Question: QUESTION 5 St. Albert Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? (rounded) WACC

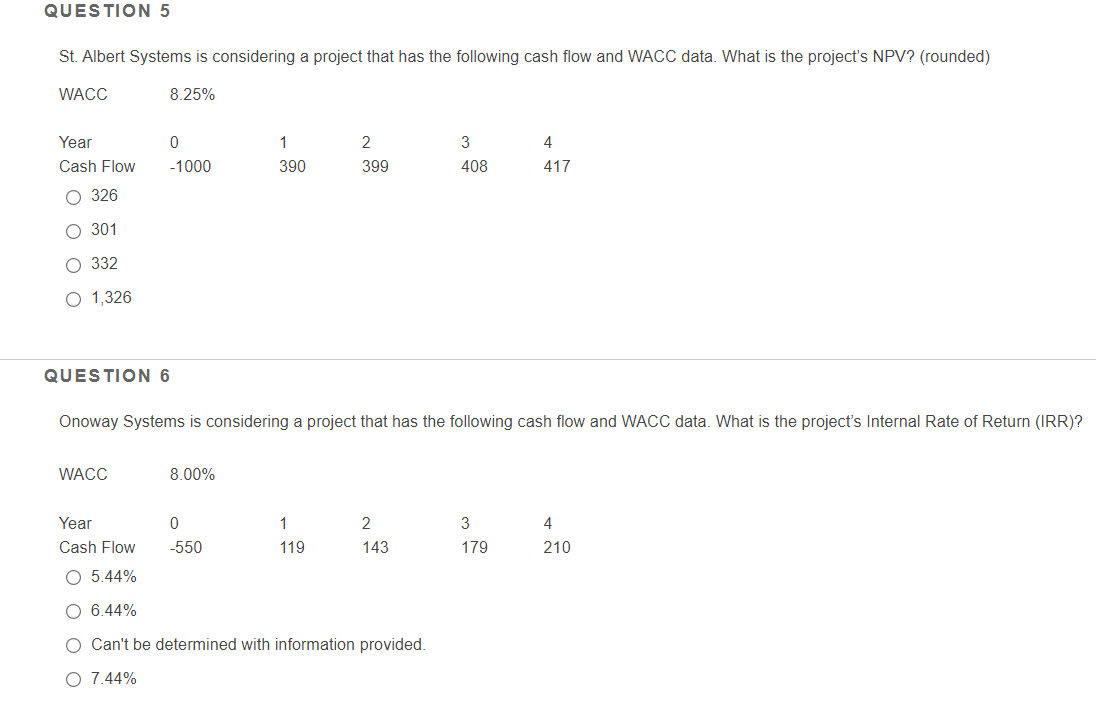

QUESTION 5 St. Albert Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? (rounded) WACC 8.25% Year 0 1 2 3 4 Cash Flow -1000 390 399 408 417 0326 0 301 O 332 O 1,326 QUESTION 6 Onoway Systems is considering a project that has the following cash flow and WACC data. What is the project's Internal Rate of Return (IRR)? WACC 8.00% Year 0 1 2 3 4 Cash Flow -550 119 143 179 210 O 5.44% 0 6.44% Can't be determined with information provided. O 7.44%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts