Question: Question 6 0 . 5 pts A $ 1 , 0 0 0 par value bond pays interest of $ 3 5 each quarter and

Question

pts

A $ par value bond pays interest of $ each quarter and will mature in years. If your annual required rate of return is percent with quarterly compounding, how much should you be willing to pay for this bond?

$

$

$

$Question

pts

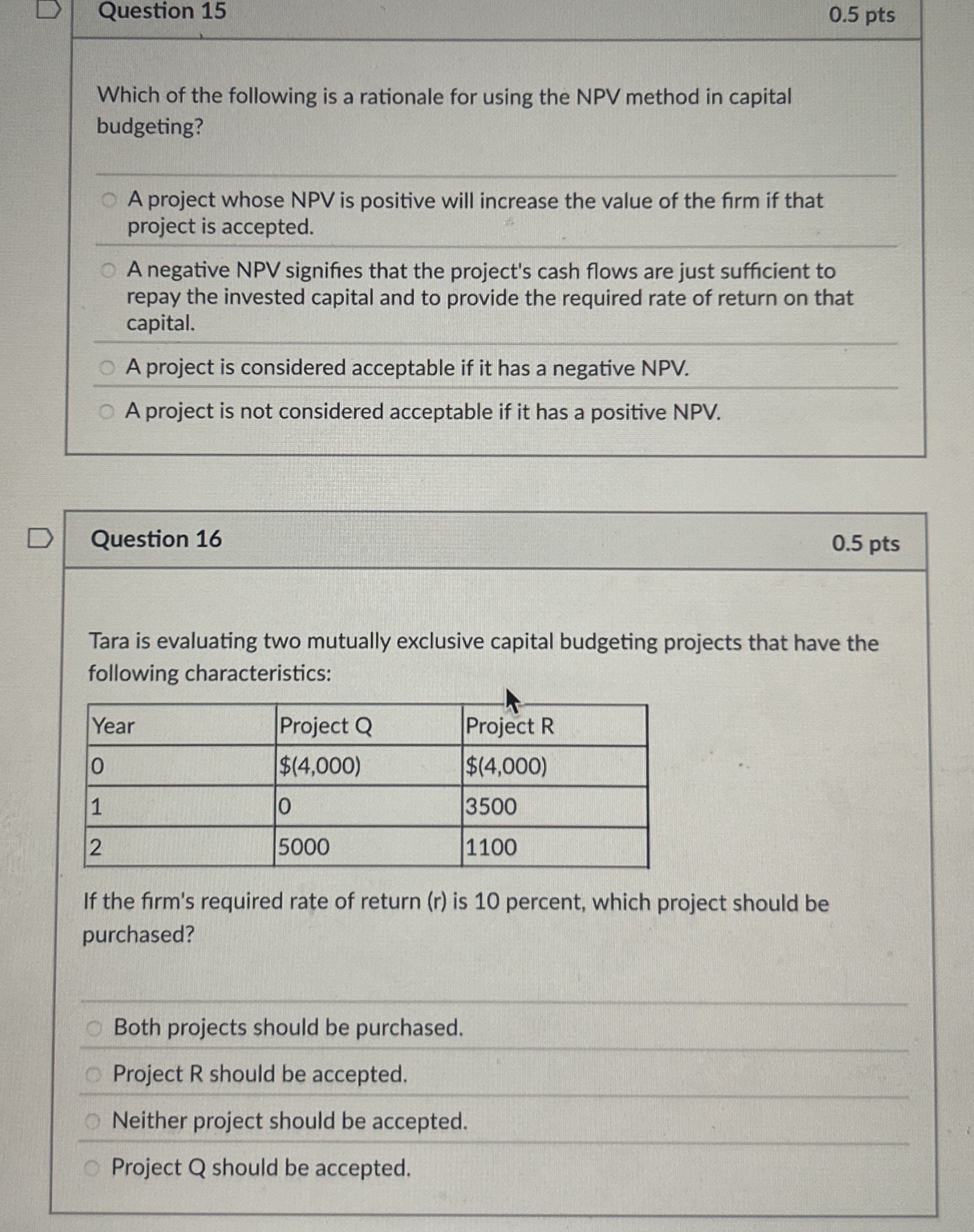

Which of the following is a rationale for using the NPV method in capital budgeting?

A project whose NPV is positive will increase the value of the firm if that project is accepted.

A negative NPV signifies that the project's cash flows are just sufficient to repay the invested capital and to provide the required rate of return on that capital.

A project is considered acceptable if it has a negative NPV

A project is not considered acceptable if it has a positive NPV

Question

pts

Tara is evaluating two mutually exclusive capital budgeting projects that have the following characteristics:

tableYearProject QProject R$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock