Question: QUESTION 5 Real Options A Part 1: You develop a new stock picking strategy. You think this strategy will deliver high returns with minimal risk,

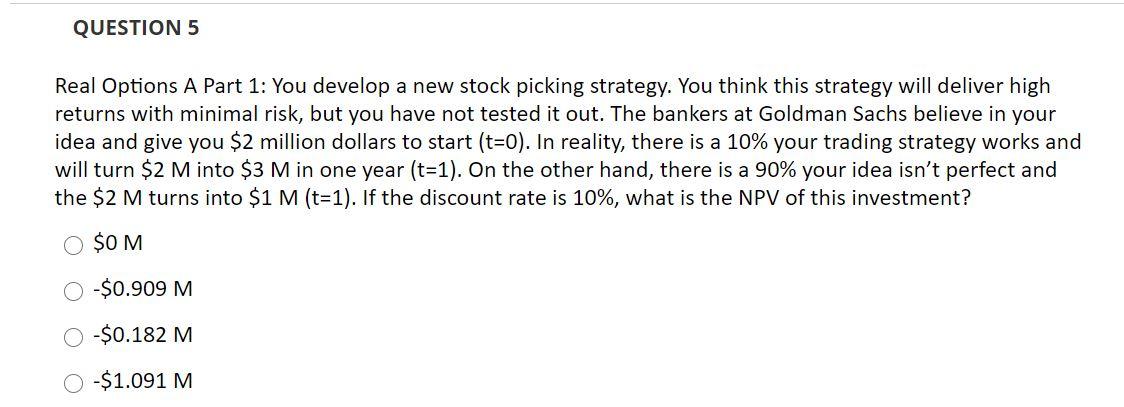

QUESTION 5 Real Options A Part 1: You develop a new stock picking strategy. You think this strategy will deliver high returns with minimal risk, but you have not tested it out. The bankers at Goldman Sachs believe in your idea and give you $2 million dollars to start (t=0). In reality, there is a 10% your trading strategy works and will turn $2 M into $3 M in one year (t=1). On the other hand, there is a 90% your idea isn't perfect and the $2 M turns into $1 M (t=1). If the discount rate is 10%, what is the NPV of this investment? O $OM $0.909 M $0.182 M -$1.091 M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts