Question: Question 5 - Non-Current Assets (10 marks). On 1 November 2017 Ski-High purchased a new ski-lift at a cost of $250,000 plus installation costs of

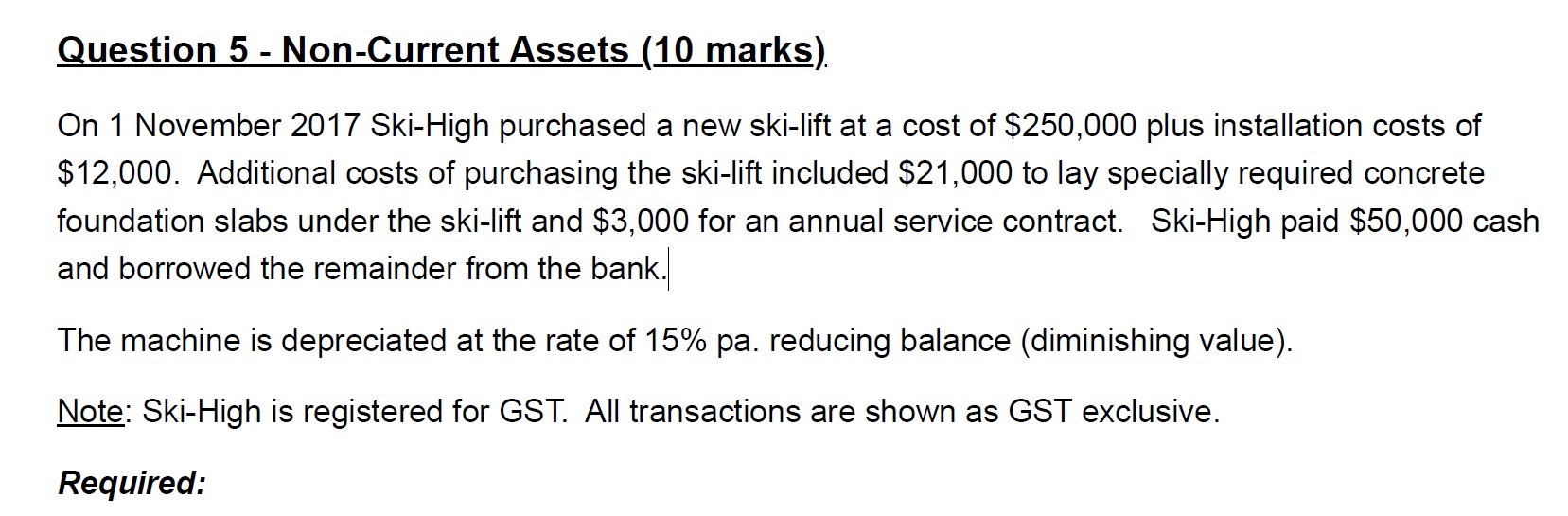

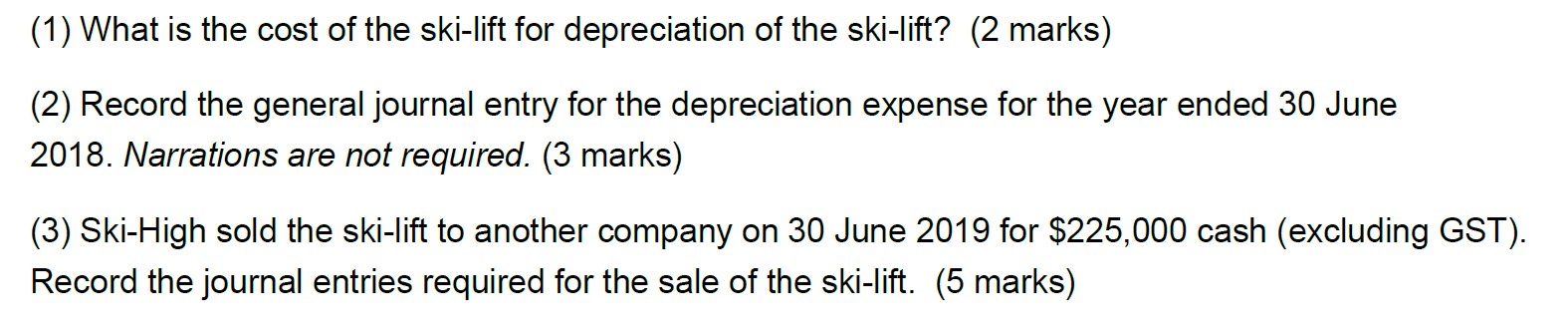

Question 5 - Non-Current Assets (10 marks). On 1 November 2017 Ski-High purchased a new ski-lift at a cost of $250,000 plus installation costs of $12,000. Additional costs of purchasing the ski-lift included $21,000 to lay specially required concrete foundation slabs under the ski-lift and $3,000 for an annual service contract. Ski-High paid $50,000 cash and borrowed the remainder from the bank. The machine is depreciated at the rate of 15% pa. reducing balance (diminishing value). Note: Ski-High is registered for GST. All transactions are shown as GST exclusive. Required: (1) What is the cost of the ski-lift for depreciation of the ski-lift? (2 marks) (2) Record the general journal entry for the depreciation expense for the year ended 30 June 2018. Narrations are not required. (3 marks) (3) Ski-High sold the ski-lift to another company on 30 June 2019 for $225,000 cash (excluding GST). Record the journal entries required for the sale of the ski-lift

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts