Question: QUESTION 5 Lapango Inc. estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its

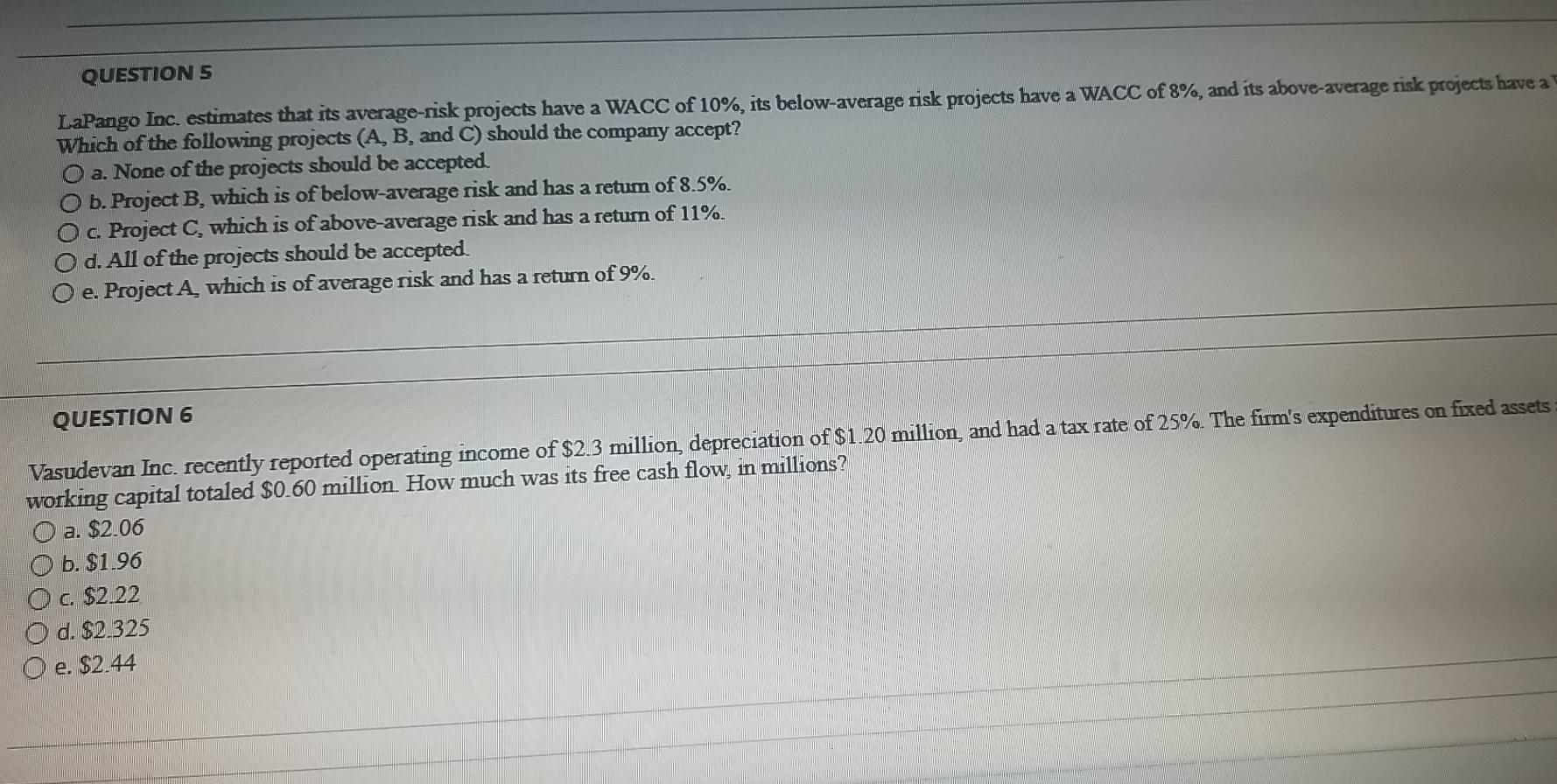

QUESTION 5 Lapango Inc. estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its above-average risk projects have a Which of the following projects (A, B, and C) should the company accept? a. None of the projects should be accepted O b. Project B, which is of below-average risk and has a retum of 8.5%. O c Project C, which is of above average risk and has a retum of 11%. Od. All of the projects should be accepted Oe. Project A which is of average risk and has a return of 9%. QUESTION 6 Vasudevan Inc. recently reported operating income of $2.3 million depreciation of $1.20 million, and had a tax rate of 25% The firm's expenditures on fixed assets working capital totaled $0.60 million How much was its free cash flow, in millions? O a. $2.06 O b. $1.96 a $2.22 d. $2.325 e. $2.44 QUESTION 5 Lapango Inc. estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its above-average risk projects have a Which of the following projects (A, B, and C) should the company accept? a. None of the projects should be accepted O b. Project B, which is of below-average risk and has a retum of 8.5%. O c Project C, which is of above average risk and has a retum of 11%. Od. All of the projects should be accepted Oe. Project A which is of average risk and has a return of 9%. QUESTION 6 Vasudevan Inc. recently reported operating income of $2.3 million depreciation of $1.20 million, and had a tax rate of 25% The firm's expenditures on fixed assets working capital totaled $0.60 million How much was its free cash flow, in millions? O a. $2.06 O b. $1.96 a $2.22 d. $2.325 e. $2.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts