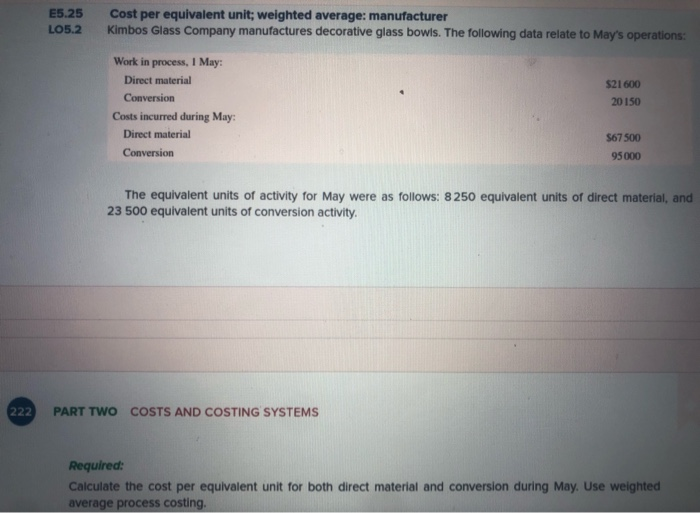

Question: Question 5.25 E5.25 LO5.2 Cost per equivalent unit; weighted average: manufacturer Kimbos Glass Company manufactures decorative glass bowls. The following data relate to May's operations:

E5.25 LO5.2 Cost per equivalent unit; weighted average: manufacturer Kimbos Glass Company manufactures decorative glass bowls. The following data relate to May's operations: Work in process, 1 May: Direct material Conversion Costs incurred during May: Direct material Conversion $21600 20 150 567 500 95000 The equivalent units of activity for May were as follows: 8 250 equivalent units of direct material, and 23 500 equivalent units of conversion activity. 222 PART TWO COSTS AND COSTING SYSTEMS Required: Calculate the cost per equivalent unit for both direct material and conversion during May. Use weighted average process costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts