Question: Question # 5 . Maple, a limited liability company, designs and manufactures high quality wooden furniture. The audit is nearing completion and you are in

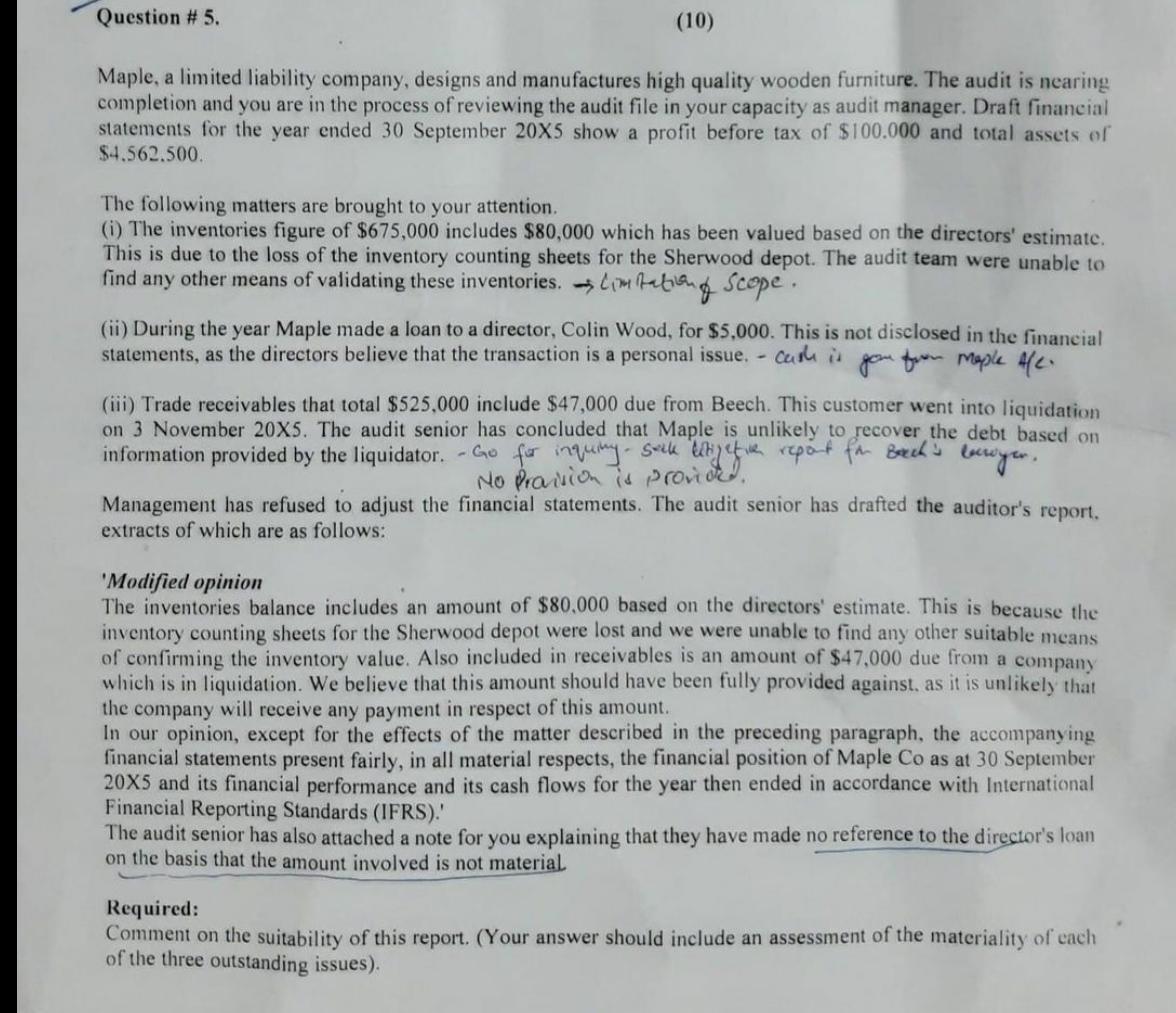

Question \# 5 . Maple, a limited liability company, designs and manufactures high quality wooden furniture. The audit is nearing completion and you are in the process of reviewing the audit file in your capacity as audit manager. Draft financial statements for the year ended 30 September 20X5 show a profit before tax of $100.000 and total assets of $4.562.500. The following matters are brought to your attention. (i) The inventories figure of $675,000 includes $80,000 which has been valued based on the directors' estimate. This is due to the loss of the inventory counting sheets for the Sherwood depot. The audit team were unable to find any other means of validating these inventories. LimRation y scope. (ii) During the year Maple made a loan to a director, Colin Wood, for $5,000. This is not disclosed in the financial statements, as the directors believe that the transaction is a personal issue, - carh is gon from maple 4/C. (iii) Trade receivables that total $525,000 include $47,000 due from Beech. This customer went into liquidation on 3 November 20X5. The audit senior has concluded that Maple is unlikely to recover the debt based on information provided by the liquidator. - Go for inquiny - selk litigifice report fin bect's enwiger. Management has refused to adjust the financial statements. The audit senior has drafted the auditor's report, extracts of which are as follows: 'Modified opinion The inventories balance includes an amount of $80.000 based on the directors' estimate. This is because the inventory counting sheets for the Sherwood depot were lost and we were unable to find any other suitable means of confirming the inventory value. Also included in receivables is an amount of $47,000 due from a company which is in liquidation. We believe that this amount should have been fully provided against, as it is unlikely that the company will receive any payment in respect of this amount. In our opinion, except for the effects of the matter described in the preceding paragraph, the accompanying financial statements present fairly, in all material respects, the financial position of Maple Co as at 30 September 205 and its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRS).' The audit senior has also attached a note for you explaining that they have made no reference to the director's loan on the basis that the amount involved is not material Required: Comment on the suitability of this report. (Your answer should include an assessment of the materiality of each of the three outstanding issues)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts