Question: Question 5: Mega operates nail salons and has an opportunity to lease new space adjacent to an existing store for 10 years. To secure

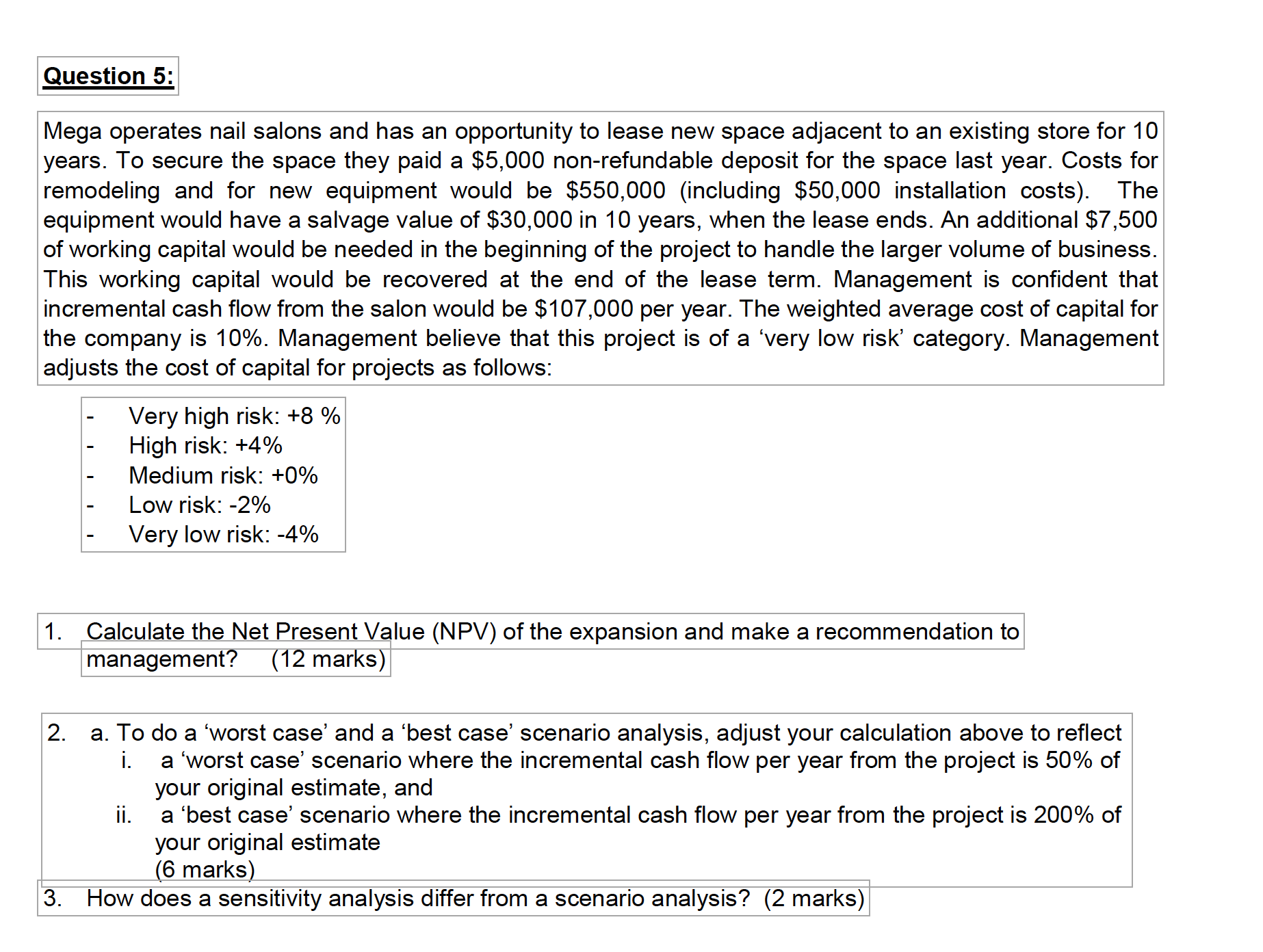

Question 5: Mega operates nail salons and has an opportunity to lease new space adjacent to an existing store for 10 years. To secure the space they paid a $5,000 non-refundable deposit for the space last year. Costs for remodeling and for new equipment would be $550,000 (including $50,000 installation costs). The equipment would have a salvage value of $30,000 in 10 years, when the lease ends. An additional $7,500 of working capital would be needed in the beginning of the project to handle the larger volume of business. This working capital would be recovered at the end of the lease term. Management is confident that incremental cash flow from the salon would be $107,000 per year. The weighted average cost of capital for the company is 10%. Management believe that this project is of a 'very low risk' category. Management adjusts the cost of capital for projects as follows: Very high risk: +8 % High risk: +4% Medium risk: +0% Low risk: -2% Very low risk: -4% 1. Calculate the Net Present Value (NPV) of the expansion and make a recommendation to management? 2. (12 marks) a. To do a 'worst case' and a 'best case' scenario analysis, adjust your calculation above to reflect . a 'worst case' scenario where the incremental cash flow per year from the project is 50% of your original estimate, and ii. a 'best case' scenario where the incremental cash flow per year from the project is 200% of your original estimate (6 marks) 3. How does a sensitivity analysis differ from a scenario analysis? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

1 calculate the Net Present ValueNPVof the Expansion and make a recommendation t... View full answer

Get step-by-step solutions from verified subject matter experts