Question: (question 5 is more important if you cant answer every question) CASE 16: THE INVESTMENT DETECTIVE Objectives This case presents the cash flows of eight

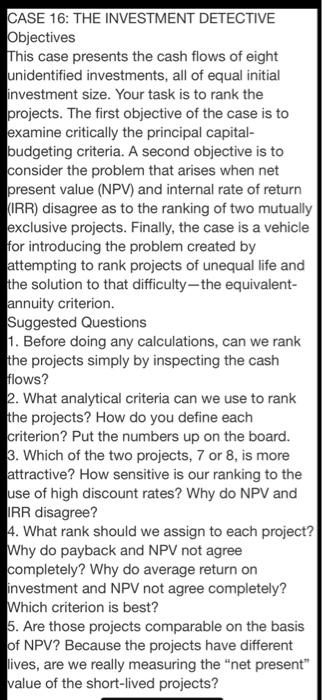

CASE 16: THE INVESTMENT DETECTIVE Objectives This case presents the cash flows of eight unidentified investments, all of equal initial investment size. Your task is to rank the projects. The first objective of the case is to examine critically the principal capital- budgeting criteria. A second objective is to consider the problem that arises when net present value (NPV) and internal rate of return (IRR) disagree as to the ranking of two mutually exclusive projects. Finally, the case is a vehicle for introducing the problem created by attempting to rank projects of unequal life and the solution to that difficulty-the equivalent- annuity criterion. Suggested Questions 1. Before doing any calculations, can we rank the projects simply by inspecting the cash flows? 2. What analytical criteria can we use to rank the projects? How do you define each criterion? Put the numbers up on the board. 3. Which of the two projects, 7 or 8, is more attractive? How sensitive is our ranking to the use of high discount rates? Why do NPV and IRR disagree? 4. What rank should we assign to each project? Why do payback and NPV not agree completely? Why do average return on investment and NPV not agree completely? Which criterion is best? 5. Are those projects comparable on the basis of NPV? Because the projects have different lives, are we really measuring the "net present" value of the short-lived projects? CASE 16: THE INVESTMENT DETECTIVE Objectives This case presents the cash flows of eight unidentified investments, all of equal initial investment size. Your task is to rank the projects. The first objective of the case is to examine critically the principal capital- budgeting criteria. A second objective is to consider the problem that arises when net present value (NPV) and internal rate of return (IRR) disagree as to the ranking of two mutually exclusive projects. Finally, the case is a vehicle for introducing the problem created by attempting to rank projects of unequal life and the solution to that difficulty-the equivalent- annuity criterion. Suggested Questions 1. Before doing any calculations, can we rank the projects simply by inspecting the cash flows? 2. What analytical criteria can we use to rank the projects? How do you define each criterion? Put the numbers up on the board. 3. Which of the two projects, 7 or 8, is more attractive? How sensitive is our ranking to the use of high discount rates? Why do NPV and IRR disagree? 4. What rank should we assign to each project? Why do payback and NPV not agree completely? Why do average return on investment and NPV not agree completely? Which criterion is best? 5. Are those projects comparable on the basis of NPV? Because the projects have different lives, are we really measuring the "net present" value of the short-lived projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts