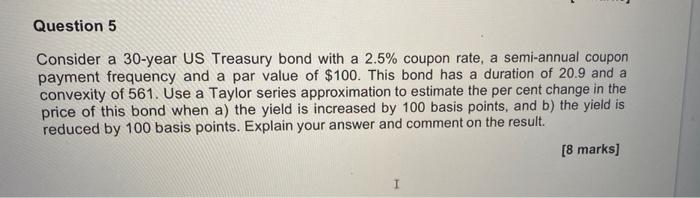

Question: Question 5 Consider a 30-year US Treasury bond with a 2.5% coupon rate, a semi-annual coupon payment frequency and a par value of $100. This

Question 5 Consider a 30-year US Treasury bond with a 2.5% coupon rate, a semi-annual coupon payment frequency and a par value of $100. This bond has a duration of 20.9 and a convexity of 561. Use a Taylor series approximation to estimate the per cent change in the price of this bond when a) the yield is increased by 100 basis points, and b) the yield is reduced by 100 basis points. Explain your answer and comment on the result. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts