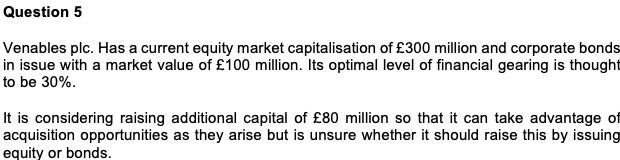

Question: Question 5 Venables plc. Has a current equity market capitalisation of 300 million and corporate bonds in issue with a market value of 100 million.

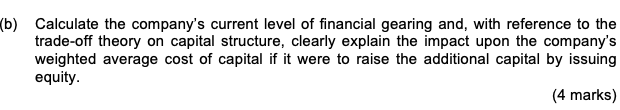

Question 5 Venables plc. Has a current equity market capitalisation of 300 million and corporate bonds in issue with a market value of 100 million. Its optimal level of financial gearing is thought to be 30% It is considering raising additional capital of 80 million so that it can take advantage of acquisition opportunities as they arise but is unsure whether it should raise this by issuing equity or bonds. (b) Calculate the company's current level of financial gearing and, with reference to the trade-off theory on capital structure, clearly explain the impact upon the company's weighted average cost of capital if it were to raise the additional capital by issuing equity. (4 marks) Question 5 Venables plc. Has a current equity market capitalisation of 300 million and corporate bonds in issue with a market value of 100 million. Its optimal level of financial gearing is thought to be 30% It is considering raising additional capital of 80 million so that it can take advantage of acquisition opportunities as they arise but is unsure whether it should raise this by issuing equity or bonds. (b) Calculate the company's current level of financial gearing and, with reference to the trade-off theory on capital structure, clearly explain the impact upon the company's weighted average cost of capital if it were to raise the additional capital by issuing equity. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts