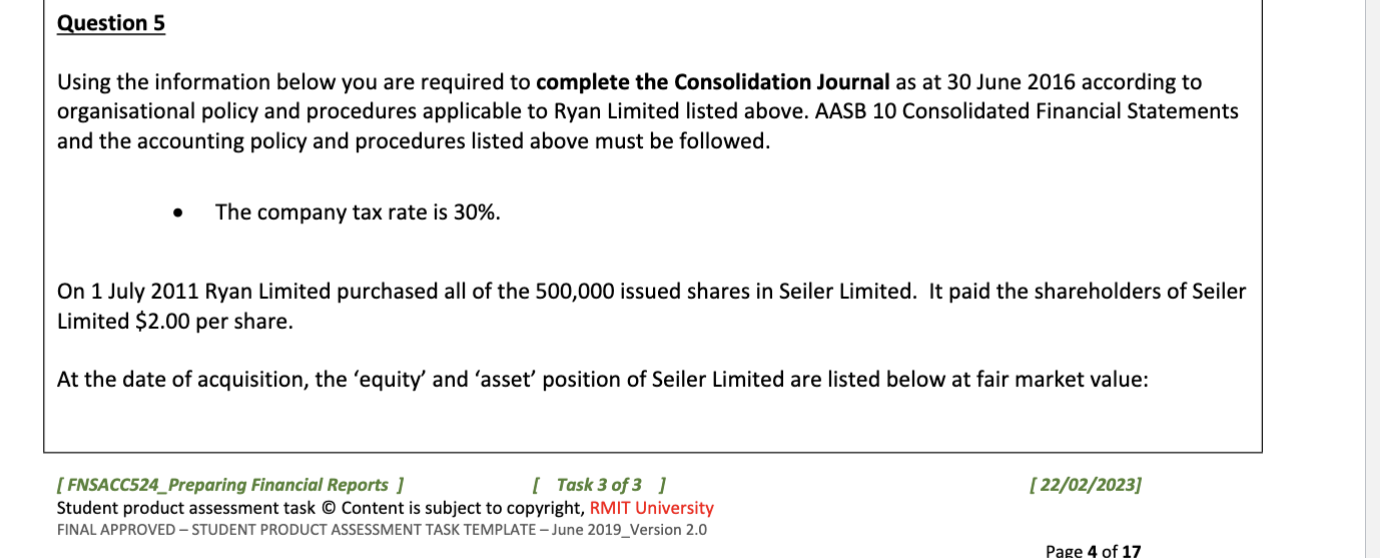

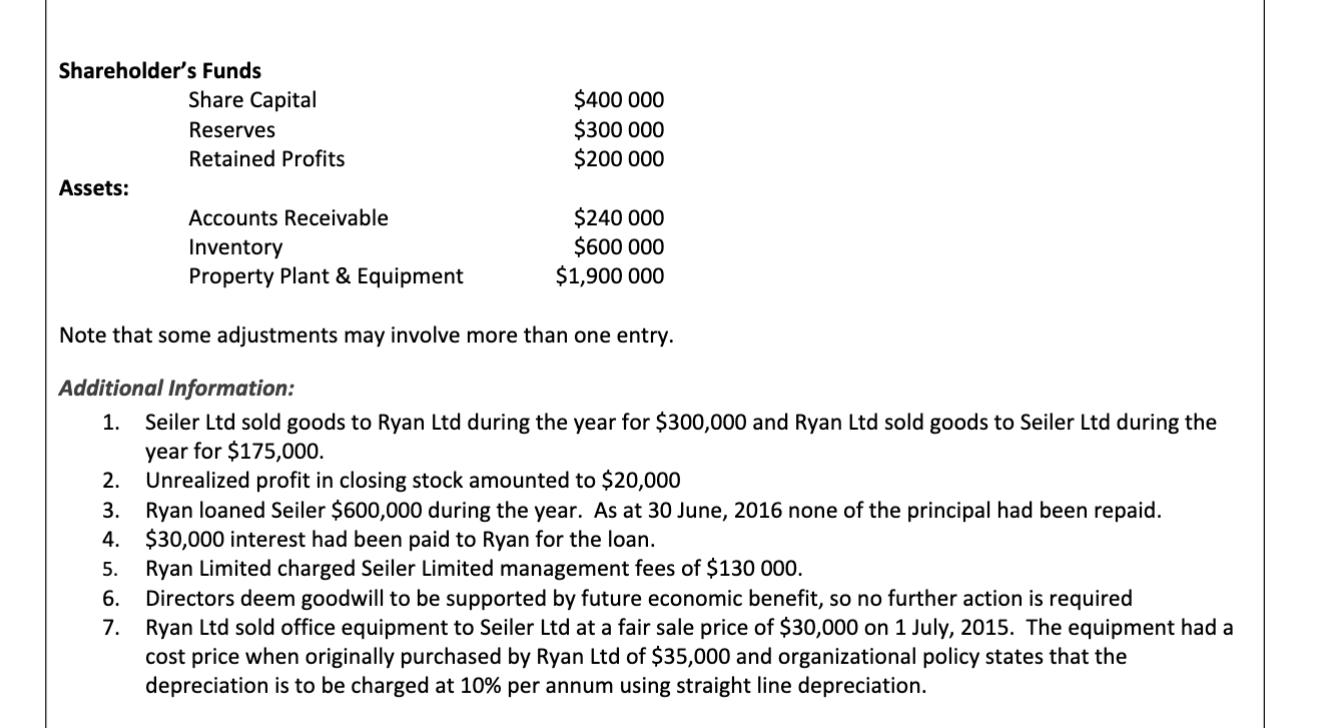

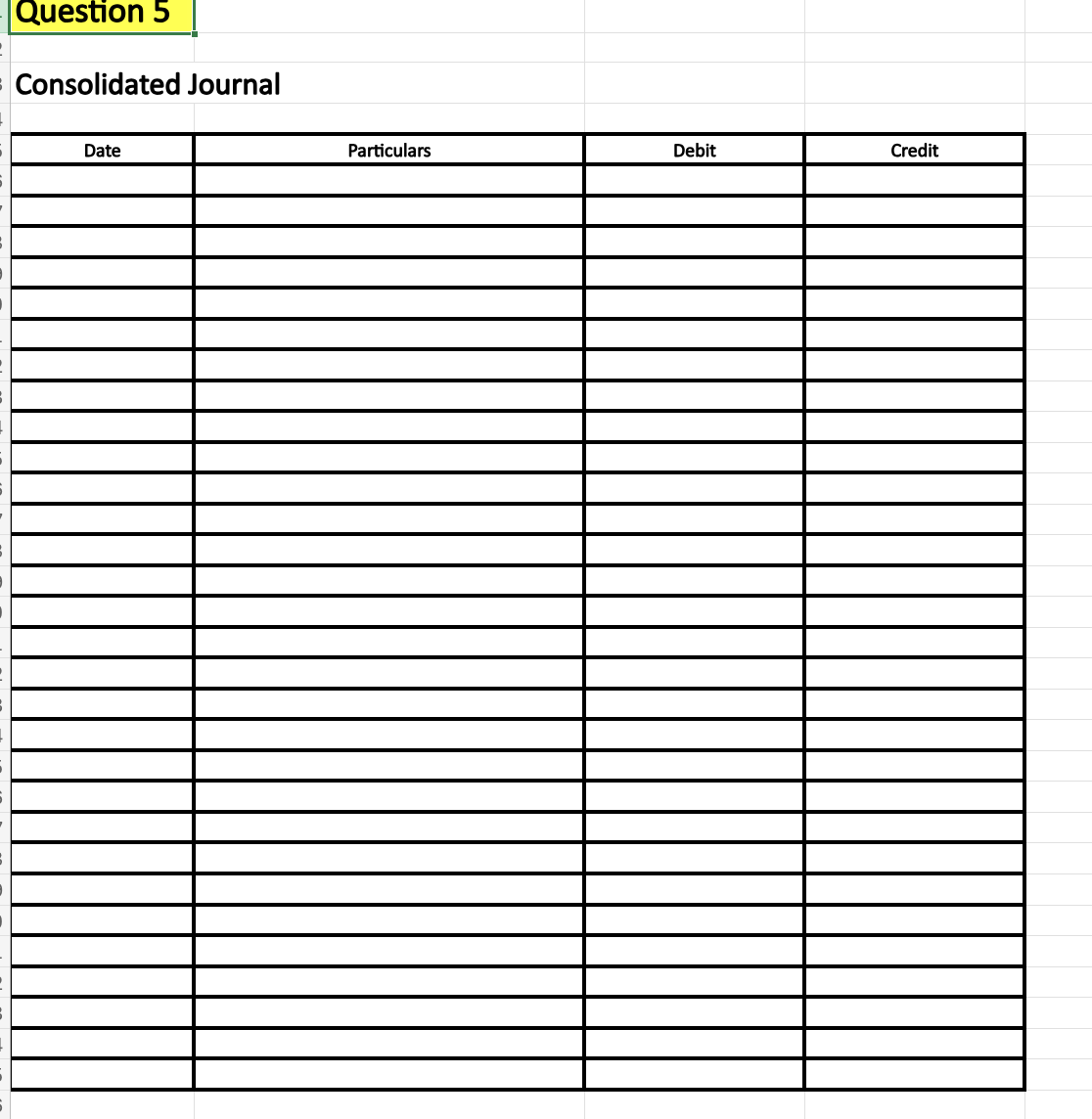

Question: Question 5 Using the information below you are required to complete the Consolidation Journal as at 30 June 2016 according to organisational policy and procedures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts