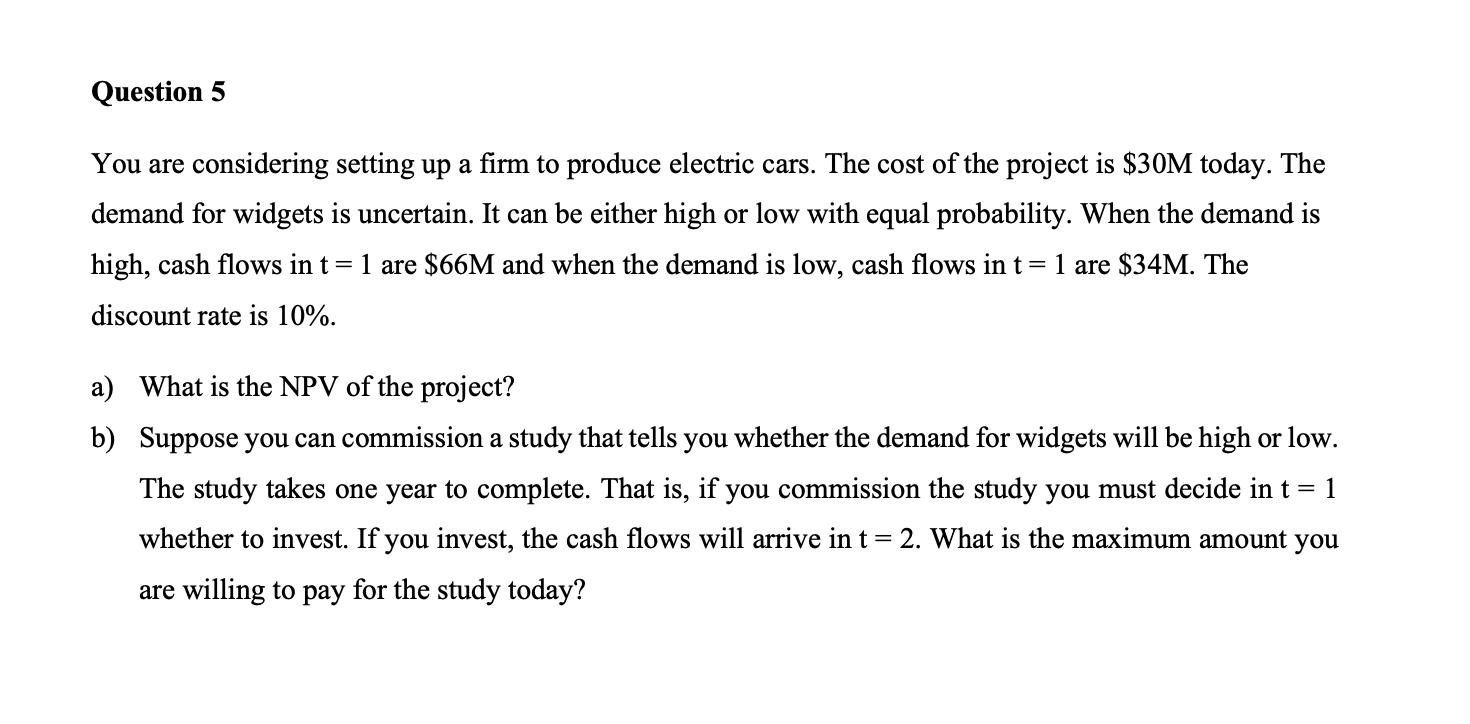

Question: Question 5 You are considering setting up a firm to produce electric cars. The cost of the project is ( $ 3 0

Question You are considering setting up a firm to produce electric cars. The cost of the project is $ mathrmM today. The demand for widgets is uncertain. It can be either high or low with equal probability. When the demand is high, cash flows in t are $ mathrmM and when the demand is low, cash flows in mathrmt are $ mathrmM The discount rate is a What is the NPV of the project? b Suppose you can commission a study that tells you whether the demand for widgets will be high or low. The study takes one year to complete. That is if you commission the study you must decide in t whether to invest. If you invest, the cash flows will arrive in t What is the maximum amount you are willing to pay for the study today?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock