Question: Question: 5 Given the following situations, determine in each case whether or not the hypothesis of an efficient capital market in its weak or semi-strong

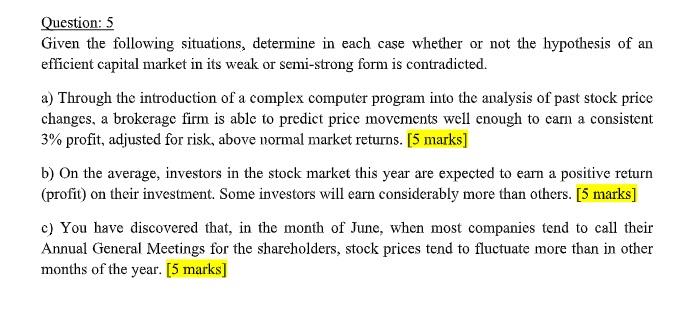

Question: 5 Given the following situations, determine in each case whether or not the hypothesis of an efficient capital market in its weak or semi-strong form is contradicted. a) Through the introduction of a complex computer program into the analysis of past stock price changes, a brokerage firm is able to predict price movements well enough to carn a consistent 3% profit, adjusted for risk, above normal market returns. [5 marks] b) On the average, investors in the stock market this year are expected to earn a positive return (profit) on their investment. Some investors will eam considerably more than others. [5 marks] c) You have discovered that, in the month of June, when most companies tend to call their Annual General Meetings for the shareholders, stock prices tend to fluctuate more than in other months of the year. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts