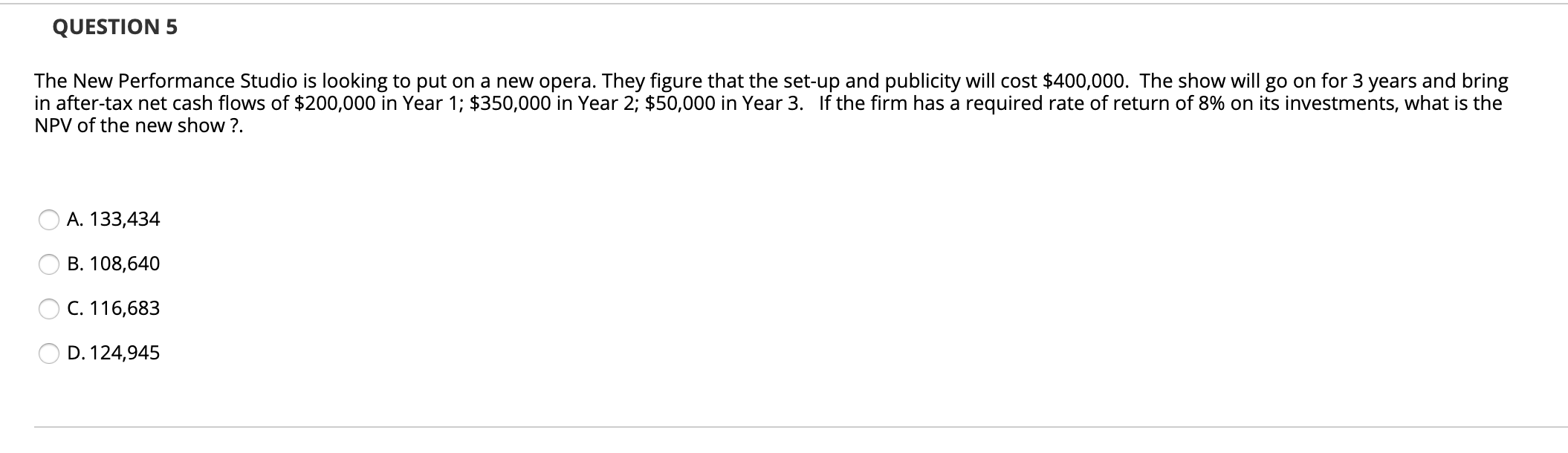

Question: QUESTION 5 The New Performance Studio is looking to put on a new opera. They figure that the set-up and publicity will cost $400,000. The

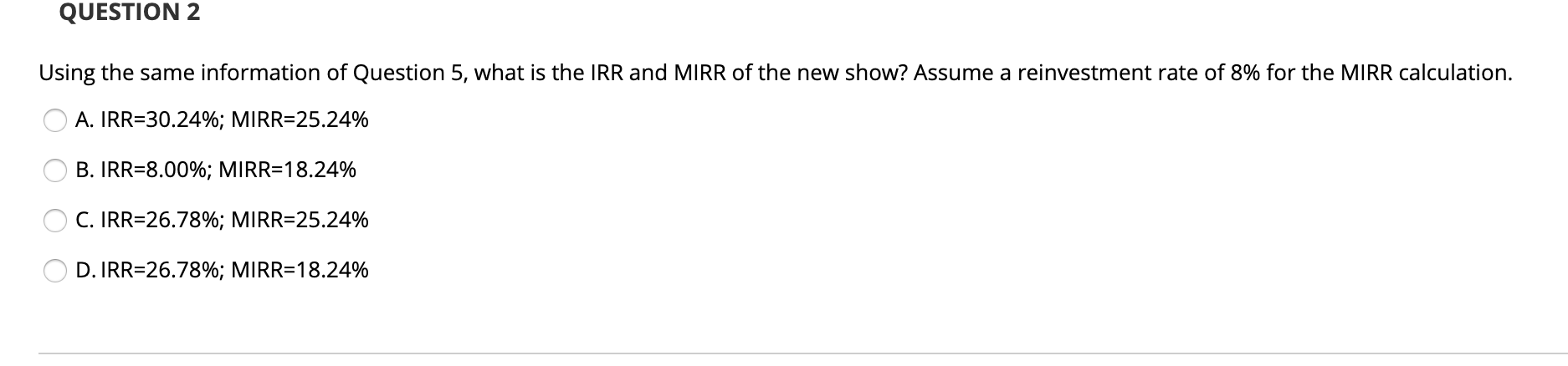

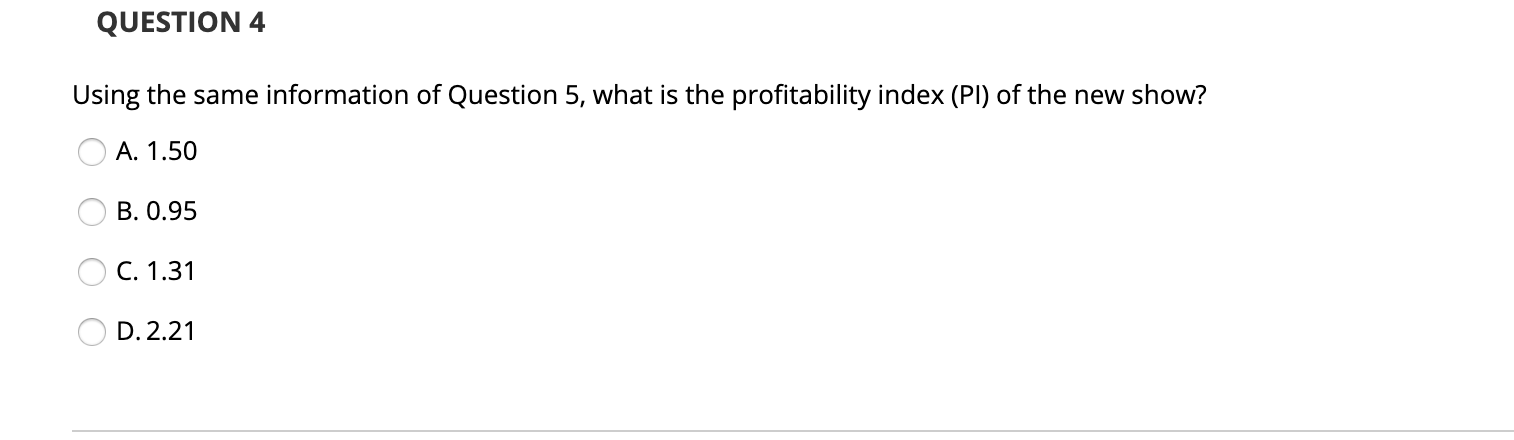

QUESTION 5 The New Performance Studio is looking to put on a new opera. They figure that the set-up and publicity will cost $400,000. The show will go on for 3 years and bring in after-tax net cash flows of $200,000 in Year 1; $350,000 in Year 2; $50,000 in Year 3. If the firm has a required rate of return of 8% on its investments, what is the NPV of the new show ?. O A. 133,434 OB. 108,640 O C. 116,683 OD. 124,945 QUESTION 2 Using the same information of Question 5, what is the IRR and MIRR of the new show? Assume a reinvestment rate of 8% for the MIRR calculation. O A. IRR=30.24%; MIRR=25.24% O B. IRR=8.00%; MIRR=18.24% O C. IRR=26.78%; MIRR=25.24% OD. IRR=26.78%; MIRR=18.24% QUESTION 4 Using the same information of Question 5, what is the profitability index (PI) of the new show? O A. 1.50 OB. 0.95 O C. 1.31 O D.2.21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts