Question: QUESTION 5 Lori established a trust with $4,000,000 in 2011. The trust provides that income is to be distributed to Nick and Ken in equal

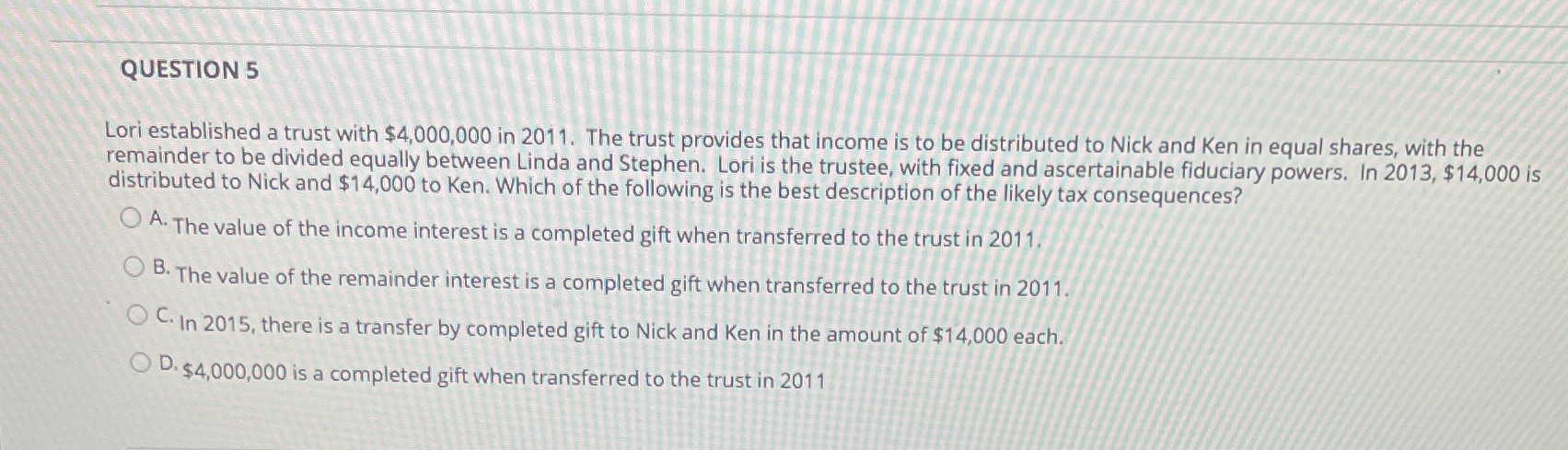

QUESTION 5 Lori established a trust with $4,000,000 in 2011. The trust provides that income is to be distributed to Nick and Ken in equal shares, with the remainder to be divided equally between Linda and Stephen. Lori is the trustee, with fixed and ascertainable fiduciary powers. In 2013, $14,000 is distributed to Nick and $14,000 to Ken. Which of the following is the best description of the likely tax consequences? A. The value of the income interest is a completed gift when transferred to the trust in 2011. O B. The value of the remainder interest is a completed gift when transferred to the trust in 2011. O C. In 2015, there is a transfer by completed gift to Nick and Ken in the amount of $14,000 each. O D. $4,000,000 is a completed gift when transferred to the trust in 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts