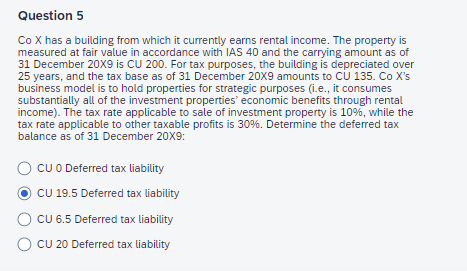

Question: Question 5 Co X has a building from which it currently earns rental income. The property is measured at fair value in accordance with IAS

Question

Co X has a building from which it currently earns rental income. The property is

measured at fair value in accordance with IAS and the carrying amount as of

December X is CU For tax purposes, the building is depreciated over

years, and the tax base as of December X amounts to CU Co Xs

business model is to hold properties for strategic purposes ie it consumes

substantially all of the investment properties' economic benefits through rental

income The tax rate applicable to sale of investment property is while the

tax rate applicable to other taxable profits is Determine the deferred tax

balance as of December X:

CU Deferred tax liability

CU Deferred tax liability

CU Deferred tax liability

CU Deferred tax liability

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock