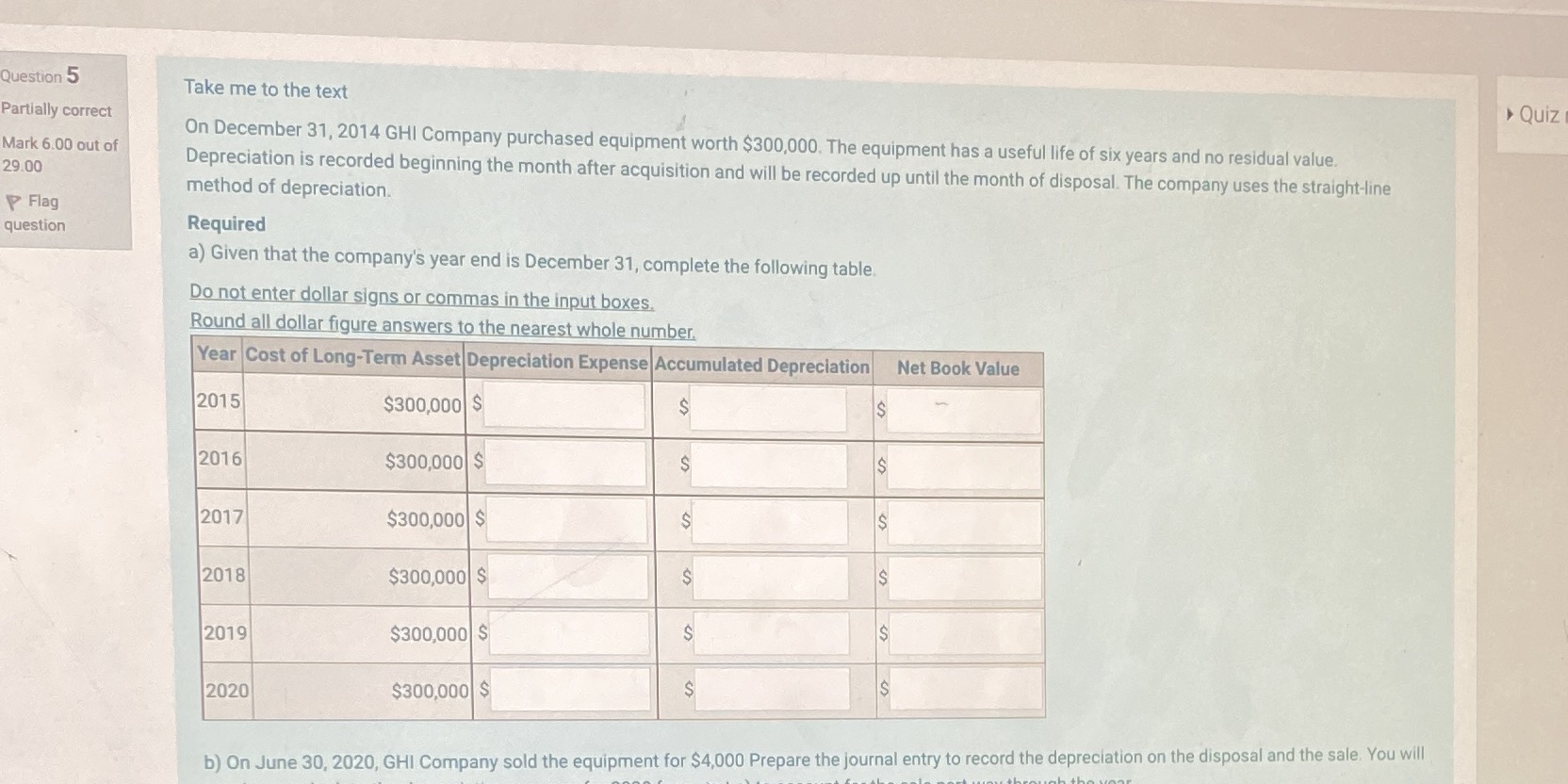

Question: Question 5 Take me to the text Partially correct > Quiz Mark 6.00 out of On December 31, 2014 GHI Company purchased equipment worth $300,000.

Step by Step Solution

There are 3 Steps involved in it

Part a Depreciation Table Given the following information Cost of equipment 300000 Useful life 6 yea... View full answer

Get step-by-step solutions from verified subject matter experts