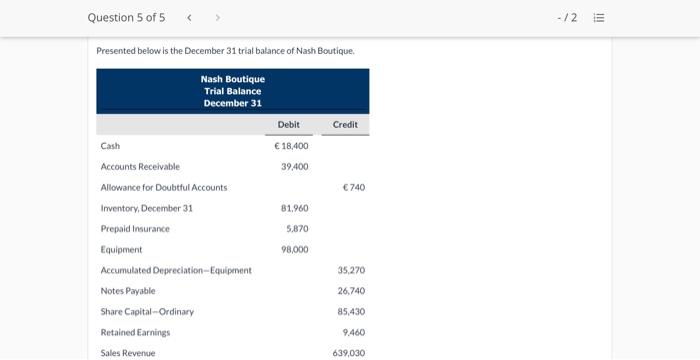

Question: Question 5 of 5 -12 E Presented below is the December 31 trial balance of Nash Boutique Nash Boutique Trial Balance December 31 Debit Credit

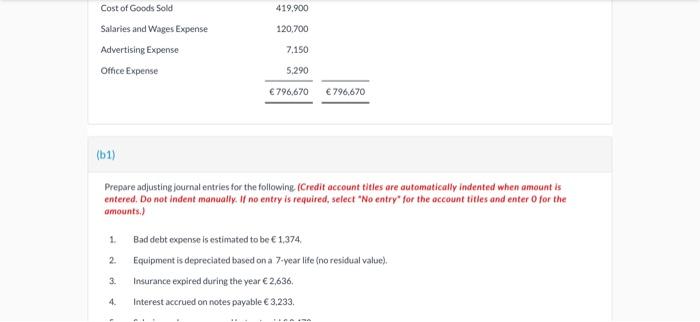

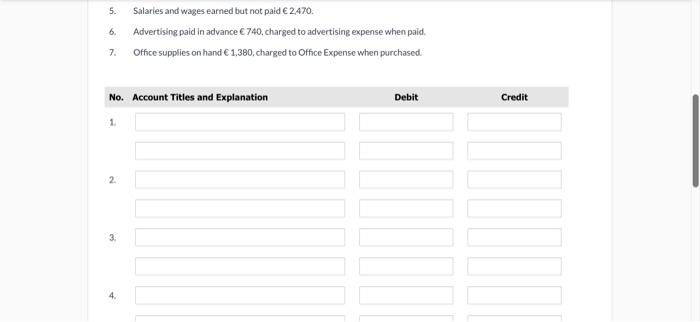

Question 5 of 5 -12 E Presented below is the December 31 trial balance of Nash Boutique Nash Boutique Trial Balance December 31 Debit Credit Cash 18,400 39,400 740 81.960 5,870 Accounts Receivable Allowance for Doubtful Accounts Inventory, December 31 Prepaid Insurance Equipment Accumulated Depreciation Equipment Notes Payable Share Capital - Ordinary Retained Earnings 98,000 35,270 26,740 85.430 9.460 Sales Revenue 639.030 419,900 120.700 Cost of Goods Sold Salaries and Wages Expense Advertising Expense Office Expense 7,150 5,290 796,670 796,670 (61) Prepare adjusting journal entries for the following (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts.) 1 2. Bad debt expense is estimated to be 1,374 Equipment is depreciated based on a 7-year life (no residual value) Insurance expired during the year 2,636, Interest accrued on notes payable 3,233, 3. 4. . 5. 6. Salaries and wages earned but not paid 2,470. Advertising paid in advance E740, charged to advertising expense when paid. Office supplies on hand 1.380, charged to Office Expense when purchased 7. No. Account Titles and Explanation Debit Credit 1 7. eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts