Question: QUESTION 5 Dodson Corp. expects a 1 0 - year replacement project designed to increase the company's productivity to produce an NPV equal to $

QUESTION

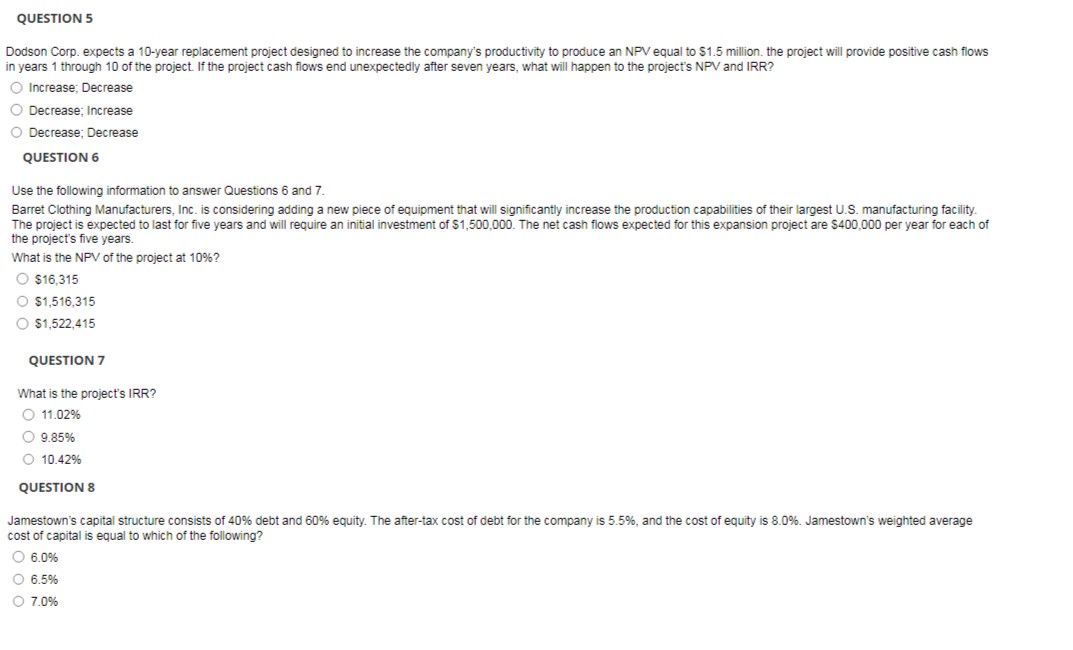

Dodson Corp. expects a year replacement project designed to increase the company's productivity to produce an NPV equal to $ million. the project will provide positive cash flows

in years through of the project. If the project cash flows end unexpectedly after seven years, what will happen to the project's NPV and IRR?

Increase; Decrease

Decrease; Increase

Decrease; Decrease

QUESTION

Use the following information to answer Questions and

Barret Clothing Manufacturers, Inc. is considering adding a new piece of equipment that will significantly increase the production capabilities of their largest US manufacturing facility.

The project is expected to last for five years and will require an initial investment of $ The net cash flows expected for this expansion project are $ per year for each of

the project's five years.

What is the NPV of the project at

$

$

$

QUESTION

What is the project's IRR?

QUESTION

Jamestown's capital structure consists of debt and equity. The aftertax cost of debt for the company is and the cost of equity is Jamestown's weighted average

cost of capital is equal to which of the following?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock