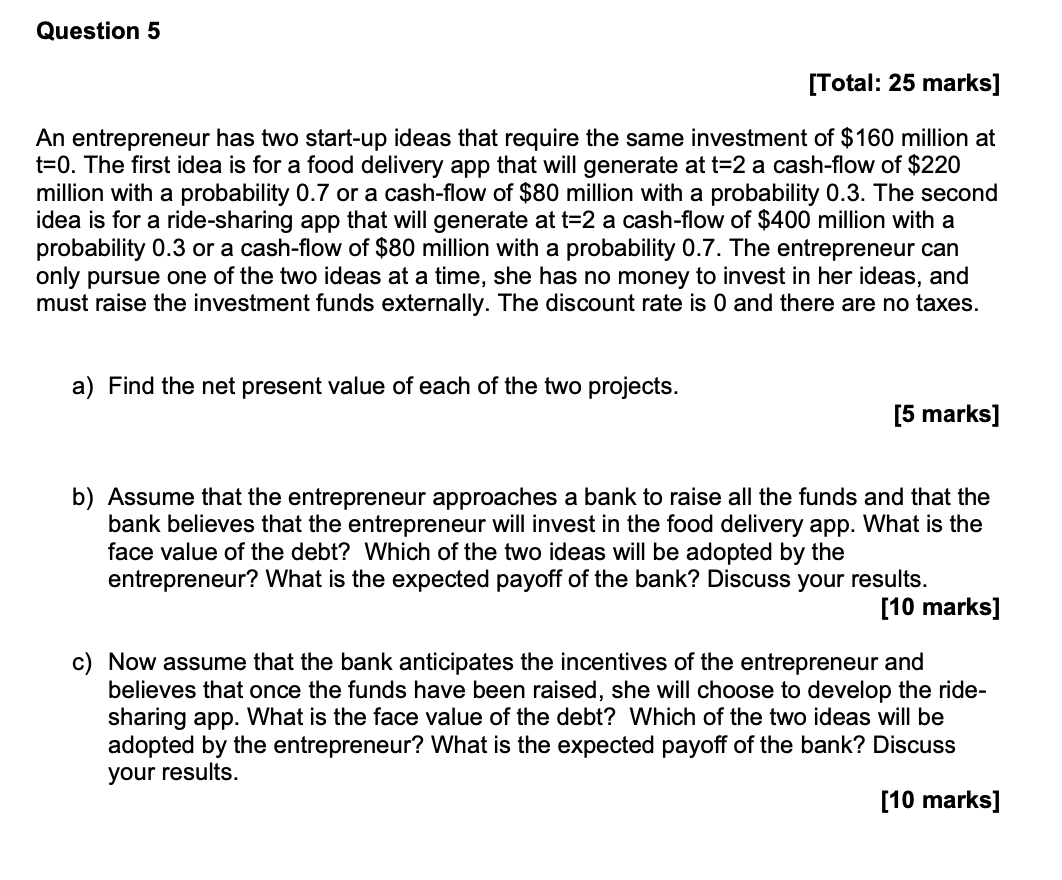

Question: Question 5 [ Total: ( mathbf { 2 5 } ) marks ] An entrepreneur has two start - up ideas that

Question

Total: mathbf marks

An entrepreneur has two startup ideas that require the same investment of $ million at mathrmt The first idea is for a food delivery app that will generate at mathrmt a cashflow of $ million with a probability or a cashflow of $ million with a probability The second idea is for a ridesharing app that will generate at mathrmt a cashflow of $ million with a probability or a cashflow of $ million with a probability The entrepreneur can only pursue one of the two ideas at a time, she has no money to invest in her ideas, and must raise the investment funds externally. The discount rate is and there are no taxes.

a Find the net present value of each of the two projects.

marks

b Assume that the entrepreneur approaches a bank to raise all the funds and that the bank believes that the entrepreneur will invest in the food delivery app. What is the face value of the debt? Which of the two ideas will be adopted by the entrepreneur? What is the expected payoff of the bank? Discuss your results.

marks

c Now assume that the bank anticipates the incentives of the entrepreneur and believes that once the funds have been raised, she will choose to develop the ridesharing app. What is the face value of the debt? Which of the two ideas will be adopted by the entrepreneur? What is the expected payoff of the bank? Discuss your results.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock