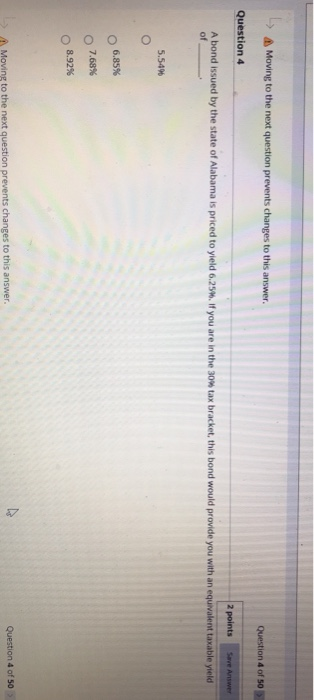

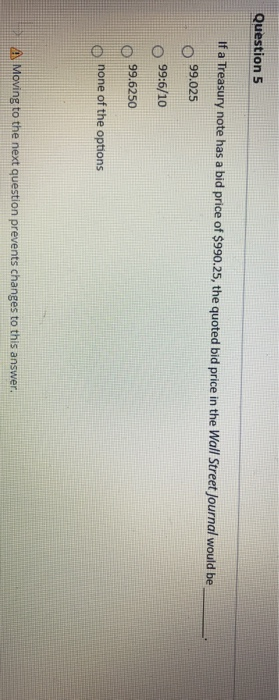

Question: Question 5 If a Treasury note has a bid price of $990.25, the quoted bid price in the Wall Street Journal would be 99.025 99:6/10

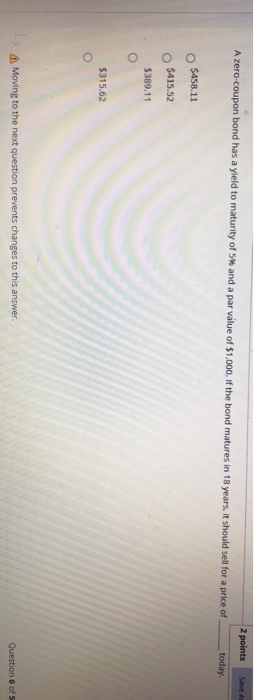

Question 5 If a Treasury note has a bid price of $990.25, the quoted bid price in the Wall Street Journal would be 99.025 99:6/10 99.6250 none of the options AN Moving to the next question prevents changes to this answer. A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. If the bond matures in 18 years. It should sell for a price of 2 points Save A today o $458.11 $415.52 $389.11 $315.62 o > Moving to the next question prevents changes to this answer. Question 6 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts