Question: Question 5 - Land Value - Extraction Method -20 Points Your Client wants to buy a piece of land to build a commercial building. It

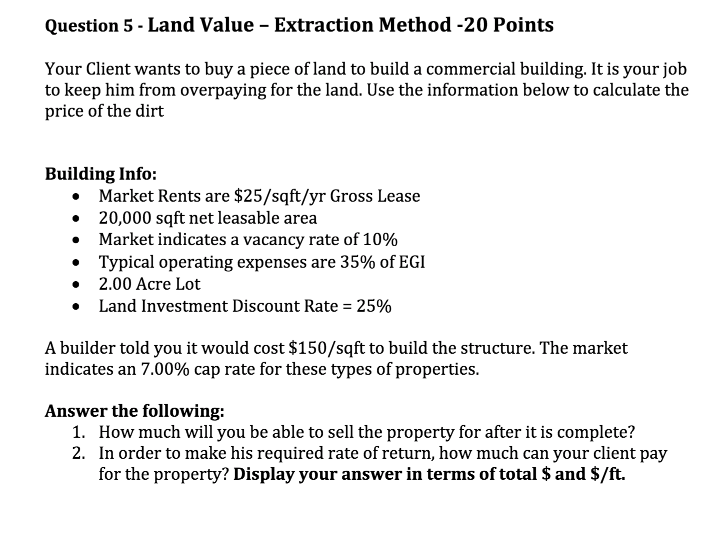

Question 5 - Land Value - Extraction Method -20 Points Your Client wants to buy a piece of land to build a commercial building. It is your job to keep him from overpaying for the land. Use the information below to calculate the price of the dirt Building Info: Market Rents are $25/sqft/yr Gross Lease 20,000 sqft net leasable area Market indicates a vacancy rate of 10% Typical operating expenses are 35% of EGI 2.00 Acre Lot Land Investment Discount Rate = 25% A builder told you it would cost $150/sqft to build the structure. The market indicates an 7.00% cap rate for these types of properties. Answer the following: 1. How much will you be able to sell the property for after it is complete? 2. In order to make his required rate of return, how much can your client pay for the property? Display your answer in terms of total $ and $/ft. Question 5 - Land Value - Extraction Method -20 Points Your Client wants to buy a piece of land to build a commercial building. It is your job to keep him from overpaying for the land. Use the information below to calculate the price of the dirt Building Info: Market Rents are $25/sqft/yr Gross Lease 20,000 sqft net leasable area Market indicates a vacancy rate of 10% Typical operating expenses are 35% of EGI 2.00 Acre Lot Land Investment Discount Rate = 25% A builder told you it would cost $150/sqft to build the structure. The market indicates an 7.00% cap rate for these types of properties. Answer the following: 1. How much will you be able to sell the property for after it is complete? 2. In order to make his required rate of return, how much can your client pay for the property? Display your answer in terms of total $ and $/ft

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts