Question: Question 5 of 5 -/5 E View Policies Current Attempt in Progress Agassi Company uses a job order cost system in each of its three

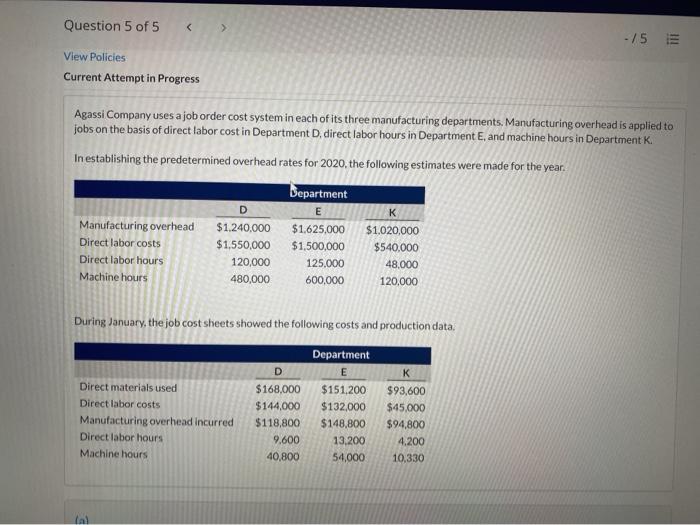

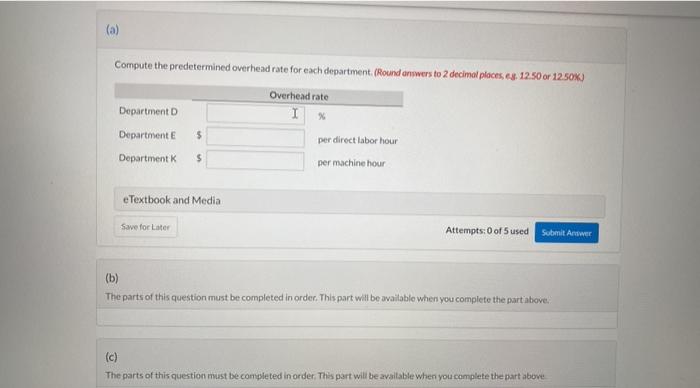

Question 5 of 5 -/5 E View Policies Current Attempt in Progress Agassi Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department D, direct labor hours in Department E, and machine hours in Department K. In establishing the predetermined overhead rates for 2020, the following estimates were made for the year. Department Manufacturing overhead $1.240,000 $1.625,000 $1,020,000 Direct labor costs $1,550,000 $1,500,000 $540,000 Direct labor hours 120,000 125.000 48.000 Machine hours 480,000 600,000 120,000 D E During January, the job cost sheets showed the following costs and production data D Direct materials used Direct labor costs Manufacturing overhead incurred Direct labor hours Machine hours $168,000 $144,000 $118,800 9.600 40,800 Department E $151,200 $132.000 $148,800 13,200 54,000 K $93,600 $45,000 $94,800 4.200 10,330 tal (a) Compute the predetermined overhead rate for each department (Round answers to 2 decimal places, s. 12.50 or 12.50%) Overhead rate Department D I % Department $ per direct labor hour Department $ per machine hour e Textbook and Media Save for Later Attempts:0 of 5 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part'above. (c) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts