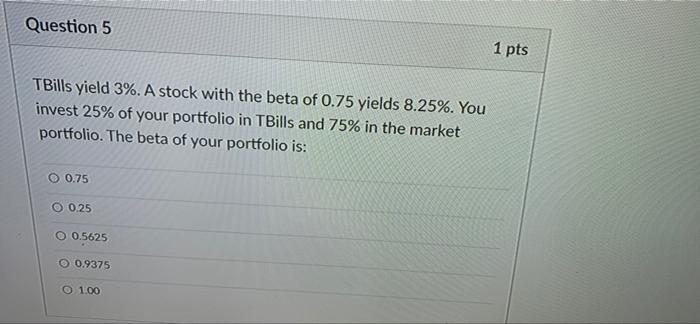

Question: Question 5 TBills yield 3%. A stock with the beta of 0.75 yields 8.25%. You invest 25% of your portfolio in TBills and 75% in

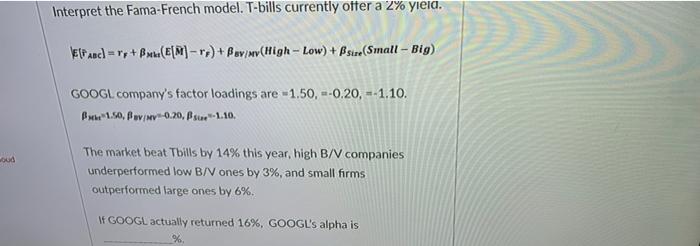

Question 5 TBills yield 3%. A stock with the beta of 0.75 yields 8.25%. You invest 25% of your portfolio in TBills and 75% in the market portfolio. The beta of your portfolio is: 0.75 0,25 O 0.5625 0.9375 1.00 1 pts woud Interpret the Fama-French model. T-bills currently offer a 2% yield. EFABC]=ry+BMM(E[M]-re)+ Bav/Mv(High-Low) + size (Small-Big) GOOGL company's factor loadings are -1.50,-0.20,-1.10. P 1.50, Bav/Mv0.20, sue-1.10. The market beat Tbills by 14% this year, high B/V companies underperformed low B/V ones by 3%, and small firms outperformed large ones by 6%. If GOOGL actually returned 16%, GOOGL's alpha is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock