Question: QUESTION 5.6 (25 Marks) PART A (14 Marks) Elt (Pty) Lid ('Elt'), with a 31 March year-end, manufactures healthier alternatives to coffee and tea that

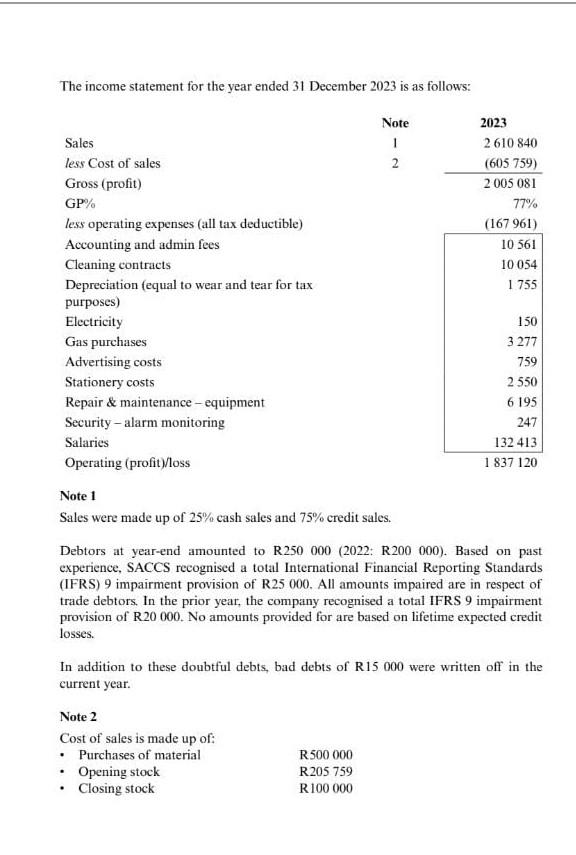

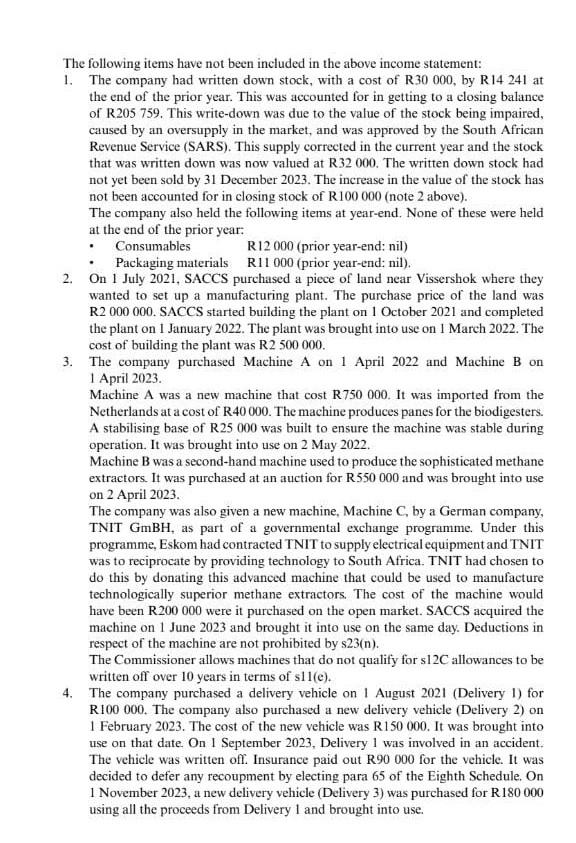

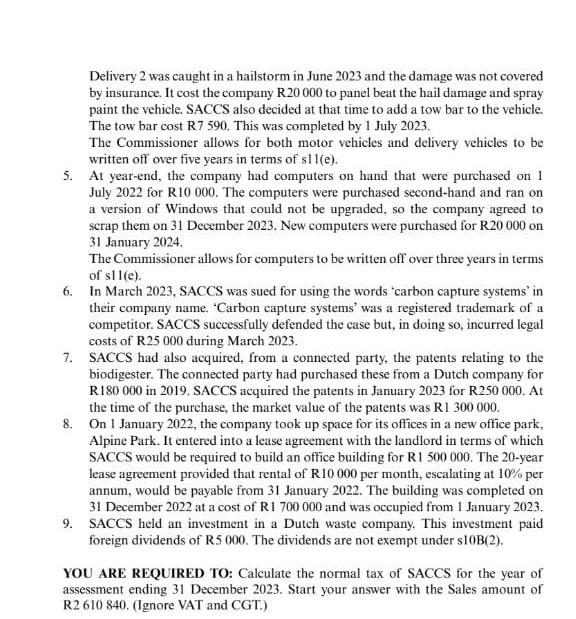

QUESTION 5.6 (25 Marks) PART A (14 Marks) Elt (Pty) Lid ('Elt'), with a 31 March year-end, manufactures healthier alternatives to coffee and tea that are also suitable for persons allergic to milk. In 2022, Elt urgently required an additional machine for use in its manufacturing process but did not have the necessary finance. Elt came to an arrangement with Stanco Bank (an unrelated third party) as follows: Elt would sell its manufacturing machine, Machine A, to Stanco on 1 January 2023 for R850 000 (including VAT). The income statement for the year ended 31 December 2023 is as follows: Note 1 Sales were made up of 25% cash sales and 75% credit sales. Debtors at year-end amounted to R250 000 (2022: R200 000). Based on past experience, SACCS recognised a total International Financial Reporting Standards (IFRS) 9 impairment provision of R25 000. All amounts impaired are in respect of trade debtors. In the prior year, the company recognised a total IFRS 9 impairment provision of R20 000. No amounts provided for are based on lifetime expected credit losses. In addition to these doubtful debts, bad debts of R 15000 were written off in the current year. The following items have not been included in the above income statement: 1. The company had written down stock, with a cost of R30 000, by R 14241 at the end of the prior year. This was accounted for in getting to a closing balance of R205 759. This write-down was due to the value of the stock being impaired, caused by an oversupply in the market, and was approved by the South African Revenue Service (SARS). This supply corrected in the current year and the stock that was written down was now valued at R32000. The written down stock had not yet been sold by 31 December 2023. The increase in the value of the stock has not been accounted for in closing stock of R 100000 (note 2 above). The company also held the following items at year-end. None of these were held at the end of the prior year: - Consumables R 12000 (prior year-end: nil) - Packaging materials R11000 (prior year-end: nil). 2. On 1 July 2021, SACCS purchased a piece of land near Vissershok where they wanted to set up a manufacturing plant. The purchase price of the land was R2 000000 . SACCS started building the plant on 1 October 2021 and completed the plant on 1 January 2022. The plant was brought into use on 1 March 2022. The cost of building the plant was R2 500000 . 3. The company purchased Machine A on 1 April 2022 and Machine B on 1 April 2023. Machine A was a new machine that cost R750000. It was imported from the Netherlands at a cost of R40 000. The machine produces panes for the biodigesters. A stabilising base of R25 000 was built to ensure the machine was stable during operation. It was brought into use on 2 May 2022. Machine B was a second-hand machine used to produce the sophisticated methane extractors. It was purchased at an auction for R 550000 and was brought into use on 2 April 2023. The company was also given a new machine, Machine C, by a German company, TNIT GmBH, as part of a governmental exchange programme. Under this programme, Eskom had contracted TNIT to supply electrical equipment and TNIT was to reciprocate by providing technology to South Africa. TNIT had chosen to do this by donating this advanced machine that could be used to manufacture technologically superior methane extractors. The cost of the machine would have been R200 000 were it purchased on the open market. SACCS acquired the machine on 1 June 2023 and brought it into use on the same day. Deductions in respect of the machine are not prohibited by s23(n). The Commissioner allows machines that do not qualify for 12C allowances to be written off over 10 years in terms of s11(e). 4. The company purchased a delivery vehicle on 1 August 2021 (Delivery 1) for R100 000. The company also purchased a new delivery vehicle (Delivery 2) on 1 February 2023. The cost of the new vehicle was R150 000. It was brought into use on that date. On 1 September 2023, Delivery 1 was involved in an accident. The vehicle was written off. Insurance paid out R90 000 for the vehicle. It was decided to defer any recoupment by electing para 65 of the Eighth Schedule. On 1 November 2023, a new delivery vehicle (Delivery 3) was purchased for R 180000 using all the proceeds from Delivery 1 and brought into use. Delivery 2 was caught in a hailstorm in June 2023 and the damage was not covered by insurance. It cost the company R20 000 to panel beat the hail damage and spray paint the vehicle. SACCS also decided at that time to add a tow bar to the vehicle. The tow bar cost R7 590. This was completed by 1 July 2023. The Commissioner allows for both motor vehicles and delivery vehicles to be written off over five years in terms of s11(e). 5. At year-end, the company had computers on hand that were purchased on 1 July 2022 for R10 000 . The computers were purchased second-hand and ran on a version of Windows that could not be upgraded, so the company agreed to scrap them on 31 December 2023. New computers were purchased for R20 000 on 31 January 2024. The Commissioner allows for computers to be written off over three years in terms of sil(e). 6. In March 2023, SACCS was sued for using the words 'carbon capture systems' in their company name. 'Carbon capture systems' was a registered trademark of a competitor. SACCS successfully defended the case but, in doing so, incurred legal costs of R25 000 during March 2023. 7. SACCS had also acquired, from a connected party, the patents relating to the biodigester. The connected party had purchased these from a Dutch company for R 180000 in 2019. SACCS acquired the patents in January 2023 for R250 000. At the time of the purchase, the market value of the patents was R1 300000 . 8. On 1 January 2022 , the company took up space for its offices in a new office park, Alpine Park. It entered into a lease agreement with the landlord in terms of which SACCS would be required to build an office building for R1 500000 . The 20-year lease agreement provided that rental of R10000 per month, escalating at 10% per annum, would be payable from 31 January 2022. The building was completed on 31 December 2022 at a cost of R1 700000 and was occupied from 1 January 2023. 9. SACCS held an investment in a Dutch waste company. This investment paid foreign dividends of R5000. The dividends are not exempt under s10B(2). YOU ARE REQUIRED TO: Calculate the normal tax of SACCS for the year of assessment ending 31 December 2023. Start your answer with the Sales amount of R2 610840 . (Ignore VAT and CGT.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts