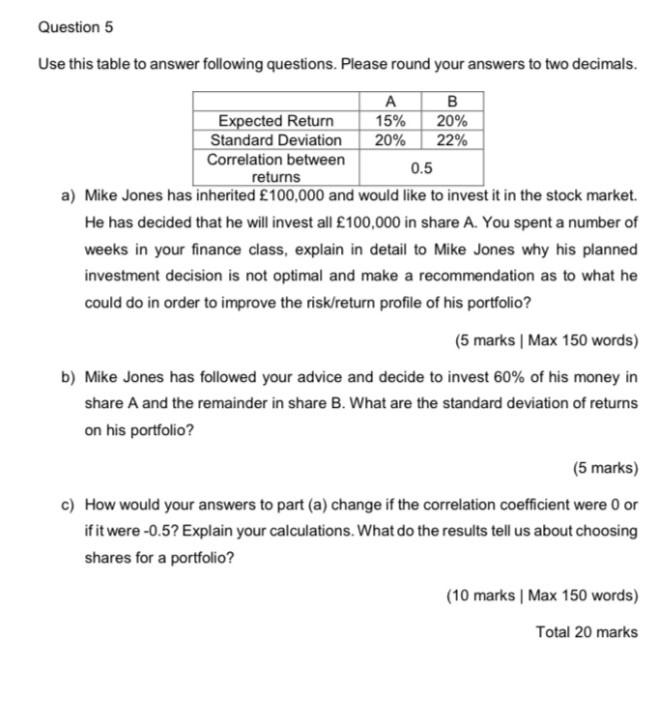

Question: Question 5 Use this table to answer following questions. Please round your answers to two decimals. A B Expected Return 15% 20% Standard Deviation 20%

Question 5 Use this table to answer following questions. Please round your answers to two decimals. A B Expected Return 15% 20% Standard Deviation 20% 22% Correlation between 0.5 returns a) Mike Jones has inherited 100,000 and would like to invest it in the stock market. He has decided that he will invest all 100,000 in share A. You spent a number of weeks in your finance class, explain in detail to Mike Jones why his planned investment decision is not optimal and make a recommendation as to what he could do in order to improve the risk/return profile of his portfolio? (5 marks | Max 150 words) b) Mike Jones has followed your advice and decide to invest 60% of his money in share A and the remainder in share B. What are the standard deviation of returns on his portfolio? (5 marks) c) How would your answers to part (a) change if the correlation coefficient were 0 or if it were -0.5? Explain your calculations. What do the results tell us about choosing shares for a portfolio? (10 marks | Max 150 words) Total 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts