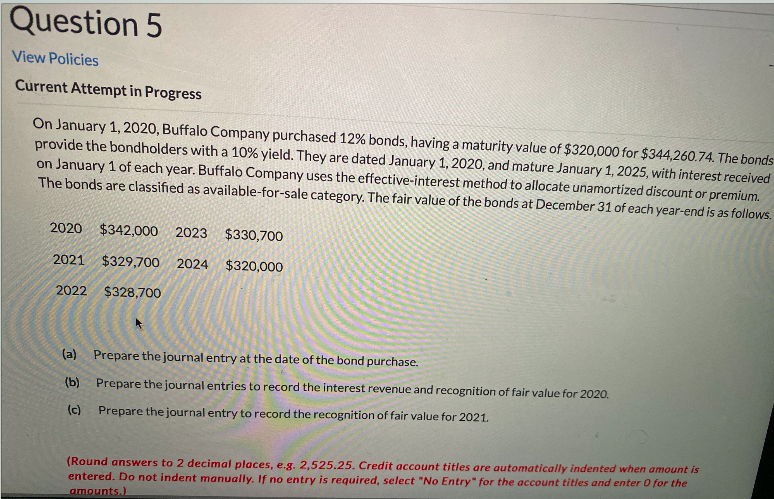

Question: Question 5 View Policies Current Attempt in Progress On January 1, 2020, Buffalo Company purchased 12% bonds, having a maturity value of $320,000 for $344,260.74.

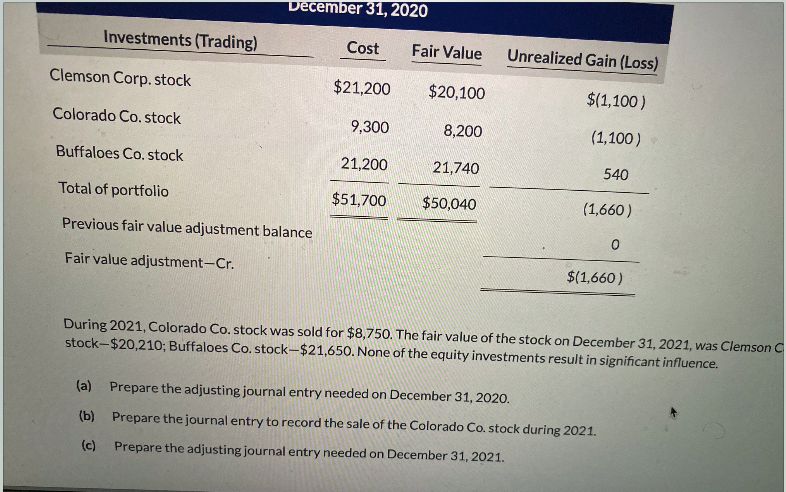

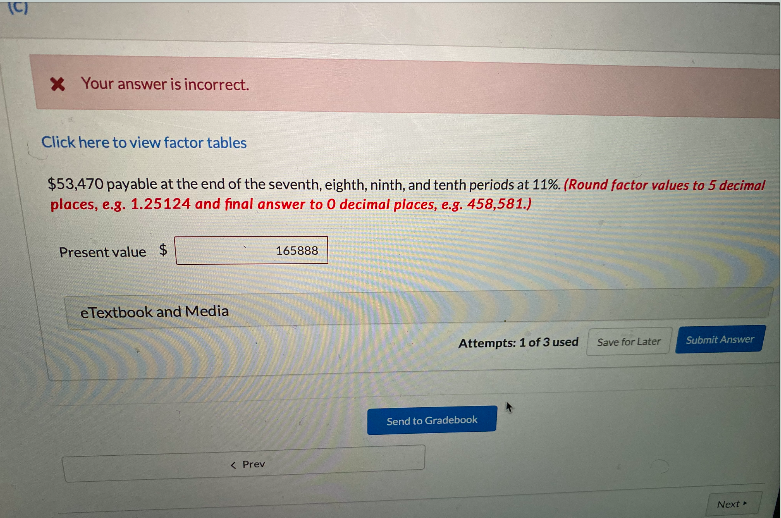

Question 5 View Policies Current Attempt in Progress On January 1, 2020, Buffalo Company purchased 12% bonds, having a maturity value of $320,000 for $344,260.74. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Buffalo Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified as available-for-sale category. The fair value of the bonds at December 31 of each year-end is as follows. 2020 $342,000 2023 $330,700 2021 $329,700 2024 $320,000 2022 $328,700 (a) Prepare the journal entry at the date of the bond purchase. (b) Prepare the journal entries to record the interest revenue and recognition of fair value for 2020. Prepare the journal entry to record the recognition of fair value for 2021. (c) (Round answers to 2 decimal places, ex. 2.525.25. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the December 31, 2020 Investments (Trading) Cost Fair Value Unrealized Gain (Loss) Clemson Corp.stock $21,200 $20,100 $(1,100) Colorado Co.stock 9,300 8,200 (1,100) Buffaloes Co.stock 21,200 21,740 540 Total of portfolio $51,700 $50,040 (1,660) Previous fair value adjustment balance Fair value adjustment-Cr. $(1,660) During 2021, Colorado Co.stock was sold for $8,750. The fair value of the stock on December 31, 2021, was Clemson C stock-$20,210; Buffaloes Co.stock-$21,650. None of the equity investments result in significant influence. (a) Prepare the adjusting journal entry needed on December 31, 2020. (b) Prepare the journal entry to record the sale of the Colorado Co. stock during 2021. (c) Prepare the adjusting journal entry needed on December 31, 2021. * Your answer is incorrect. Click here to view factor tables $53,470 payable at the end of the seventh, eighth, ninth, and tenth periods at 11%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Present value $ 165888 e Textbook and Media Attempts: 1 of 3 used Save for Later Submit Answer Send to Gradebook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts