Question: QUESTION 51 Eileen has a beach house in Freeport, which she rents out every year. In the current year, she rented it for 185 days

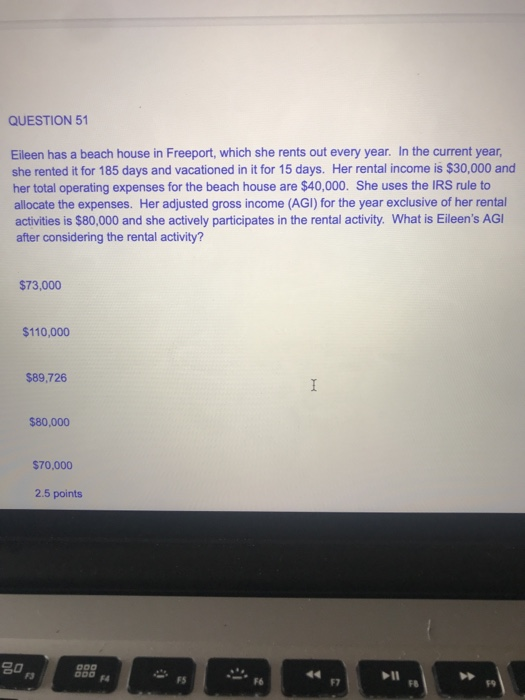

QUESTION 51 Eileen has a beach house in Freeport, which she rents out every year. In the current year, she rented it for 185 days and vacationed in it for 15 days. Her rental income is $30,000 and her total operating expenses for the beach house are $40,000. She uses the IRS rule to allocate the expenses. Her adjusted gross income (AGI) for the year exclusive of her rental activities is $80,000 and she actively participates in the rental activity. What is Eileen's AGI after considering the rental activity? $73,000 $110,000 $89,726 I $80,000 $70,000 2.5 points 90 DDD DOO F4 F6 FB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts