Question: Question 5, Problem 9-20 (algorithmic) Question Help It is being decided whether or not to replace an existing piece of equipment with a newer, more

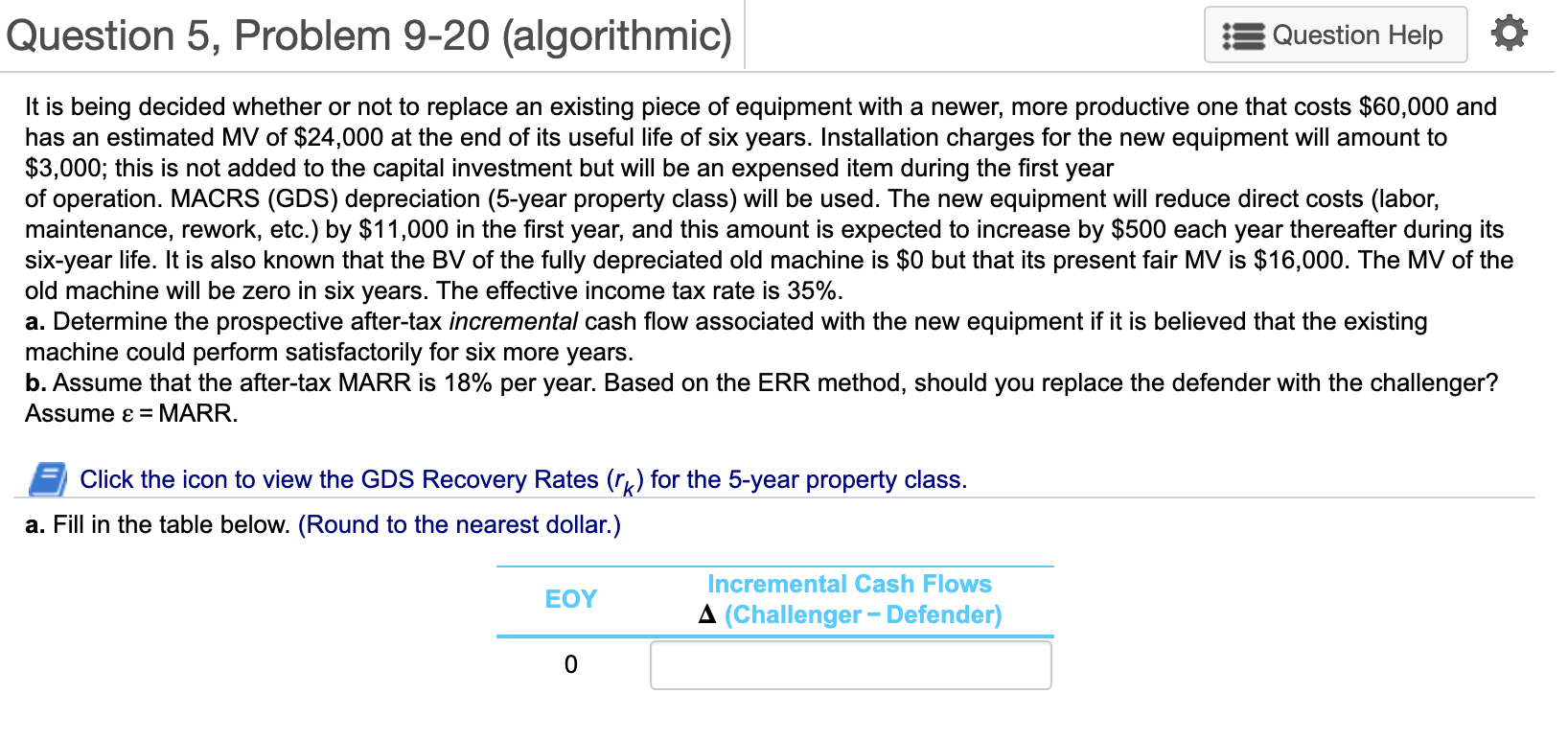

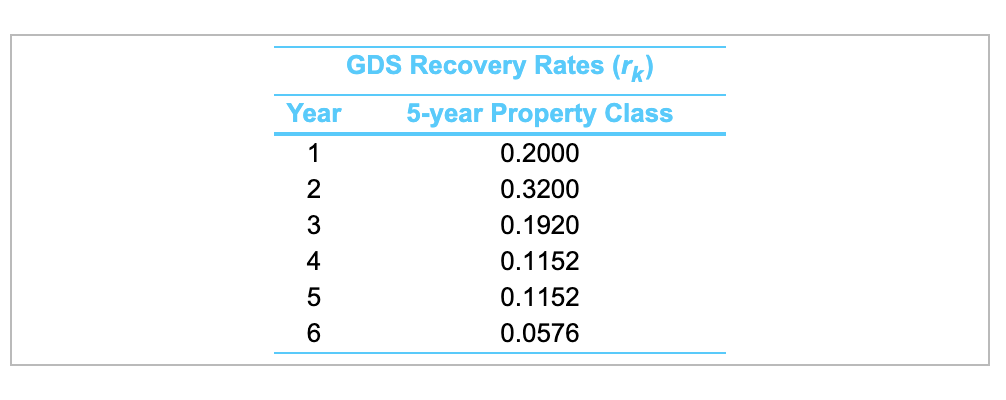

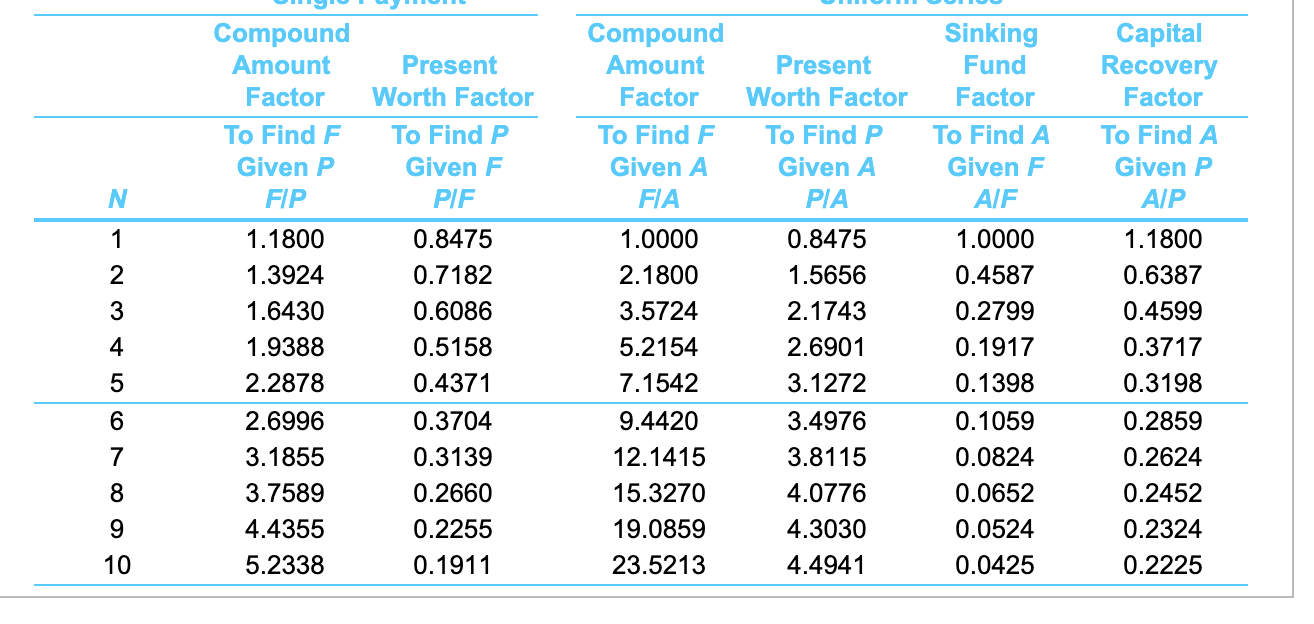

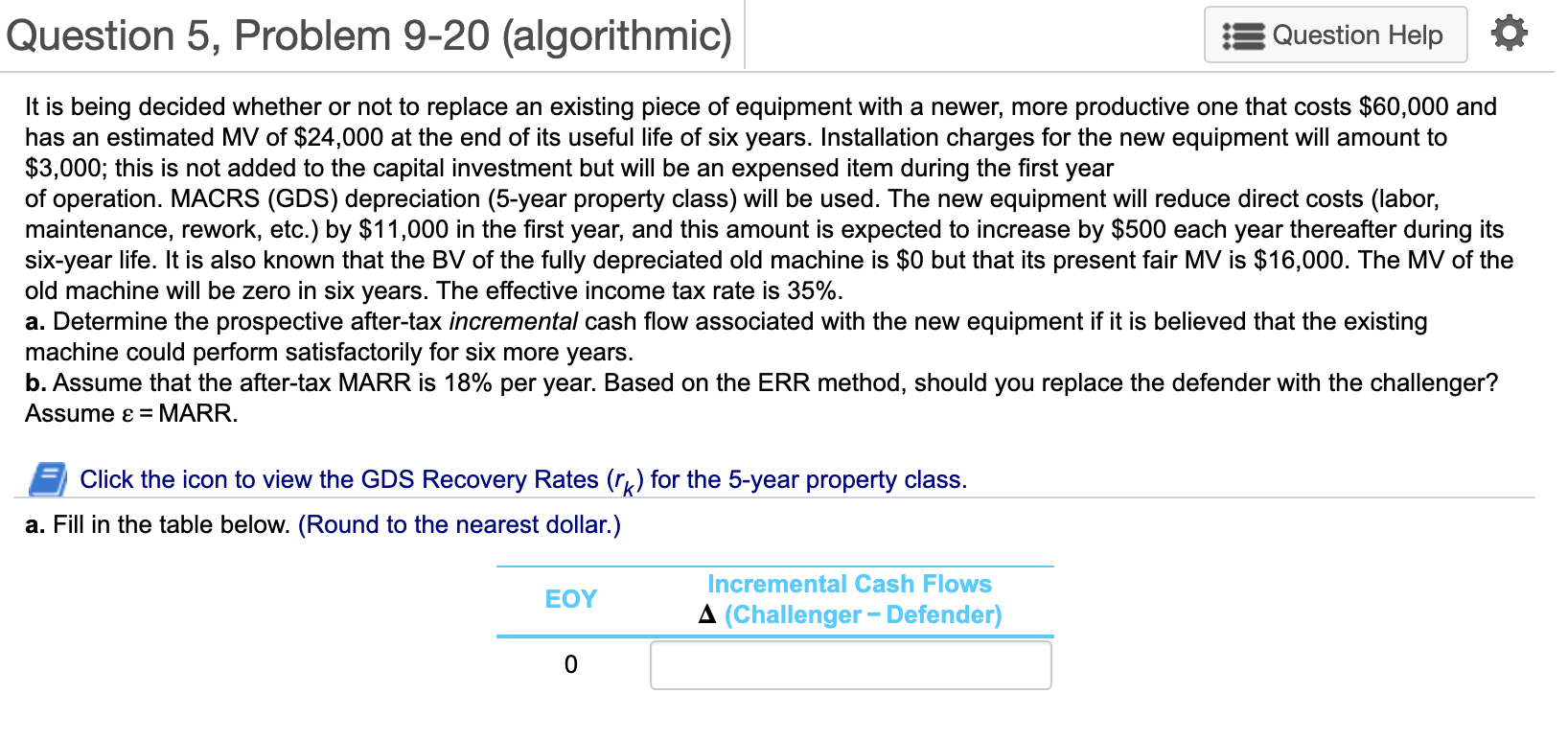

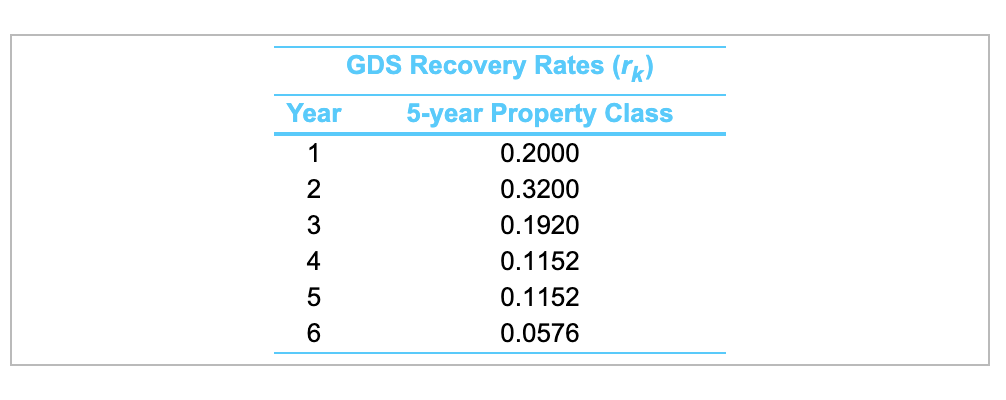

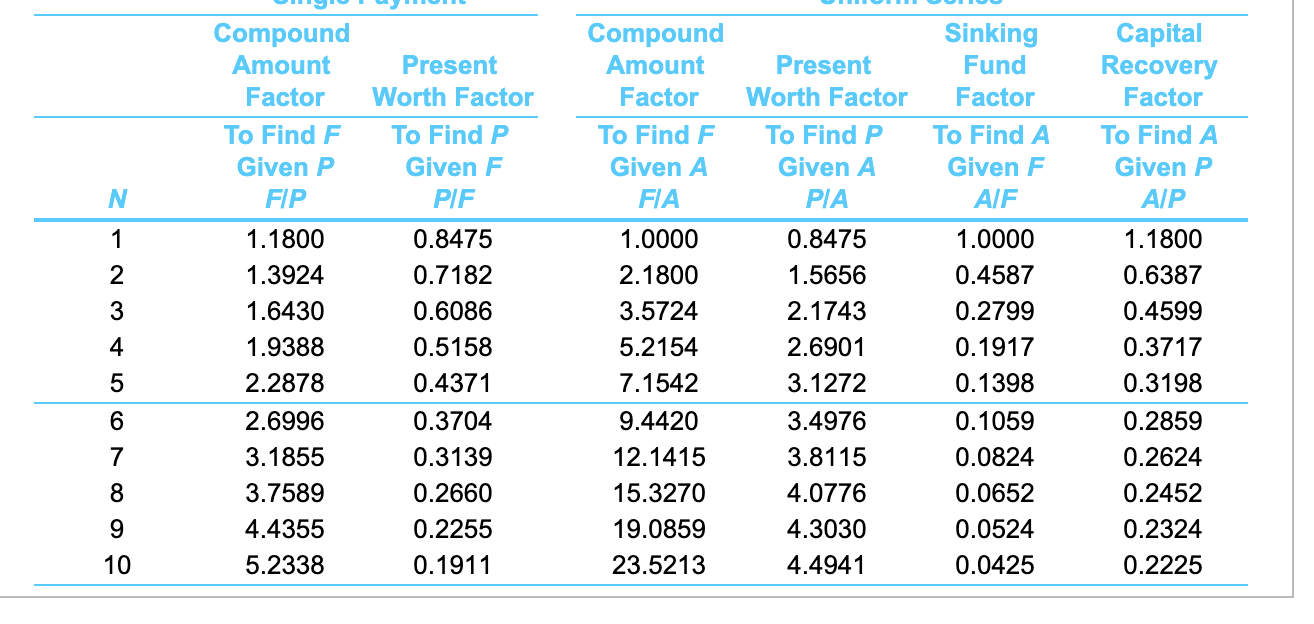

Question 5, Problem 9-20 (algorithmic) Question Help It is being decided whether or not to replace an existing piece of equipment with a newer, more productive one that costs $60,000 and has an estimated MV of $24,000 at the end of its useful life of six years. Installation charges for the new equipment will amount to $3,000; this is not added to the capital investment but will be an expensed item during the first year of operation. MACRS (GDS) depreciation (5-year property class) will be used. The new equipment will reduce direct costs (labor, maintenance, rework, etc.) by $11,000 in the first year, and this amount is expected to increase by $500 each year thereafter during its six-year life. It is also known that the BV of the fully depreciated old machine is $0 but that its present fair MV is $16,000. The MV of the old machine will be zero in six years. The effective income tax rate is 35%. a. Determine the prospective after-tax incremental cash flow associated with the new equipment if it is believed that the existing machine could perform satisfactorily for six more years. b. Assume that the after-tax MARR is 18% per year. Based on the ERR method, should you replace the defender with the challenger? Assume = MARR. Click the icon to view the GDS Recovery Rates ("k) for the 5-year property class. a. Fill in the table below. (Round to the nearest dollar.) EOY Incremental Cash Flows A (Challenger Defender) 0 GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 Compound Amount Factor To Find F Given A FIA Present Worth Factor To Find P Given A PIA Sinking Fund Factor To Find A Given F AIF Capital Recovery Factor To Find A Given P AIP N 1 2 Compound Amount Present Factor Worth Factor To Find F To Find P Given P Given F FIP PIF 1.1800 0.8475 1.3924 0.7182 1.6430 0.6086 1.9388 0.5158 2.2878 0.4371 2.6996 0.3704 3.1855 0.3139 3.7589 0.2660 4.4355 0.2255 5.2338 0.1911 3 0.8475 1.5656 2.1743 2.6901 3.1272 1.1800 0.6387 0.4599 0.3717 0.3198 4 5 1.0000 2.1800 3.5724 5.2154 7.1542 9.4420 12.1415 15.3270 19.0859 23.5213 1.0000 0.4587 0.2799 0.1917 0.1398 0.1059 0.0824 0.0652 0.0524 0.0425 6 7 8 3.4976 3.8115 4.0776 4.3030 4.4941 0.2859 0.2624 0.2452 0.2324 0.2225 9 10 Question 5, Problem 9-20 (algorithmic) Question Help It is being decided whether or not to replace an existing piece of equipment with a newer, more productive one that costs $60,000 and has an estimated MV of $24,000 at the end of its useful life of six years. Installation charges for the new equipment will amount to $3,000; this is not added to the capital investment but will be an expensed item during the first year of operation. MACRS (GDS) depreciation (5-year property class) will be used. The new equipment will reduce direct costs (labor, maintenance, rework, etc.) by $11,000 in the first year, and this amount is expected to increase by $500 each year thereafter during its six-year life. It is also known that the BV of the fully depreciated old machine is $0 but that its present fair MV is $16,000. The MV of the old machine will be zero in six years. The effective income tax rate is 35%. a. Determine the prospective after-tax incremental cash flow associated with the new equipment if it is believed that the existing machine could perform satisfactorily for six more years. b. Assume that the after-tax MARR is 18% per year. Based on the ERR method, should you replace the defender with the challenger? Assume = MARR. Click the icon to view the GDS Recovery Rates ("k) for the 5-year property class. a. Fill in the table below. (Round to the nearest dollar.) EOY Incremental Cash Flows A (Challenger Defender) 0 GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 Compound Amount Factor To Find F Given A FIA Present Worth Factor To Find P Given A PIA Sinking Fund Factor To Find A Given F AIF Capital Recovery Factor To Find A Given P AIP N 1 2 Compound Amount Present Factor Worth Factor To Find F To Find P Given P Given F FIP PIF 1.1800 0.8475 1.3924 0.7182 1.6430 0.6086 1.9388 0.5158 2.2878 0.4371 2.6996 0.3704 3.1855 0.3139 3.7589 0.2660 4.4355 0.2255 5.2338 0.1911 3 0.8475 1.5656 2.1743 2.6901 3.1272 1.1800 0.6387 0.4599 0.3717 0.3198 4 5 1.0000 2.1800 3.5724 5.2154 7.1542 9.4420 12.1415 15.3270 19.0859 23.5213 1.0000 0.4587 0.2799 0.1917 0.1398 0.1059 0.0824 0.0652 0.0524 0.0425 6 7 8 3.4976 3.8115 4.0776 4.3030 4.4941 0.2859 0.2624 0.2452 0.2324 0.2225 9 10