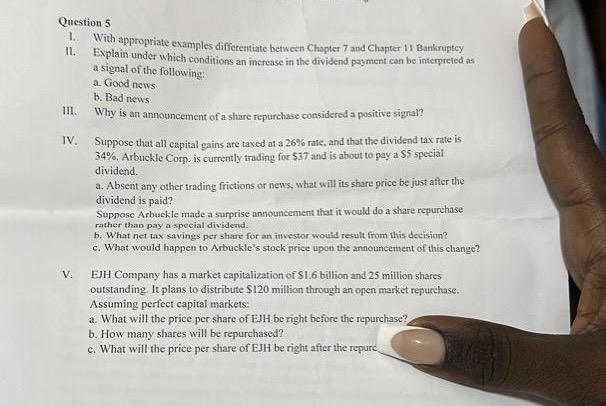

Question: Question 5 With appropriate examples differentiate between Chapter 7 and Chapter 1 1 Bankrupty II . Explain under which conditions an increase in the dividend

Question

With appropriate examples differentiate between Chapter and Chapter Bankrupty

II Explain under which conditions an increase in the dividend payment can be interpreted as a signal of the following:

a Good news

b Bad news

III. Why is an announcement of a share repurchase considered a positive signal?

IV Suppose that all capital gains are taxed at a rate, and that the dividend tax rate is Arbuckle Corp. is currently trading for $ and is about to pay a $ special dividend.

a Absent any other trading frictions or news, what will its share price be just after the dividend is paid?

Suppose Arbuckle made a surprise announcement that it would do a share repurchase rather than pay a special dividend.

b What net tax savings per share for an investor would result from this decision?

c What would happen to Arbuckle's stock price upon the announcement of this change?

V EJH Company has a market capitalization of $ billion and million shares outstanding. It plans to distribute $ million through an open market repurchase. Assuming perfect capital markets:

a What will the price per share of EJH beright before the repurchase?

b How many shares will be repurchased?

c What will the price per share of EJH be right after the repurchase

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock