January's salary d. Feb 18, 2020-Paid telephone bill of $90.87 e Feb 19, 2020-Bought ice cream on account. $395.00 9. Calculate the rate of return for the following investment. The total cost of the investment is $250.000, the depreciable life of the investment is 10 years, and the annual prof (net of depreciation) is $30,000. What considerations other than financial ones exist? 10. Assume the annual depreciation charge for the investment in Problem 9 is $25,000. Determine the payback period of the investment 11. Determine the break-even point in dollars, for an investment with fixed costs of $100.000 and an estimated contribution of 60 percent. How much revenue would it need to produce before you would invest? 12. a. From the balance sheet and income statement of Sam's Paint and Drywall, determine the following ratios. ) Current 2) Inventory turnover (3) Profit to sales 4) Return on investment 5) Total debt to equity b. From Dun and Bradstreet's key business ratios on industry norms, evaluate each of the above ratios. $ 15 4 20 39 41 SAM'S PAINT AND DRYWALL FOR YEAR ENDED DECEMBER 31, 2020 (in thousands of dollars) ASSETS LIABILITIES AND NET WORTH Cash $ 12 Accounts payable Inventory 41 Notes payable-bank Accounts receivable 18 Other Total current assets 71 Total current liabilities Fixed assets Long term liabilities Vehicles 10 Equipment 15 Building 22 Land 23 Total not worth owner's equity) Total fixed assets 70 Total assets $141 Total sobilities and net worth Income Statement December 31, 2020 (in thousands of dollars) Sales Less: Cost of goods sold Gross margin on sales Less: Operating expenses Net profit 61 $141 $280 186 94 81 $ 13 CHAPTER 9 Financial Management 347

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts