Question: Question 58 0.59 out of 0.59 points The CAPM. Capital Asset Pricing Model, model that attempts to answer the question: Answers: How much should an

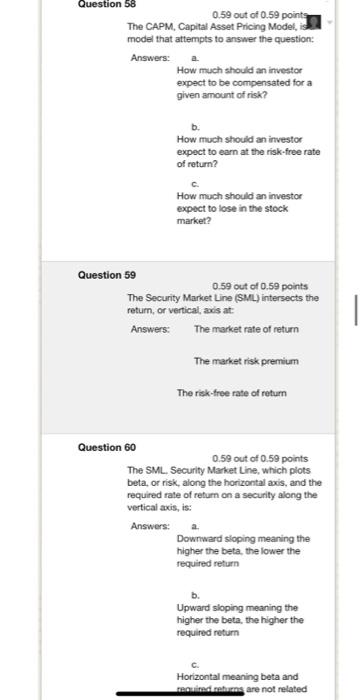

Question 58 0.59 out of 0.59 points The CAPM. Capital Asset Pricing Model, model that attempts to answer the question: Answers: How much should an investor expect to be compensated for a givena namount of risk? a How much should an investor expect to earn at the risk-free rate of return? How much should an investor expect to lose in the stock market? Question 59 0.59 out of 0.59 points The Security Market Line (SML) intersects the return, or vertical, as at Answers: The market rate of return The market risk premium The risk-free rate of return Question 60 0.59 out of 0.59 points The SML. Security Market Line, which plots beta, or risk, along the horizontal axis, and the required rate of return on a security along the vertical axis, is: Answers: Downward sloping meaning the higher the beta, the lower the required return a Upward sioping meaning the higher the beta, the higher the required return Horizontal meaning beta and reciendenburns are not related

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts