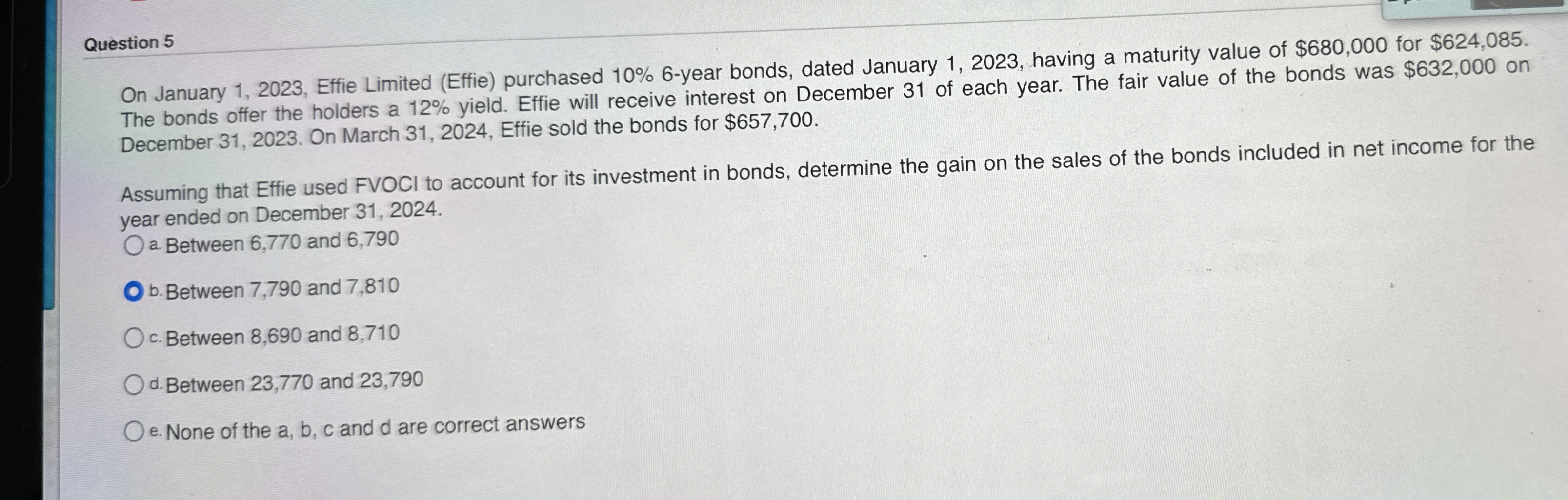

Question: Question 5 On January 1 , 2 0 2 3 , Effie Limited ( Effie ) purchased 1 0 % 6 - year bonds, dated

Question

On January Effie Limited Effie purchased year bonds, dated January having a maturity value of $ for $

The bonds offer the holders a yield. Effie will receive interest on December of each year. The fair value of the bonds was $ on

December On March Effie sold the bonds for $

Assuming that Effie used FVOCI to account for its investment in bonds, determine the gain on the sales of the bonds included in net income for the

year ended on December

a Between and

b Between and

c Between and

d Between and

e None of the a b c and are correct answers

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock