Question: Question 5 - Marginal Costing vs Absorption Costing Azy Sdn Bhd is a cabinet manufacturer and the data for the month of January 20x8 is

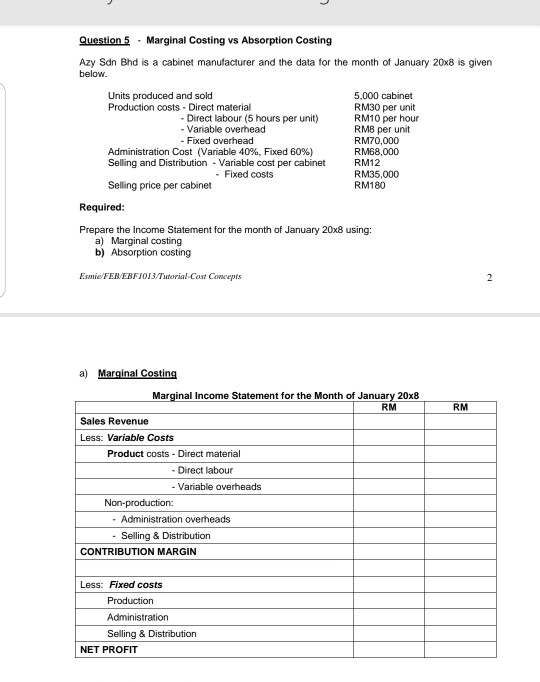

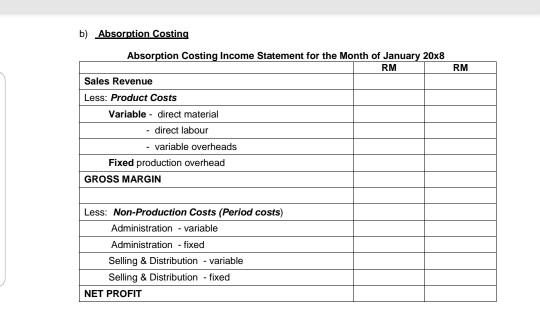

Question 5 - Marginal Costing vs Absorption Costing Azy Sdn Bhd is a cabinet manufacturer and the data for the month of January 20x8 is given below. Units produced and sold 5,000 cabinet Production costs - Direct material RM30 per unit Direct labour (5 hours per unit) RM10 per hour - Variable overhead RM8 per unit Fixed overhead RM70,000 Administration Cost (Variable 40%, Fixed 60%) RM68,000 Selling and Distribution - Variable cost per cabinet RM12 - Fixed costs RM35,000 Selling price per cabinet RM180 Required: Prepare the Income Statement for the month of January 20x8 using: a) Marginal costing b) Absorption costing Esmie/FEB/EBF1073/Tutorial Cost Concepts 2 a) Marginal Costing Marginal Income Statement for the Month of January 20x8 RM RM Sales Revenue Less: Variable Costs Product costs - Direct material - Direct labour - Variable overheads Non-production: - Administration overheads - Selling & Distribution CONTRIBUTION MARGIN Less: Fixed costs Production Administration Selling & Distribution NET PROFIT b) Absorption Costing Absorption Costing Income Statement for the Month of January 20x8 RM RM Sales Revenue Less: Product Costs Variable - direct material - direct labour - variable overheads Fixed production overhead GROSS MARGIN Less: Non-Production Costs (Period costs) Administration - variable Administration - fixed Selling & Distribution - variable Selling & Distribution - fixed NET PROFIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts