Question: Question 5: Portfolio Performance Evaluation; International Diversification Your Aunt has been investing in a company's shares over the last three years. The information on her

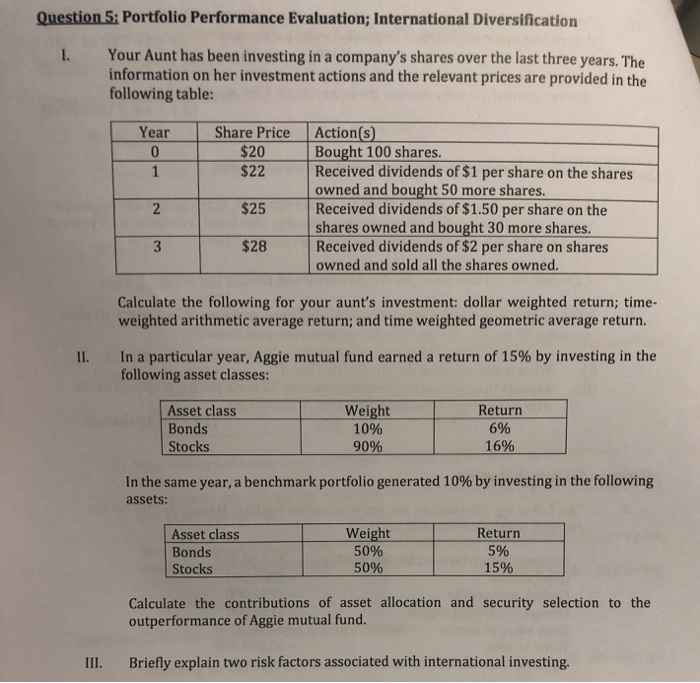

Question 5: Portfolio Performance Evaluation; International Diversification Your Aunt has been investing in a company's shares over the last three years. The information on her investment actions and the relevant prices are provided in the following table: I. Year Share Price Action(s) Bought 100 shares. Received dividends of $1 per share on the shares owned and bought 50 more shares. Received dividends of $1.50 per share on the shares owned and bought 30 more shares. Received dividends of $2 per share on shares owned and sold all the shares owned. $20 $22 0 1 $25 2 $28 Calculate the following for your aunt's investment: dollar weighted return; time- weighted arithmetic average return; and time weighted geometric average return. In a particular year, Aggie mutual fund earned a return of 15% by investing in the following asset classes: 11. Weight 10% 90% Asset class Return Bonds 6% 16% Stocks In the same year, a benchmark portfolio generated 10 % by investing in the following assets: Weight 50% 50% Asset class Return 5% 15% Bonds Stocks Calculate the contributions of asset allocation and security selection to the outperformance of Aggie mutual fund. Briefly explain two risk factors associated with international investing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts