Question: Question 5: Risk and Return with correlation coefficient Question 6: State Preference theory Question 6 :` The following data relates to three different securities prevailing

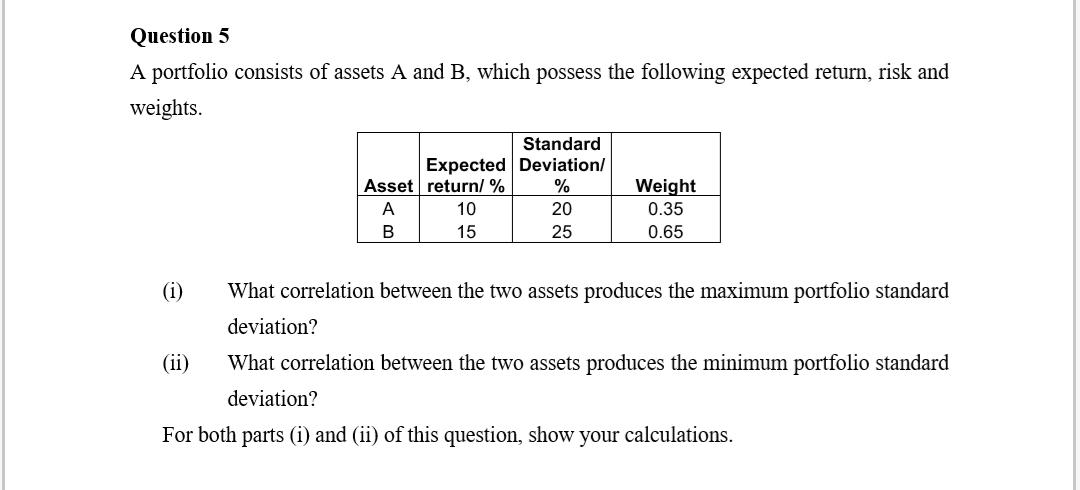

Question 5: Risk and Return with correlation coefficient

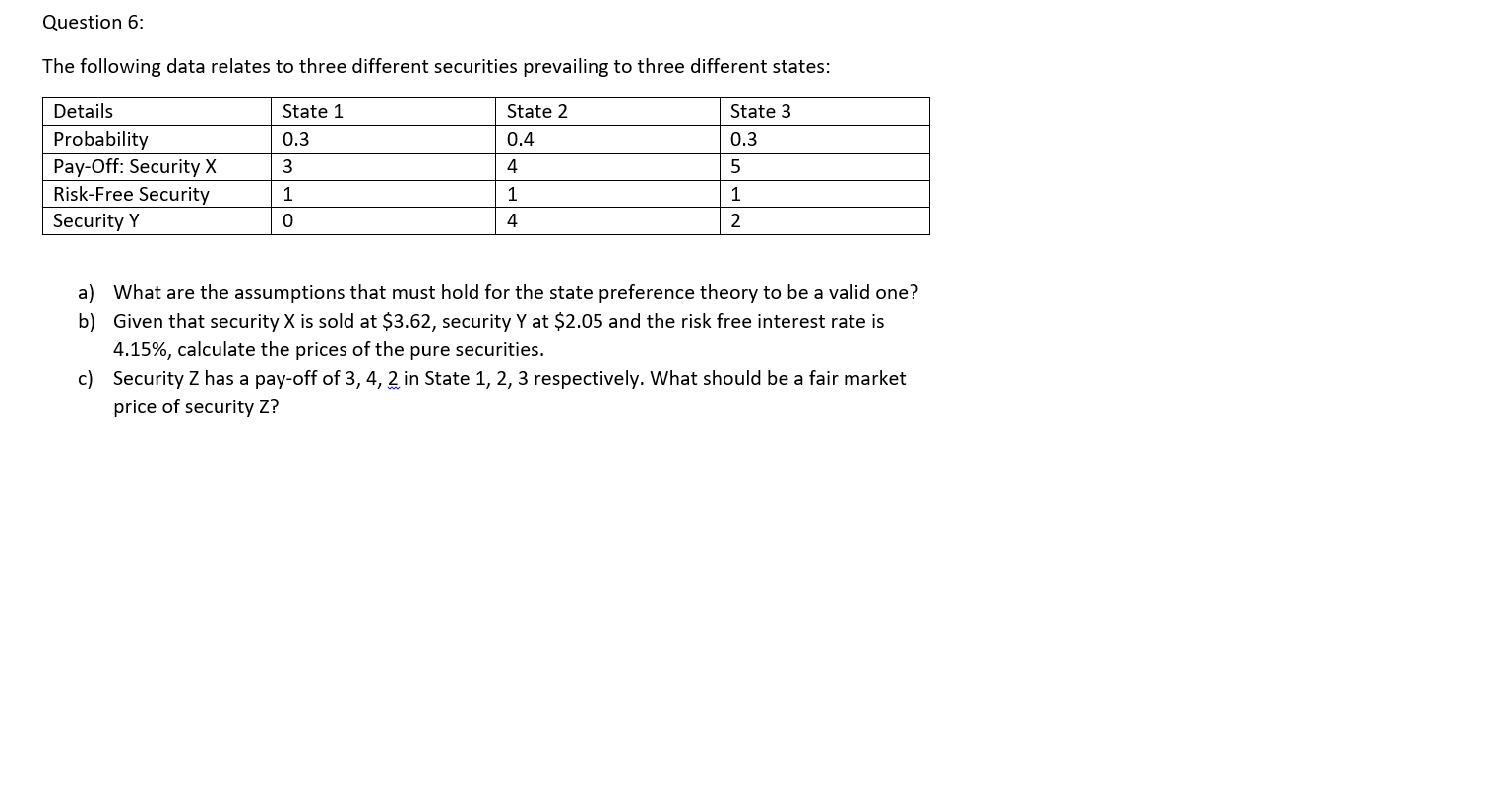

Question 6: State Preference theory

Question 6 :` The following data relates to three different securities prevailing to three different states :" Details state 1 State 2 State 3 Probability 0. 3 0 . 4 0 . 3 Pay - Off : Security X 3 4 5 Risk - Free Security 1 1 1 Security Y A 2 a ) What are the assumptions that must hold for the state preference theory to be a valid one ?" 6 ) Given that security X is sold at $3. 62 , security Y at $2 . 05 and the risk free interest rate is 4 . 15% , calculate the prices of the pure securities . C ) Security Z has a pay - off of 3 , 4 , 2 in State 1 , 2 , 3 respectively . What should be a fair market price of security Z ?Question 5 A portfolio consists of assets A and B, which possess the following expected return, risk and weights. Standard Expected Deviation! Asset retum!% % Weight A 10 20 0.35 B 15 25 0.65 (i) What correlation between the two assets produces the maximum portfolio standard deviation? (ii) What correlation between the two assets produces the minimum portfolio standard deviation? For both parts (i) and (ii) of this question, show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts