Question: QUESTION 5 Vroom Ltd will be undertaking a few contracts from Tanjung Berhad (a resident company). The contracts involve the following payments to suppliers and

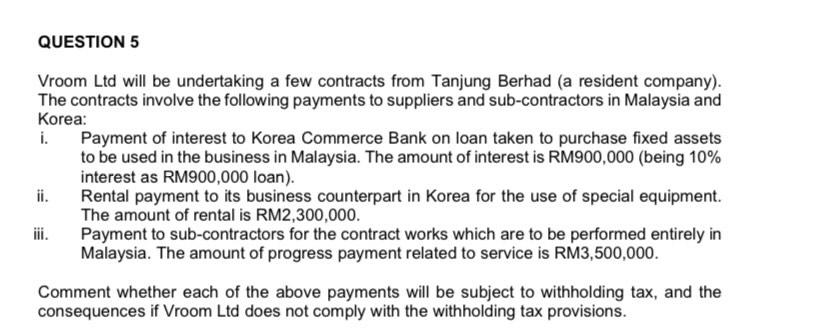

QUESTION 5 Vroom Ltd will be undertaking a few contracts from Tanjung Berhad (a resident company). The contracts involve the following payments to suppliers and sub-contractors in Malaysia and Korea: i. Payment of interest to Korea Commerce Bank on loan taken to purchase fixed assets to be used in the business in Malaysia. The amount of interest is RM900,000 (being 10\% interest as RM900,000 loan). ii. Rental payment to its business counterpart in Korea for the use of special equipment. The amount of rental is RM2,300,000. iii. Payment to sub-contractors for the contract works which are to berformed entirely in Malaysia. The amount of progress payment related to service is RM3,500,000. Comment whether each of the above payments will be subject to withholding tax, and the consequences if Vroom Ltd does not comply with the withholding tax provisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts