Question: Question 59 (1 point) A stock is expected to pay a dividend of $0.75 at the end of the next year. The required rate of

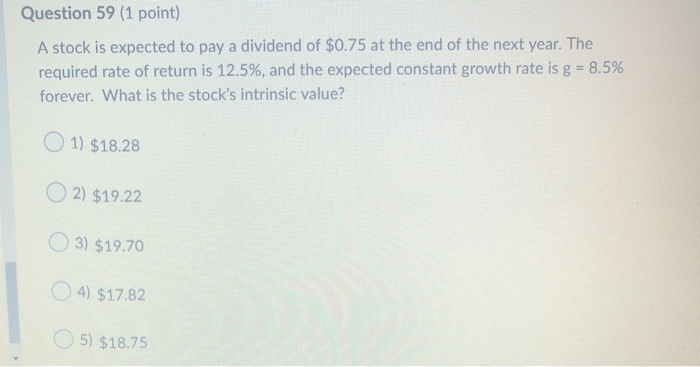

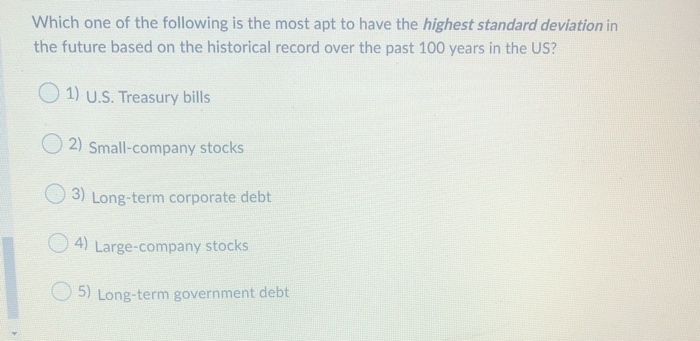

Question 59 (1 point) A stock is expected to pay a dividend of $0.75 at the end of the next year. The required rate of return is 12.5%, and the expected constant growth rate is g = 8.5% forever. What is the stock's intrinsic value? 1) $18.28 O2) $19.22 3) $19.70 4) $17.82 5) $18.75 Which one of the following is the most apt to have the highest standard deviation in the future based on the historical record over the past 100 years in the US? 1) U.S. Treasury bills O2) Small-company stocks 3) Long-term corporate debt 4) Large-company stocks, 5) Long-term government debt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock