Question: Question 5: Interest Rate Swaps (2/10) Consider a 1 year fixed for floating interest rate swap with a notional value of $1. The floating

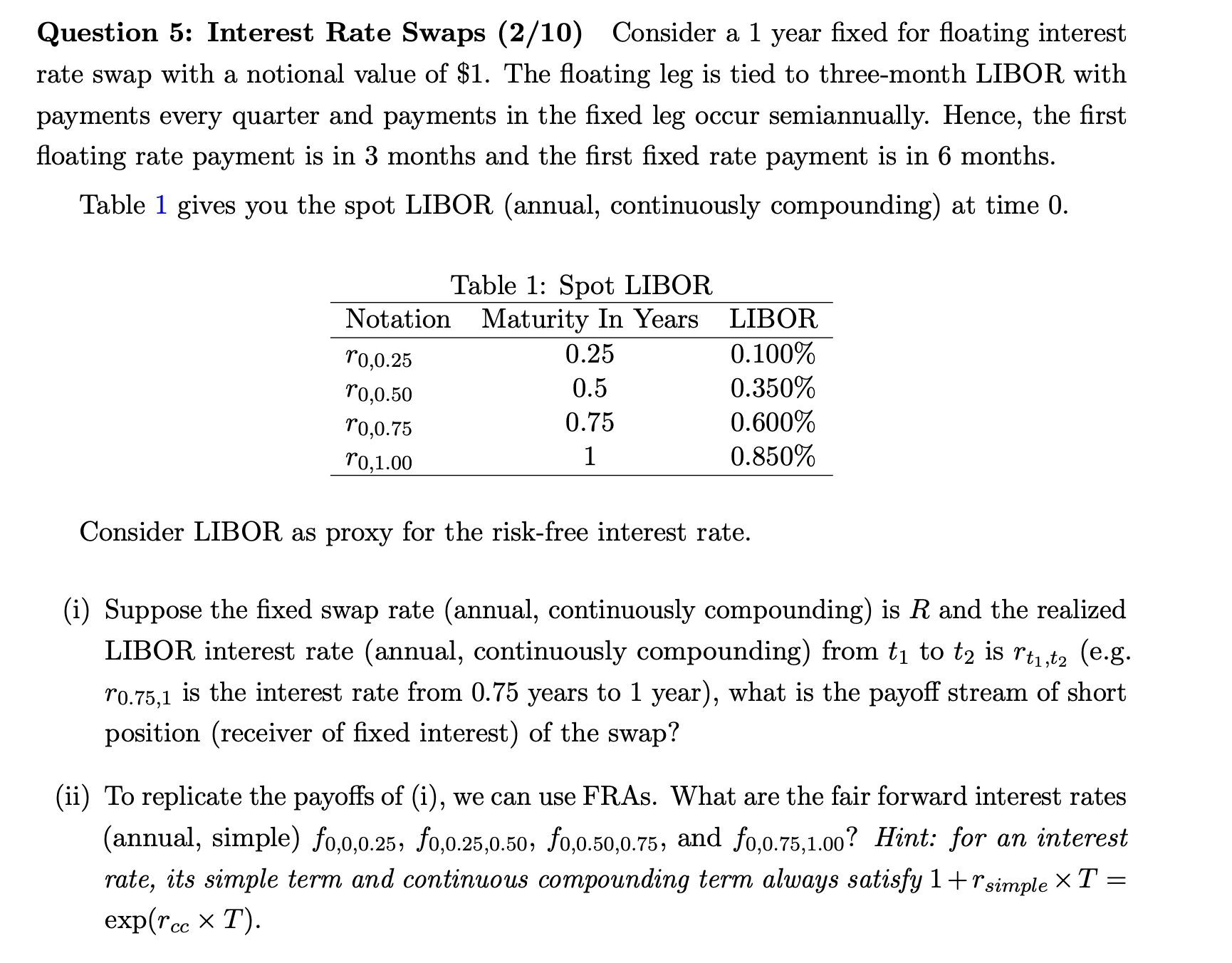

Question 5: Interest Rate Swaps (2/10) Consider a 1 year fixed for floating interest rate swap with a notional value of $1. The floating leg is tied to three-month LIBOR with payments every quarter and payments in the fixed leg occur semiannually. Hence, the first floating rate payment is in 3 months and the first fixed rate payment is in 6 months. Table 1 gives you the spot LIBOR (annual, continuously compounding) at time 0. Table 1: Spot LIBOR Notation Maturity In Years LIBOR r0,0.25 0.25 0.100% r0,0.50 0.5 0.350% r0,0.75 0.75 0.600% r0,1.00 1 0.850% Consider LIBOR as proxy for the risk-free interest rate. (i) Suppose the fixed swap rate (annual, continuously compounding) is R and the realized LIBOR interest rate (annual, continuously compounding) from t to t is r,t (e.g. ro.75,1 is the interest rate from 0.75 years to 1 year), what is the payoff stream of short position (receiver of fixed interest) of the swap? (ii) To replicate the payoffs of (i), we can use FRAs. What are the fair forward interest rates (annual, simple) f0,0,0.25, f0,0.25,0.50, f0,0.50,0.75, and f0,0.75,1.00? Hint: for an interest rate, its simple term and continuous compounding term always satisfy 1+r simple exp(recxT). =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts