Question: Question 5 Moving to another question will save this response Question of Questions 2 points Suppose the rate on a tax exempt municipal bond is

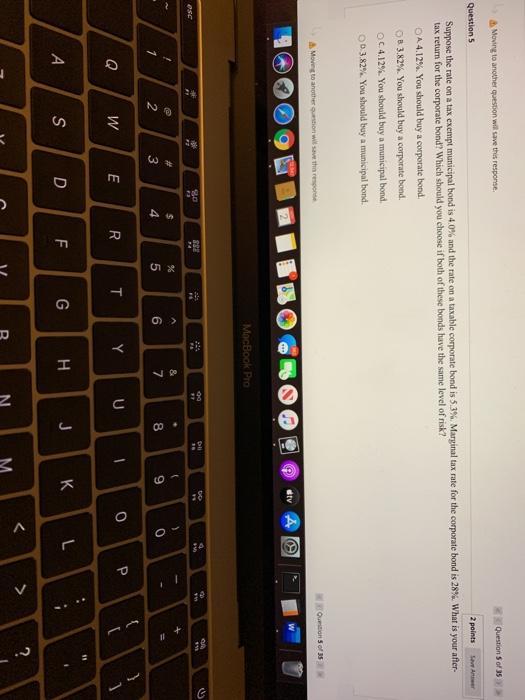

Moving to another question will save this response Question of Questions 2 points Suppose the rate on a tax exempt municipal bond is 4.0% and the rate on a taxable corporate bond is 5.3%. Marginal tax rate for the corporate bond is 28% What is your after tax return for the corporate bond? Which should you choose if both of these bonds have the same level of risk? DA 4.12%. You should buy a corporate bond, 83.82%. You should buy a corporate bond. OC 4.12%. You should buy a municipal bond 0 0.3.82%. You should buy a municipal bond. Oitions of 35 A Move to another wit save the one MacBook Pro DU so 23 32 re esc 8 + A % $ 4 & 7 N 6 0 8 9 3 2 Q P W } 1 R E T 0 Y T U S F D G I L J K V > ? c N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts