Question: Question 5 View Policies Current Attempt in Progress Ivanhoe Company, a ski tuning and repair shop, opened on November 1, 2021. The company carefully kept

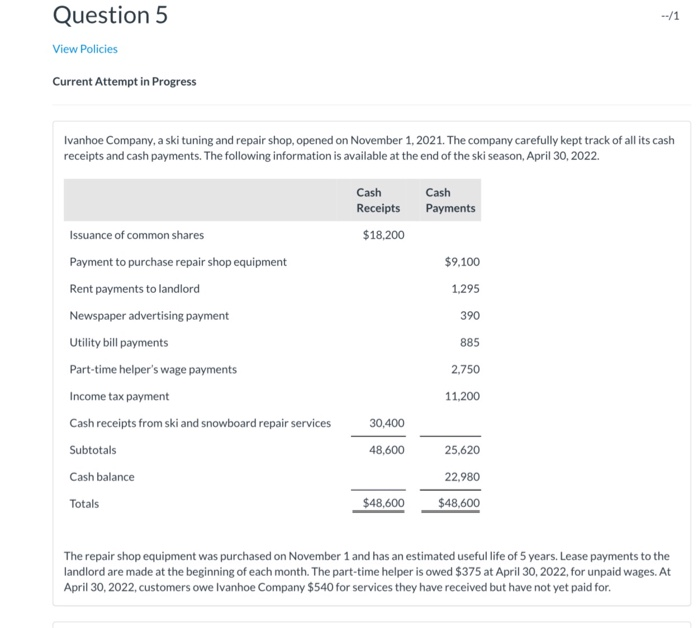

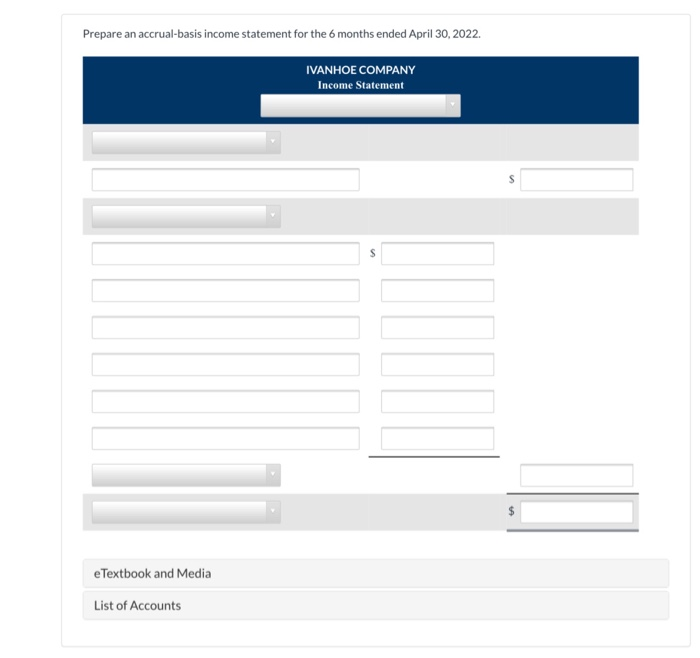

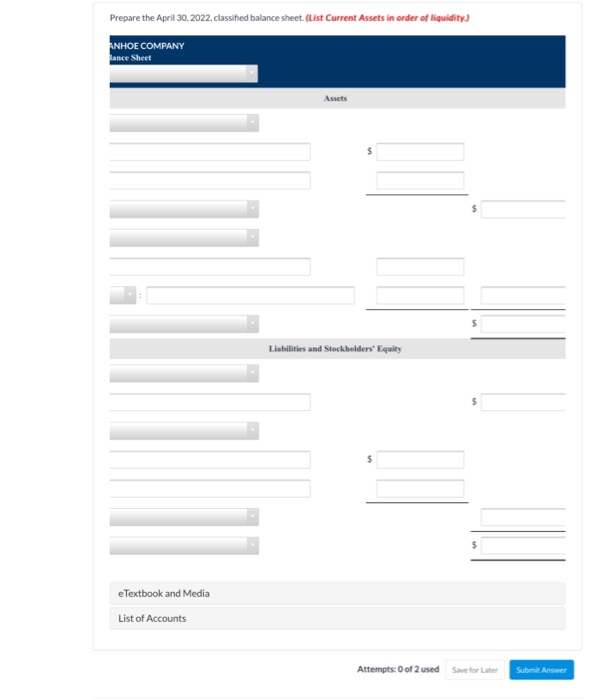

Question 5 View Policies Current Attempt in Progress Ivanhoe Company, a ski tuning and repair shop, opened on November 1, 2021. The company carefully kept track of all its cash receipts and cash payments. The following information is available at the end of the ski season, April 30, 2022 Cash Receipts Cash Payments Issuance of common shares $18,200 Payment to purchase repair shop equipment $9,100 Rent payments to landlord 1,295 Newspaper advertising payment 390 Utility bill payments 885 Part-time helper's wage payments 2.750 Income tax payment 11,200 Cash receipts from ski and snowboard repair services 30,400 Subtotals 48,600 25,620 Cash balance 22,980 Totals $48,600 $48,600 The repair shop equipment was purchased on November 1 and has an estimated useful life of 5 years. Lease payments to the landlord are made at the beginning of each month. The part-time helper is owed $375 at April 30, 2022, for unpaid wages. At April 30, 2022, customers owe Ivanhoe Company $540 for services they have received but have not yet paid for. Prepare an accrual-basis income statement for the 6 months ended April 30,2022. IVANHOE COMPANY Income Statement e Textbook and Media List of Accounts Prepare the April 30, 2022, classified balance sheet. (List Current Assets in order of liquidity) ANHOE COMPANY Lance Sheet Liabilities and Stockholders' Equity eTextbook and Media List of Accounts Attempts: 0 of 2 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts