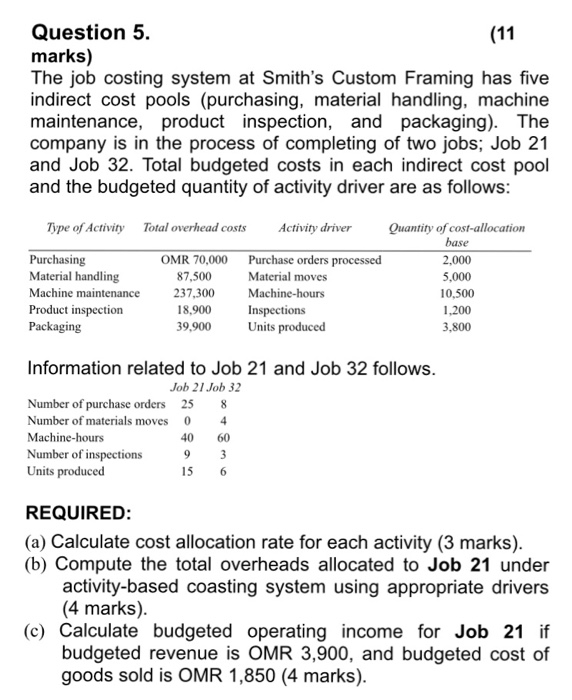

Question: Question 5. marks) The job costing system at Smith's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging).

Question 5. marks) The job costing system at Smith's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of completing of two jobs; Job 21 and Job 32. Total budgeted costs in each indirect cost pool and the budgeted quantity of activity driver are as follows Type of Activity Total overhead costsActivity driver Quantity of cost-allocation Purchasing Material handling Machine maintenance Product inspection Packaging OMR 70,000 87,500 237,300 18,900 39,900 Purchase orders processed Material moves Machine-hours Inspections Units produced base 2,000 5,000 10.500 1,200 3,800 Information related to Job 21 and Job 32 follows Job 21 Job 32 Number of purchase orders 25 8 Number of materials moves 04 Machine-hours Number of inspections Units produced 40 60 15 6 REQUIRED: (a) Calculate cost allocation rate for each activity (3 marks) (b) Compute the total overheads allocated to Job 21 under activity-based coasting system using appropriate drivers (4 marks) (c) Calculate budgeted operating income for Job 21 if budgeted revenue is OMR 3,900, and budgeted cost of goods sold is OMR 1,850 (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts