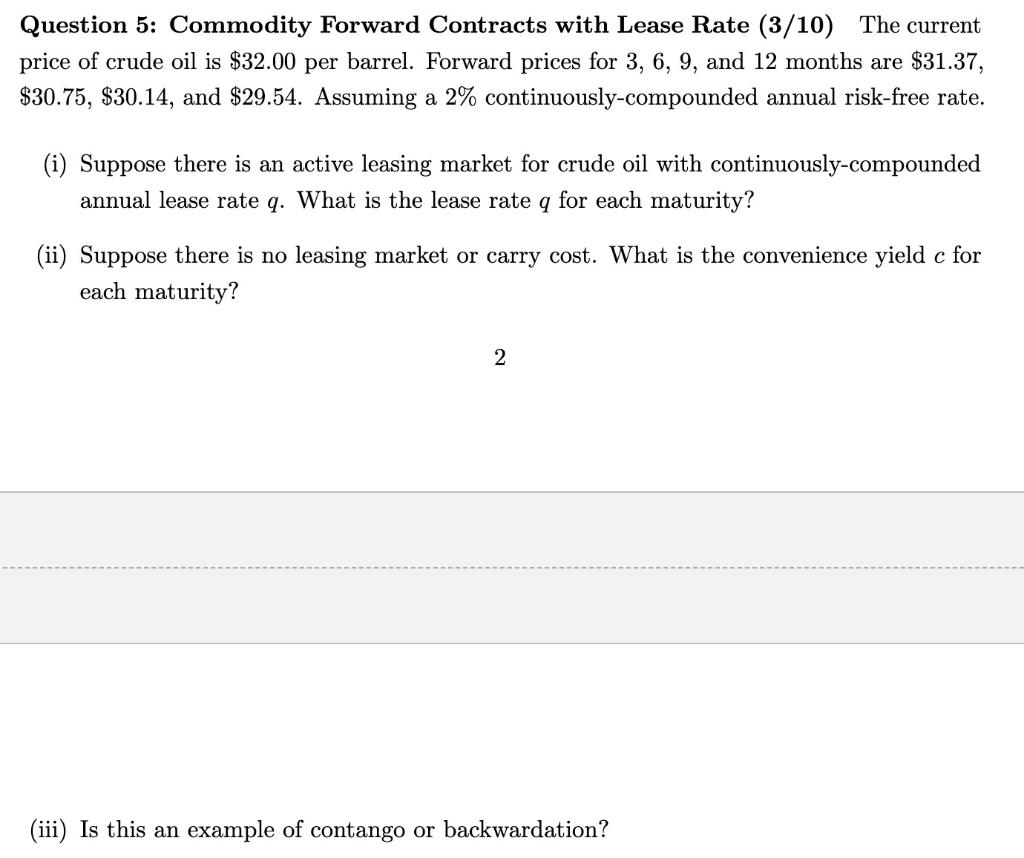

Question: Question 5: Commodity Forward Contracts with Lease Rate (3/10) The current price of crude oil is $32.00 per barrel. Forward prices for 3,6,9, and 12

Question 5: Commodity Forward Contracts with Lease Rate (3/10) The current price of crude oil is $32.00 per barrel. Forward prices for 3,6,9, and 12 months are $31.37, $30.75,$30.14, and $29.54. Assuming a 2% continuously-compounded annual risk-free rate. (i) Suppose there is an active leasing market for crude oil with continuously-compounded annual lease rate q. What is the lease rate q for each maturity? (ii) Suppose there is no leasing market or carry cost. What is the convenience yield c for each maturity? 2 (iii) Is this an example of contango or backwardation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts