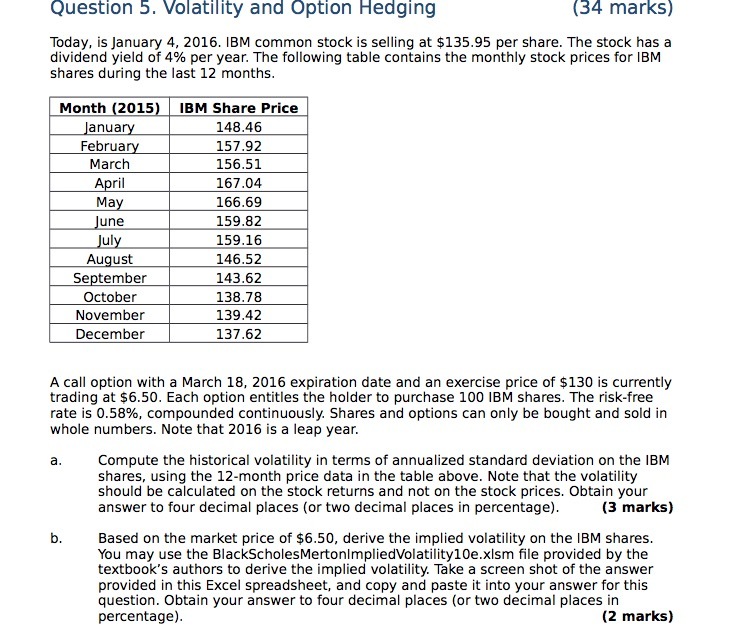

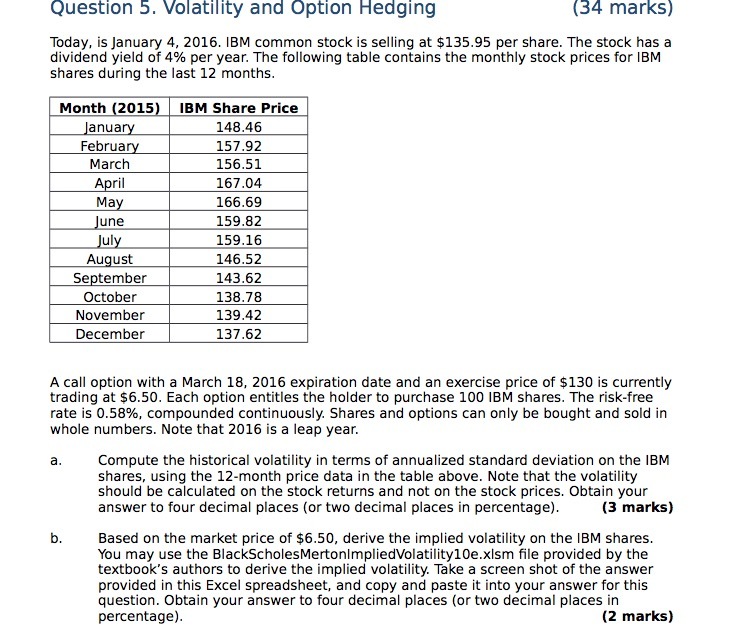

Question: Question 5. Volatility and Option Hedging {34 marks} Today. is january 4. 2016. IBM common stock is selling at $135.95 per share. The stock has

Question 5. Volatility and Option Hedging {34 marks} Today. is january 4. 2016. IBM common stock is selling at $135.95 per share. The stock has a dividend yield of 4% per year. The following table contains the monthly stock: prices for IBM shares during the last 12 months. m m m m W 13333 m 13162 A call option with a March 18, EDIE expiration date and an exercise price of $1311) is currently trading at $6.5. Each option entitles the holder to purchase 1oo IBM shares. The risk-free rate is [1.58%. compounded continuously. Shares and options can only be bought and sold in whole numbers. Note that El is a leap year. a. Compute the historical volatility in terms of annualized standard deviation on the IBM shares, using the 12-month price data in the table above. Note that the volatility should be calculated on the stock returns and not on the stock prices. Dbtain your answer to four decimal places [or two decimal places in percentage]. [3 marks} b. Based on the market price of $6.511}. derive the implied volatility on the IBM shares. You may use the BlaclcSchoIesMertonlmpliedVolatilityle.xlsm le provided by the textbook's authors to derive the implied volatility. Take a screen shot of the answer provided in this Excel spreadsheet. and copy and paste it into your answer for this question. Dbtain your answer to four decimal places [or two decimal places in pa rcenta gel. [2 marks}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts